Answered step by step

Verified Expert Solution

Question

1 Approved Answer

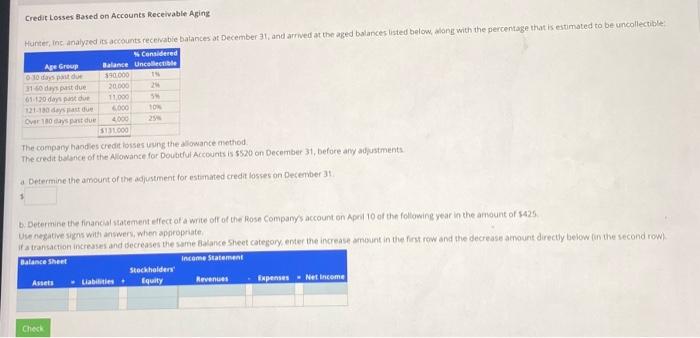

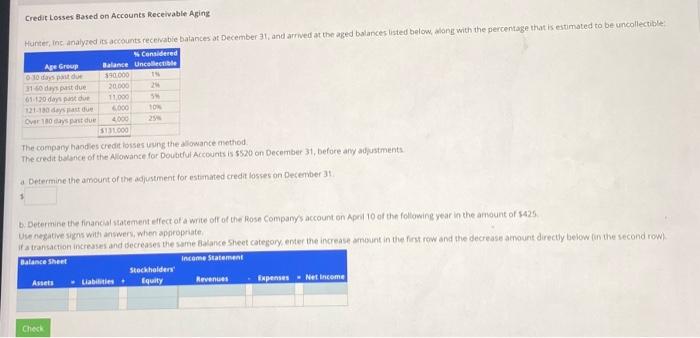

help pls Credit Losses Based on Accounts Receivable Aging Hunter, Inc analyzed its accounts receivable balances at December 31, and arrived at the aged balances

help pls

Credit Losses Based on Accounts Receivable Aging Hunter, Inc analyzed its accounts receivable balances at December 31, and arrived at the aged balances listed below, along with the percentage that is estimated to be uncollectible Considered Age Group 030 days past due 31 60 days past due 61-120 days past due 121-180 days past due Balance Uncollectible IN $90,000 20,000 26 11,000 SM 6.000 10% Over 180 days past due 25% 4,000 $131.000 The company handles credit losses using the allowance method. The credit balance of the Allowance for Doubtful Accounts is $520 on December 31, before any adjustments a Determine the amount of the adjustment for estimated credit losses on December 31. b. Determine the financial statement effect of a write off of the Rose Company's account on April 10 of the following year in the amount of $425 Use negative signs with answers, when appropriate. if a transaction increases and decreases the same Balance Sheet category, enter the increase amount in the first row and the decrease amount directly below (in the second row). Balance Sheet Income Statement Stockholders Equity Assets Liabilities + Revenues Expenses Net Income Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started