Help please!! will upvote!

Help please!! will upvote!

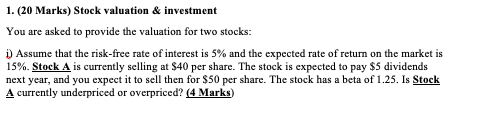

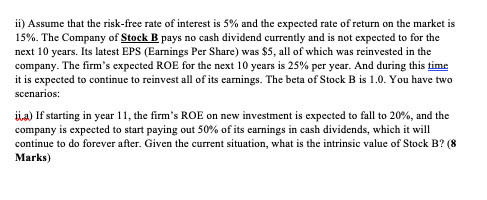

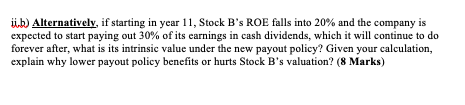

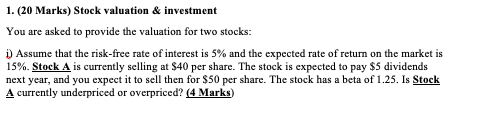

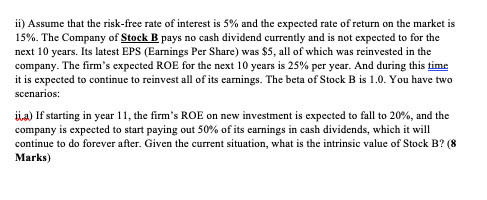

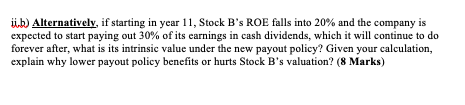

1. (20 Marks) Stock valuation & investment You are asked to provide the valuation for two stocks: D) Assume that the risk-free rate of interest is 5% and the expected rate of return on the market is 15%. Stock A is currently selling at $40 per share. The stock is expected to pay $5 dividends next year, and you expect it to sell then for $50 per share. The stock has a beta of 1.25. Is Stock A currently underpriced or overpriced? (4 Marks ii) Assume that the risk-free rate of interest is 5% and the expected rate of return on the market is 15%. The Company of Stock B pays no cash dividend currently and is not expected to for the next 10 years. Its latest EPS (Earnings Per Share) was $5, all of which was reinvested in the company. The firm's expected ROE for the next 10 years is 25% per year. And during this time it is expected to continue to reinvest all of its earnings. The beta of Stock B is 1.0. You have two scenarios: ja) If starting in year 11, the firm's ROE on new investment is expected to fall to 20%, and the company is expected to start paying out 50% of its earnings in cash dividends, which it will continue to do forever after. Given the current situation, what is the intrinsic value of Stock B? (8 Marks) i.b) Alternatively, if starting in year 11, Stock B's ROE falls into 20% and the company is expected to start paying out 30% of its earnings in cash dividends, which it will continue to do forever after, what is its intrinsic value under the new payout policy? Given your calculation, explain why lower payout policy benefits or hurts Stock B's valuation? (8 Marks) 1. (20 Marks) Stock valuation & investment You are asked to provide the valuation for two stocks: D) Assume that the risk-free rate of interest is 5% and the expected rate of return on the market is 15%. Stock A is currently selling at $40 per share. The stock is expected to pay $5 dividends next year, and you expect it to sell then for $50 per share. The stock has a beta of 1.25. Is Stock A currently underpriced or overpriced? (4 Marks ii) Assume that the risk-free rate of interest is 5% and the expected rate of return on the market is 15%. The Company of Stock B pays no cash dividend currently and is not expected to for the next 10 years. Its latest EPS (Earnings Per Share) was $5, all of which was reinvested in the company. The firm's expected ROE for the next 10 years is 25% per year. And during this time it is expected to continue to reinvest all of its earnings. The beta of Stock B is 1.0. You have two scenarios: ja) If starting in year 11, the firm's ROE on new investment is expected to fall to 20%, and the company is expected to start paying out 50% of its earnings in cash dividends, which it will continue to do forever after. Given the current situation, what is the intrinsic value of Stock B? (8 Marks) i.b) Alternatively, if starting in year 11, Stock B's ROE falls into 20% and the company is expected to start paying out 30% of its earnings in cash dividends, which it will continue to do forever after, what is its intrinsic value under the new payout policy? Given your calculation, explain why lower payout policy benefits or hurts Stock B's valuation? (8 Marks)

Help please!! will upvote!

Help please!! will upvote!