Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help Pro forma income statement. The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.64 million. Interest expense is expected

help

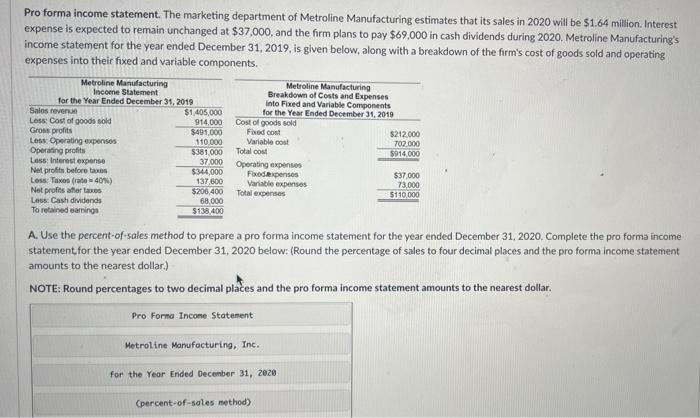

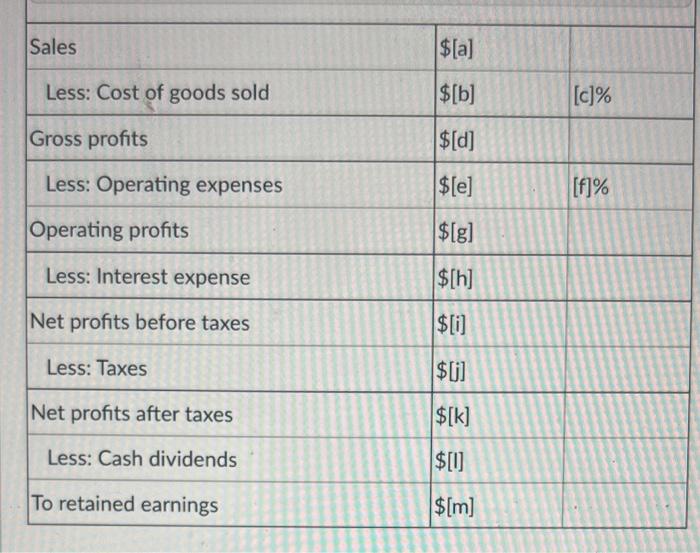

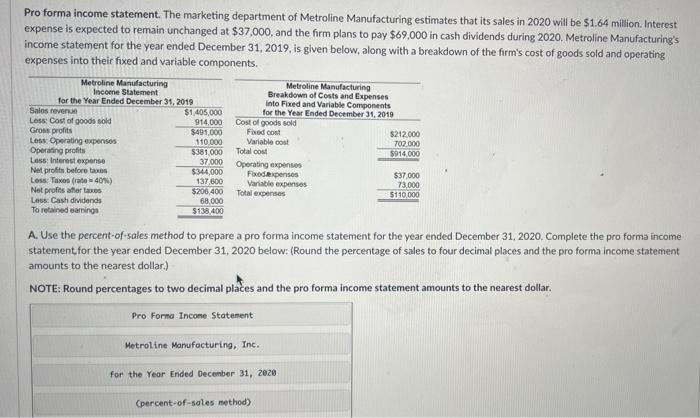

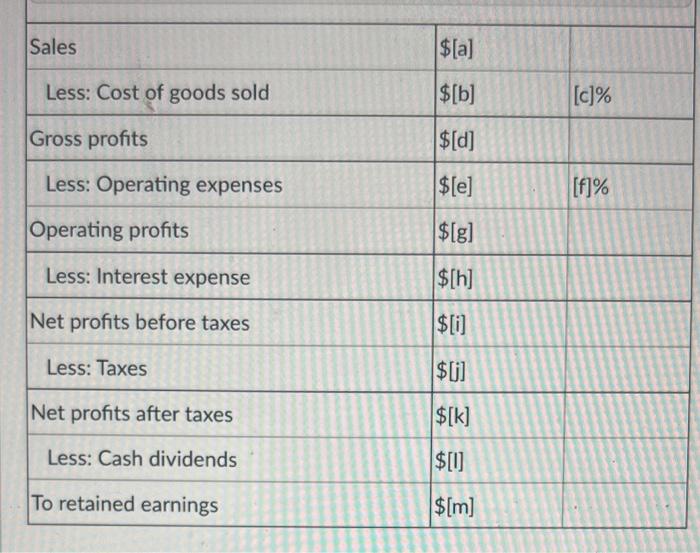

Pro forma income statement. The marketing department of Metroline Manufacturing estimates that its sales in 2020 will be $1.64 million. Interest expense is expected to remain unchanged at $37,000, and the firm plans to pay $69,000 in cash dividends during 2020. Metroline Manufacturing's income statement for the year ended December 31,2019 , is given below, along with a breakdown of the firm's cost of goods sold and operating expenses into their fixed and variable components. A. Use the percent-of-sales method to prepare a pro forma income statement for the year ended December 31, 2020. Complete the pro forma income statement, for the year ended December 31,2020 below: (Round the percentage of sales to four decimal places and the pro forma income statement amounts to the nearest dollar.) NOTE: Round percentages to two decimal places and the pro forma income statement amounts to the nearest dollar. \begin{tabular}{|l|l|l|} \hline Sales & $[a] & \\ \hline Less: Cost of goods sold & $[b] & {[c]%} \\ \hline Gross profits & $[d] & \\ \hline Less: Operating expenses & $[e] & {[f]%} \\ \hline Operating profits & $[g] & \\ \hline Less: Interest expense & $[h] & \\ \hline Net profits before taxes & $[i] & \\ \hline Less: Taxes & $[j] & \\ \hline Net profits after taxes & $[k] & \\ \hline Less: Cash dividends & $[l] \\ \hline To retained earnings & $[m] \\ \hline \end{tabular} [Choose] [Choose] [Choose] [Choose] [Choose] [Choose] [Choose] [Choose] [Choose] [Choose] Choose] [Choose] [Choose]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started