Answered step by step

Verified Expert Solution

Question

1 Approved Answer

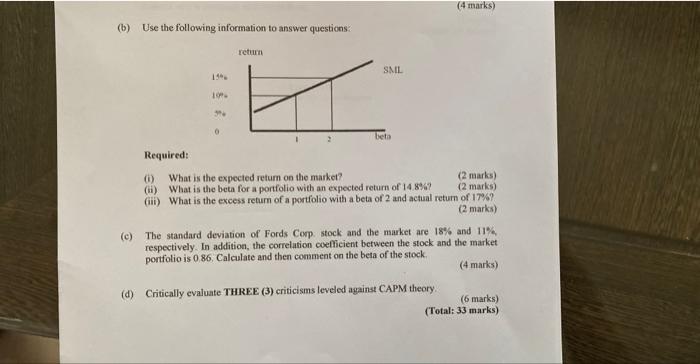

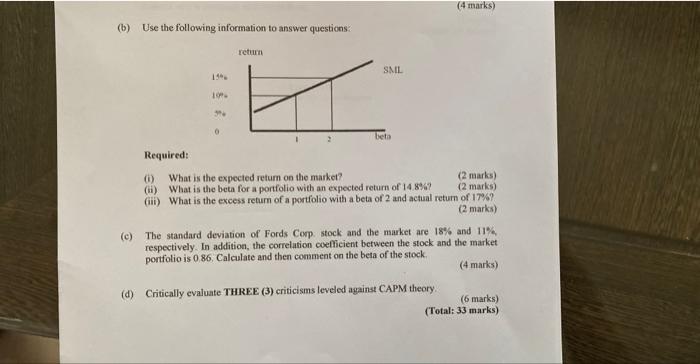

help pls. questionB) and C) step by step calculation (b) Use the following information to answer questions: Reasuired: (i) What is the expected retum on

help pls. questionB) and C) step by step calculation

(b) Use the following information to answer questions: Reasuired: (i) What is the expected retum on the market? (2 marks) (ii) What is the beta for a portfolio with an expected return of 14.8% (2 marks) (iii) What is the excess return of a portiolio with a beta of 2 and actual retum of 17% ? (2 marks) (c) The standard deviation of Fords Comp stock and the market are 18% and 11%, respectively. In addition, the correlation coefficient between the stock and the market portfolio is 0.86. Calcalate and then comment on the beta of the stock. (4 marks) (d) Critically evaluate THREE (3) criticisms leveled against CAPM theory. (6 marks) (Total: 33 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started