help pls

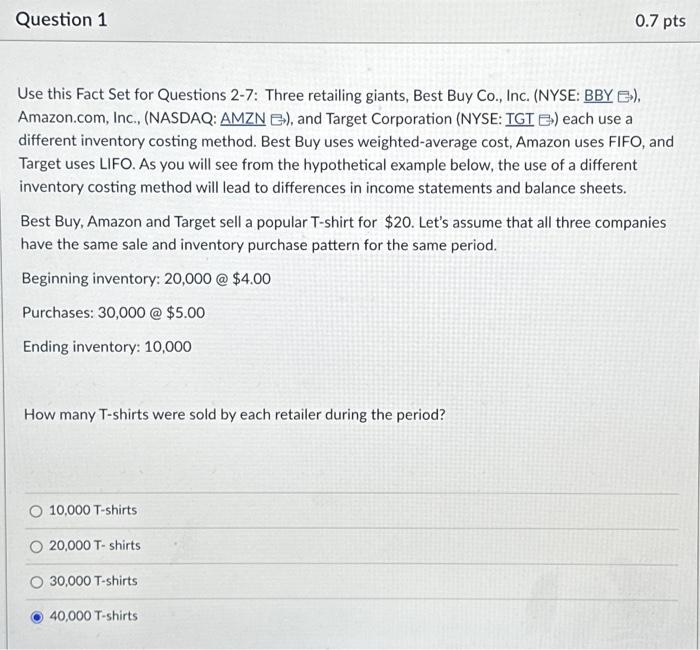

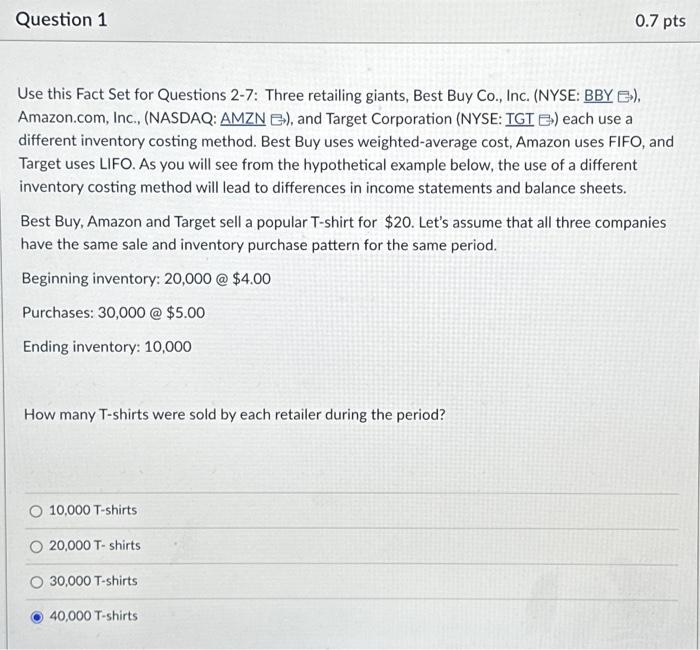

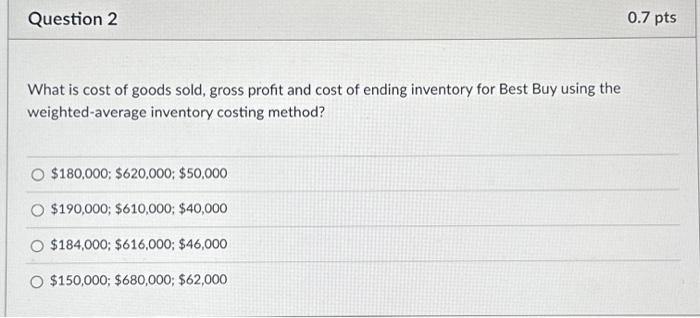

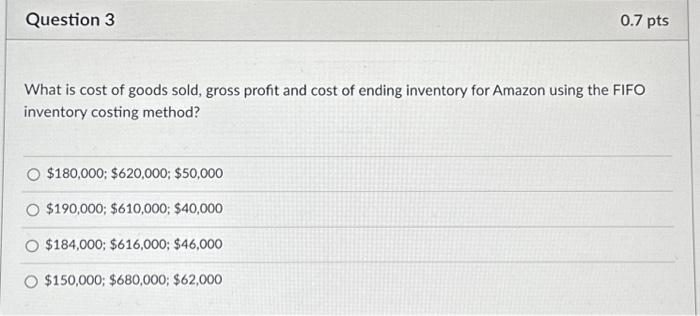

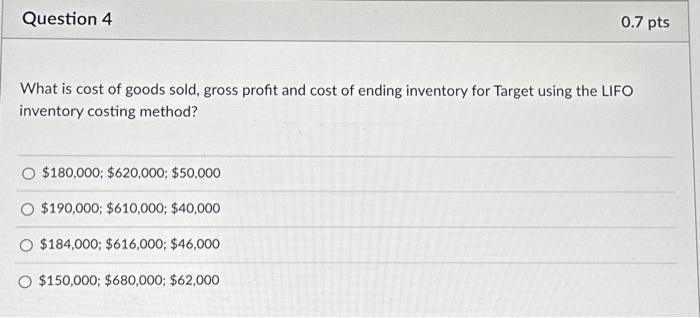

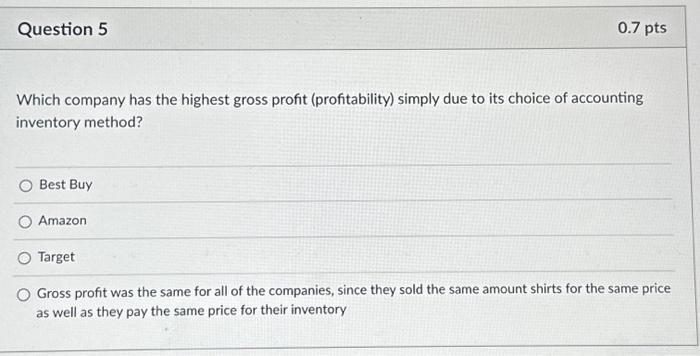

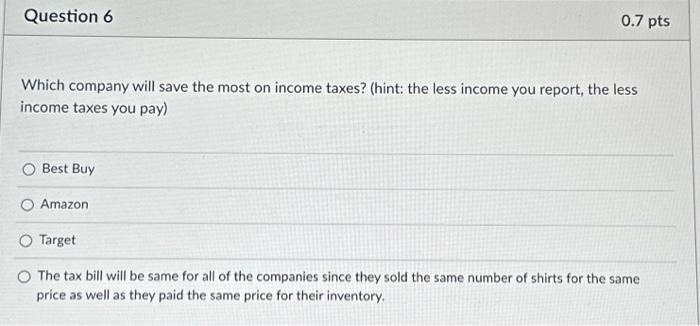

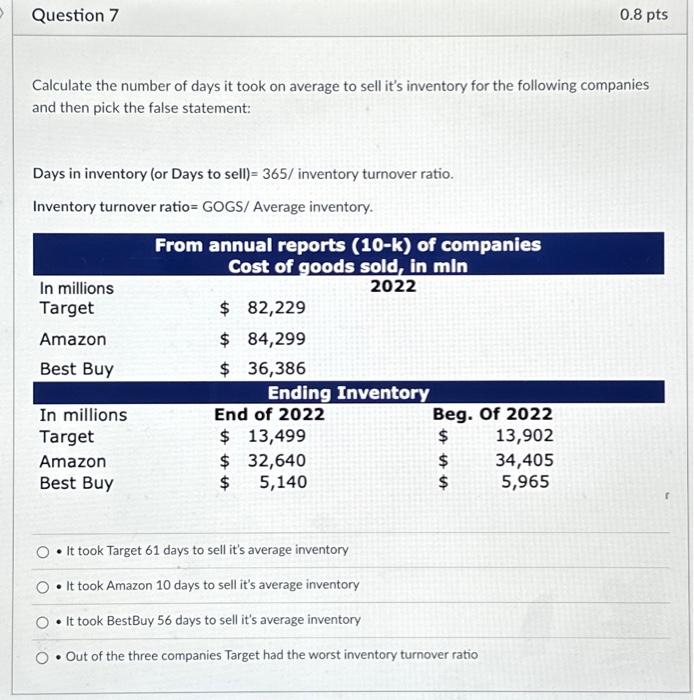

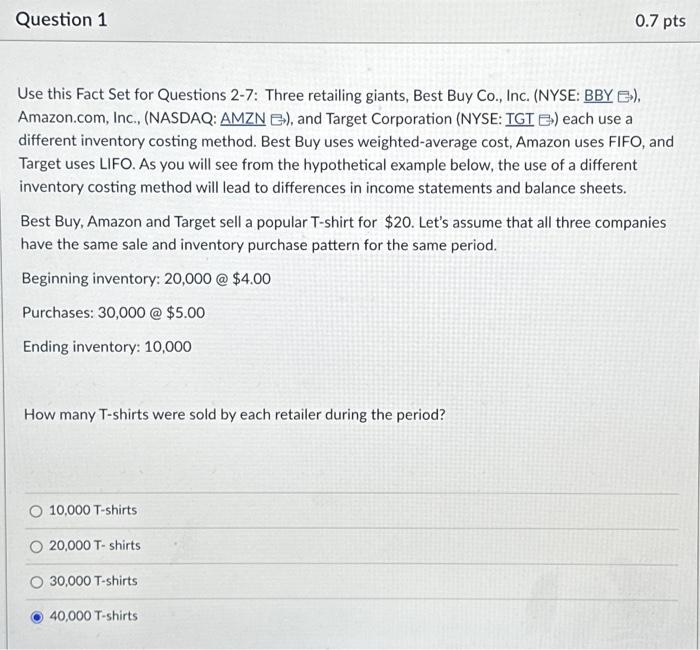

What is cost of goods sold, gross profit and cost of ending inventory for Amazon using the FIFO inventory costing method? $180,000;$620,000;$50,000$190,000;$610,000;$40,000$184,000;$616,000;$46,000$150,000;$680,000;$62,000 Which company will save the most on income taxes? (hint: the less income you report, the less income taxes you pay) Best Buy Amazon Target The tax bill will be same for all of the companies since they sold the same number of shirts for the same price as well as they paid the same price for their inventory. Calculate the number of days it took on average to sell it's inventory for the following companies and then pick the false statement: Days in inventory (or Days to sell) =365/ inventory turnover ratio. Inventory turnover ratio= GOGS/ Average inventory . - It took Target 61 days to sell it's average inventory - It took Amazon 10 days to sell it's average inventory - It took BestBuy 56 days to sell it's average inventory - Out of the three companies Target had the worst inventory turnover ratio Which company has the highest gross profit (profitability) simply due to its choice of accounting inventory method? Best Buy Amazon Target Gross profit was the same for all of the companies, since they sold the same amount shirts for the same price as well as they pay the same price for their inventory Use this Fact Set for Questions 2-7: Three retailing giants, Best Buy Co., Inc. (NYSE: BBY ), Amazon.com, Inc., (NASDAQ: AMZN ) ), and Target Corporation (NYSE: TGT ) each use a different inventory costing method. Best Buy uses weighted-average cost, Amazon uses FIFO, and Target uses LIFO. As you will see from the hypothetical example below, the use of a different inventory costing method will lead to differences in income statements and balance sheets. Best Buy, Amazon and Target sell a popular T-shirt for $20. Let's assume that all three companies have the same sale and inventory purchase pattern for the same period. Beginning inventory: 20,000@$4.00 Purchases: 30,000@$5.00 Ending inventory: 10,000 How many T-shirts were sold by each retailer during the period? 10,000 T-shirts 20,000 T- shirts 30,000 T-shirts 40,000 T-shirts What is cost of goods sold, gross profit and cost of ending inventory for Best Buy using the weighted-average inventory costing method? $180,000;$620,000;$50,000$190,000;$610,000;$40,000$184,000;$616,000;$46,000$150,000;$680,000;$62,000 What is cost of goods sold, gross profit and cost of ending inventory for Target using the LIFO inventory costing method? $180,000;$620,000;$50,000$190,000;$610,000;$40,000$184,000;$616,000;$46,000$150,000;$680,000;$62,000