help pls!!! ( will rate !!! ) ~~thank you in advance

DISCLAIMER!!!!! i also need the retained earnings statement if possible as well!

the dividens on preferred stock is 6350

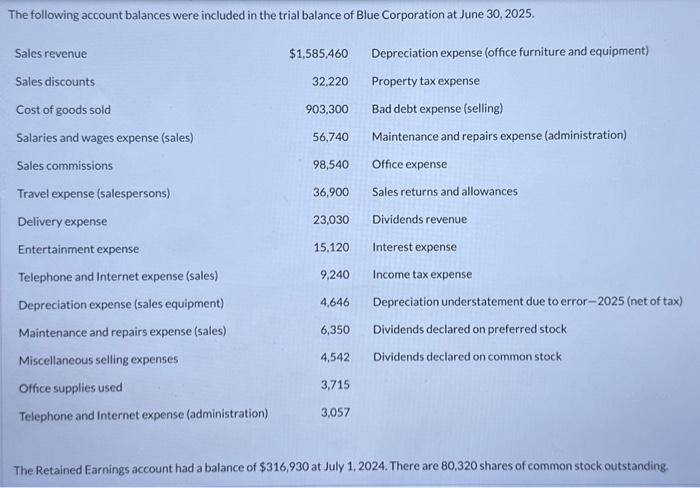

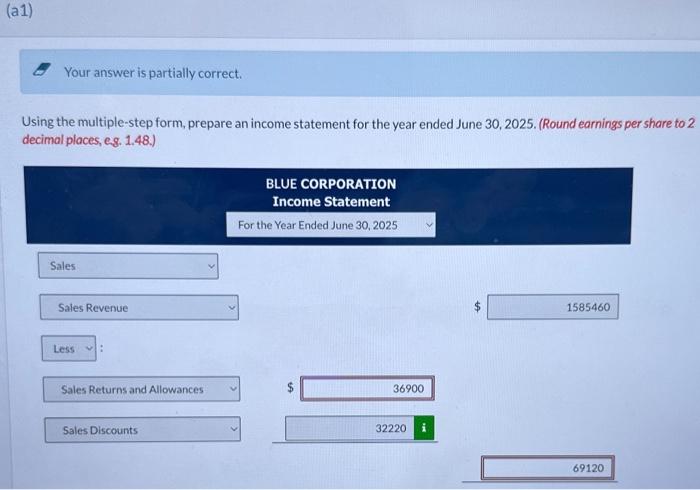

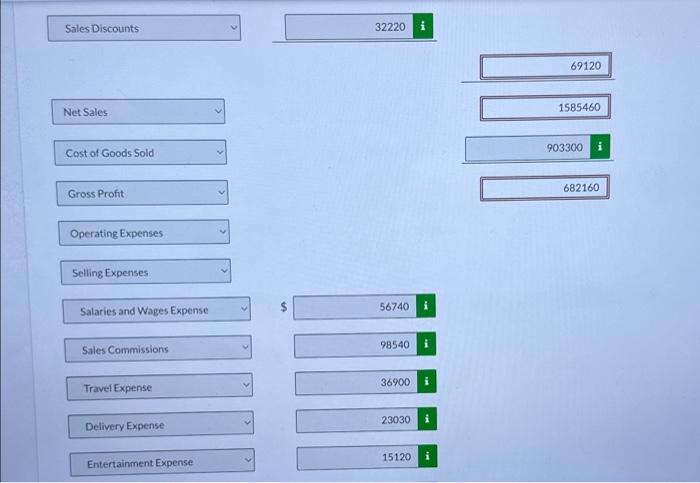

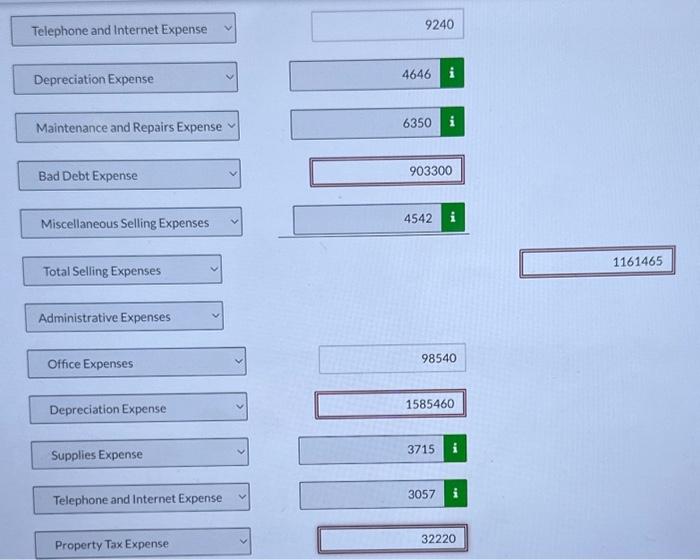

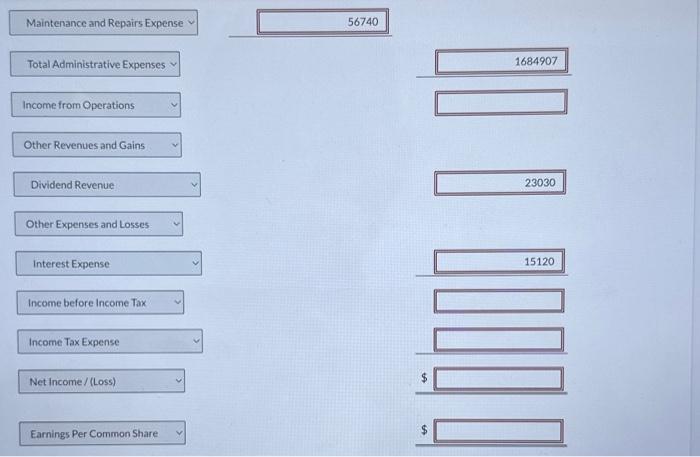

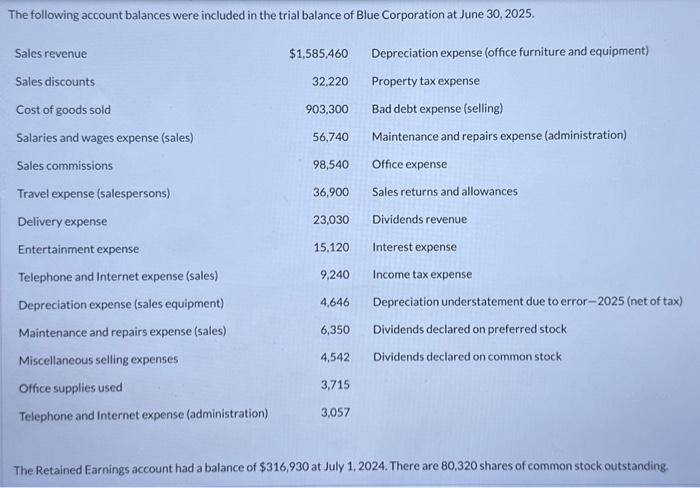

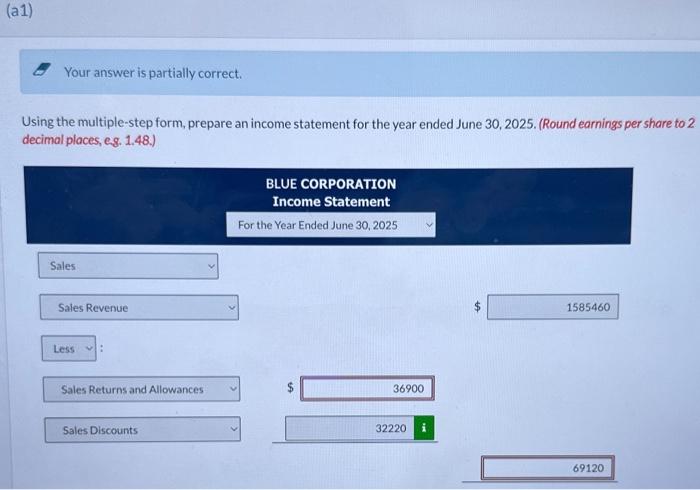

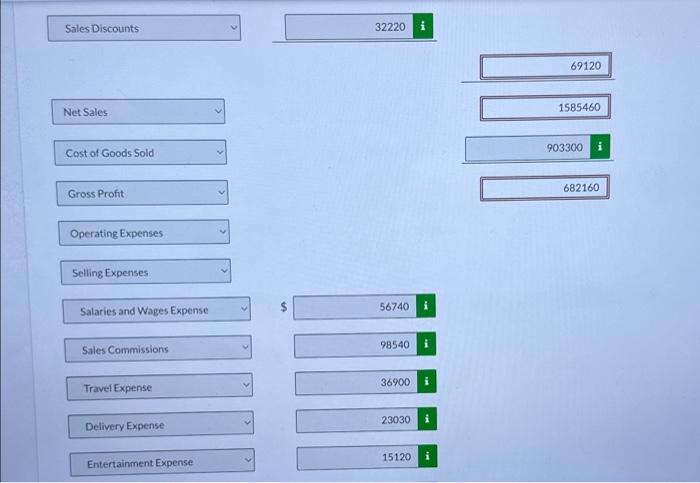

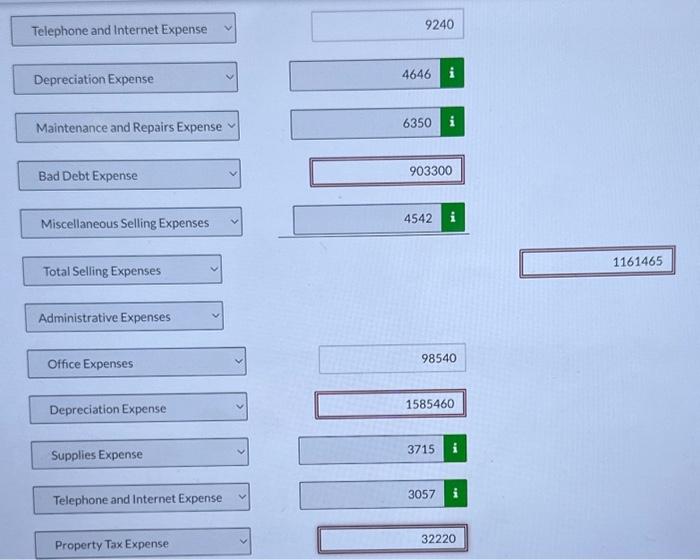

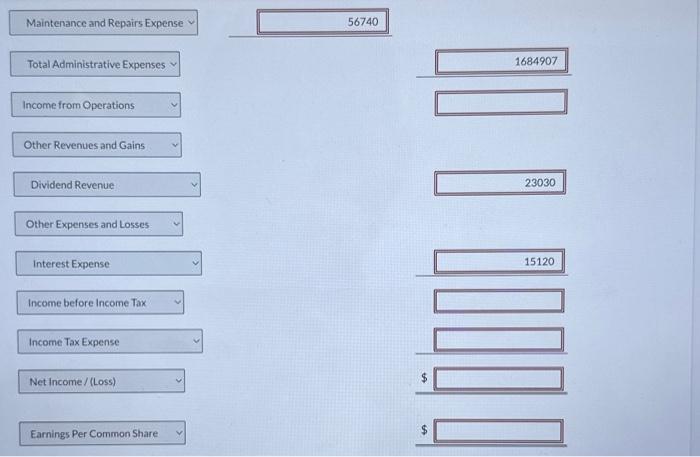

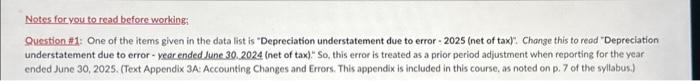

The following account balances were included in the trial balance of Blue Corporation at June 30,2025. The Retained Earnings account had a balance of $316,930 at July 1, 2024. There are 80,320 shares of common stock outstanding. 6 Your answer is partially correct. Using the multiple-step form, prepare an income statement for the year ended June 30, 2025. (Round earnings per share to 2 decimal places, eg. 1.48.) Sales Discounts Gross Profit \begin{tabular}{||c||} \hline 682160 \\ \hline \end{tabular} Selling Expenses Salaries and Wages Expense Sales Commissions \begin{tabular}{|l|l|} \hline 98540 & i \\ \hline \end{tabular} Travel Expense \begin{tabular}{|l|l|} \hline 36900 & i \\ \hline \end{tabular} Delivery Expense \begin{tabular}{|l|l|l|} \hline & 23030 & i \\ \hline \end{tabular} Entertainment Expense 15120 i Telephone and Internet Expense 9240 Depreciation Expense Maintenance and Repairs Expense \begin{tabular}{|l|l|} \hline 6350 & i \\ \hline \end{tabular} Bad Debt Expense \begin{tabular}{|r|} \hline 903300 \\ \hline \end{tabular} Miscellaneous Selling Expenses Total Selling Expenses \begin{tabular}{|c||} \hline 1161465 \\ \hline \end{tabular} Administrative Expenses Office Expenses 98540 Depreciation Expense Supplies Expense Telephone and Internet Expense \begin{tabular}{|l|l|} \hline 3057 & i \\ \hline \end{tabular} Property Tax Expense 32220 Maintenance and Repairs Expense v Total Administrative Expenses Other Revenues and Gains Dividend Revenue Other Expenses and Losses: Interest Expense Income before income Tax Income Tax Expense Net income / (Loss) Earnings Per Common Share Notes for you to read before working Question \#1: One of the items given in the data list is "Depreciation understatement due to error - 2025 (net of tax): Chonze this to read "Depreclation understatement due to error - yeor ended June 30.2024 (net of tax)." So, this error is treated as a prior period adjustment when reporting for the year. ended June 30, 2025. (Text Appendix 3A: Accounting Changes and Errors. This appendix is included in this course. as noted on p. 7 of the syllabus.) The following account balances were included in the trial balance of Blue Corporation at June 30,2025. The Retained Earnings account had a balance of $316,930 at July 1, 2024. There are 80,320 shares of common stock outstanding. 6 Your answer is partially correct. Using the multiple-step form, prepare an income statement for the year ended June 30, 2025. (Round earnings per share to 2 decimal places, eg. 1.48.) Sales Discounts Gross Profit \begin{tabular}{||c||} \hline 682160 \\ \hline \end{tabular} Selling Expenses Salaries and Wages Expense Sales Commissions \begin{tabular}{|l|l|} \hline 98540 & i \\ \hline \end{tabular} Travel Expense \begin{tabular}{|l|l|} \hline 36900 & i \\ \hline \end{tabular} Delivery Expense \begin{tabular}{|l|l|l|} \hline & 23030 & i \\ \hline \end{tabular} Entertainment Expense 15120 i Telephone and Internet Expense 9240 Depreciation Expense Maintenance and Repairs Expense \begin{tabular}{|l|l|} \hline 6350 & i \\ \hline \end{tabular} Bad Debt Expense \begin{tabular}{|r|} \hline 903300 \\ \hline \end{tabular} Miscellaneous Selling Expenses Total Selling Expenses \begin{tabular}{|c||} \hline 1161465 \\ \hline \end{tabular} Administrative Expenses Office Expenses 98540 Depreciation Expense Supplies Expense Telephone and Internet Expense \begin{tabular}{|l|l|} \hline 3057 & i \\ \hline \end{tabular} Property Tax Expense 32220 Maintenance and Repairs Expense v Total Administrative Expenses Other Revenues and Gains Dividend Revenue Other Expenses and Losses: Interest Expense Income before income Tax Income Tax Expense Net income / (Loss) Earnings Per Common Share Notes for you to read before working Question \#1: One of the items given in the data list is "Depreciation understatement due to error - 2025 (net of tax): Chonze this to read "Depreclation understatement due to error - yeor ended June 30.2024 (net of tax)." So, this error is treated as a prior period adjustment when reporting for the year. ended June 30, 2025. (Text Appendix 3A: Accounting Changes and Errors. This appendix is included in this course. as noted on p. 7 of the syllabus.)