Answered step by step

Verified Expert Solution

Question

1 Approved Answer

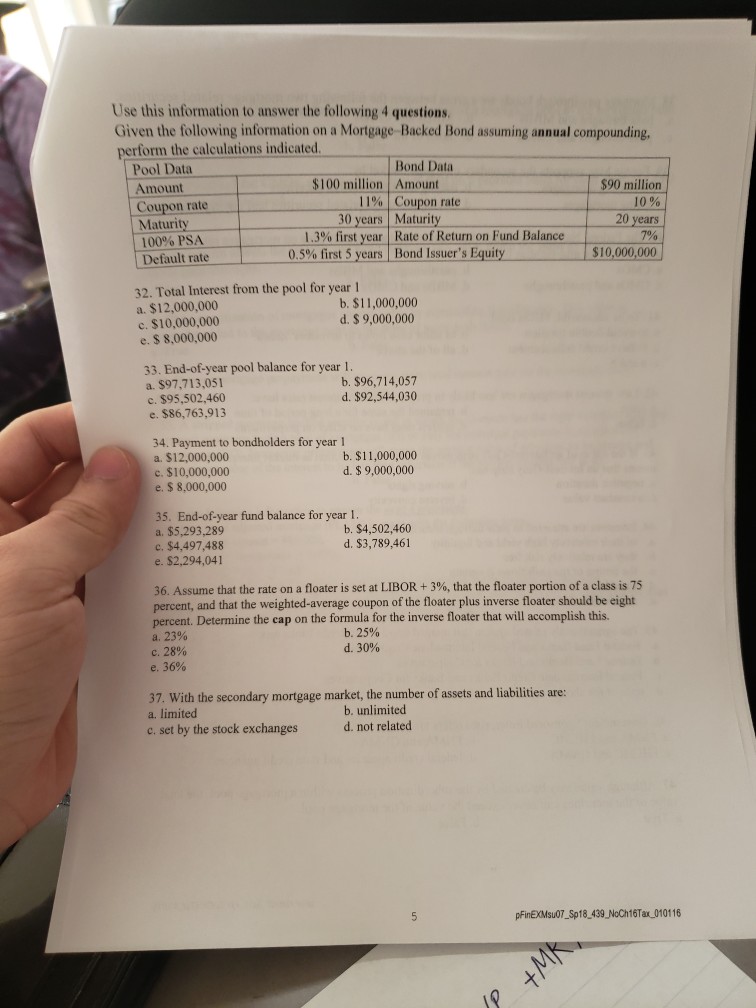

help please Use this information to answer the following 4 questions Given the following information on a Mortgage- Backed Bond assuming annual compounding perform the

help please

Use this information to answer the following 4 questions Given the following information on a Mortgage- Backed Bond assuming annual compounding perform the calculations indicated. Bond Data Pool Data Amount $100 million Amount $90 million 10% 20 years 790 11%, | Coupon rate Coupon rate Maturity 100% PSA Default rate 30 years Maturity 1 .3% first year Rate of Return on Fund Balance l 0.5% first 5years/Bond-issuer's. Equity $10,000,000 32. Total Interest from the pool for year1 a. $12,000,000 c. $10,000,000 e. $ 8,000,000 b. $11,000,000 d. $ 9,000,000 33. End-of-year pool balance for year1. a. $97,713,051 c. $95,502,460 e. $86,763,913 b. $96,714,057 d. $92,544,030 34. Payment to bondholders for year 1 a. $12,000,000 c. $10,000,000 e. $ 8,000,000 b. $11,000,000 d. $ 9,000,000 35. End-of-year fund balance for year 1. a $5,293,289b a. $5,293,289 e. $4,497,488 b. $4,502,460 d. $3,789,461 e. $2,294,041 36. Assume that the rate on a floater is set at LIBOR + 3%, that the floater portion of a class is 75 percent, and that the weighted-average coupon of the floater plus inverse floater should be eight percent. Determine the cap on the formula for the inverse floater that will accomplish this. a, 23% c. 28% e, 36% b. 25% d. 30% 37. With the secondary mortgage market, the number of assets and liabilities are: b. unlimited d. not related a. limited c. set by the stock exchanges pFinEXMsu07 Sp18439 NoCh16Tax 010116 Use this information to answer the following 4 questions Given the following information on a Mortgage- Backed Bond assuming annual compounding perform the calculations indicated. Bond Data Pool Data Amount $100 million Amount $90 million 10% 20 years 790 11%, | Coupon rate Coupon rate Maturity 100% PSA Default rate 30 years Maturity 1 .3% first year Rate of Return on Fund Balance l 0.5% first 5years/Bond-issuer's. Equity $10,000,000 32. Total Interest from the pool for year1 a. $12,000,000 c. $10,000,000 e. $ 8,000,000 b. $11,000,000 d. $ 9,000,000 33. End-of-year pool balance for year1. a. $97,713,051 c. $95,502,460 e. $86,763,913 b. $96,714,057 d. $92,544,030 34. Payment to bondholders for year 1 a. $12,000,000 c. $10,000,000 e. $ 8,000,000 b. $11,000,000 d. $ 9,000,000 35. End-of-year fund balance for year 1. a $5,293,289b a. $5,293,289 e. $4,497,488 b. $4,502,460 d. $3,789,461 e. $2,294,041 36. Assume that the rate on a floater is set at LIBOR + 3%, that the floater portion of a class is 75 percent, and that the weighted-average coupon of the floater plus inverse floater should be eight percent. Determine the cap on the formula for the inverse floater that will accomplish this. a, 23% c. 28% e, 36% b. 25% d. 30% 37. With the secondary mortgage market, the number of assets and liabilities are: b. unlimited d. not related a. limited c. set by the stock exchanges pFinEXMsu07 Sp18439 NoCh16Tax 010116Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started