Answered step by step

Verified Expert Solution

Question

1 Approved Answer

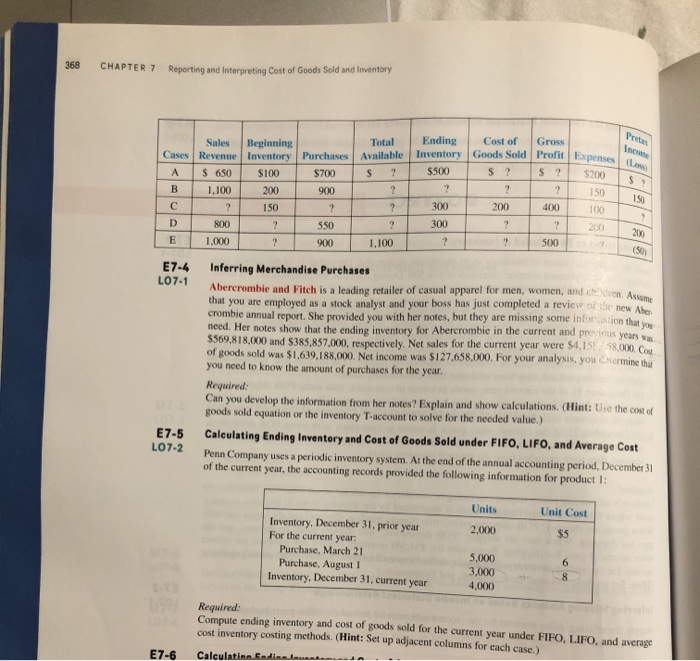

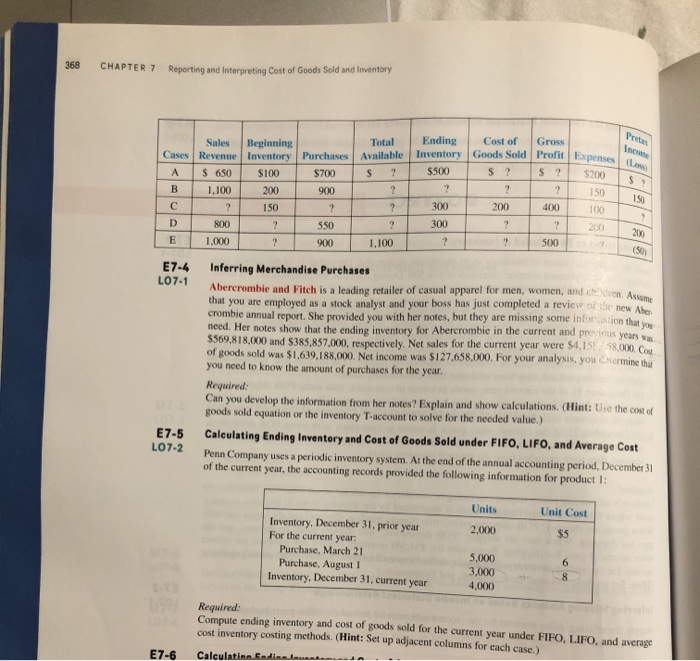

help please with E7-5 question E7-5 368 CHAPTER 7 Reporting and interpreting Cost of Goods Sold and Inventory Purchases Total Available S ? Ending Inventory

help please with E7-5

question E7-5

368 CHAPTER 7 Reporting and interpreting Cost of Goods Sold and Inventory Purchases Total Available S ? Ending Inventory $500 Cost of Gross Goods Sold Profit Expenses $ ? $ ? $200 Sales Beginning Revenue Inventory $ 650 $100 1.100 200 150 800 $700 900 2 200 400 104 300 300 550 900 1.000 1.100 500 E7-4 LO7-1 Inferring Merchandise Purchases Abercrombie and Fitch is a leading retailer of casual apparel for men, women, and c uren. As that you are employed as a stock analyst and your boss has just completed a review of the new Am crombie annual report. She provided you with her notes, but they are missing some infortion that need. Her notes show that the ending inventory for Abercrombie in the current and previous year 5569,818,000 and $385,857,000, respectively. Net sales for the current year were $4.158.000 of goods sold was $1.639,188,000. Net income was $127.658,000. For your analysis, you cermine the you need to know the amount of purchases for the year. Required: Can you develop the information from her notes? Explain and show calculations. (Hint: Use the cost of goods sold equation or the inventory T-account to solve for the needed value.) E7-5 LO7-2 Calculating Ending Inventory and Cost of Goods Sold under FIFO, LIFO, and Average Cost Penn Company uses a periodic inventory system. At the end of the annual accounting period, December 31 of the current year, the accounting records provided the following information for product I: Units Unit Cost 2,000 Inventory, December 31, prior year For the current year: Purchase, March 21 Purchase, Augusti Inventory, December 31, current year 5,000 3,000 4,000 Required: Compute ending inventory and cost of goods sold for the current year under FIFO, LIFO, and average cost inventory costing methods. (Hint: Set up adjacent columns for each case.) Calculation Codina E7-6 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started