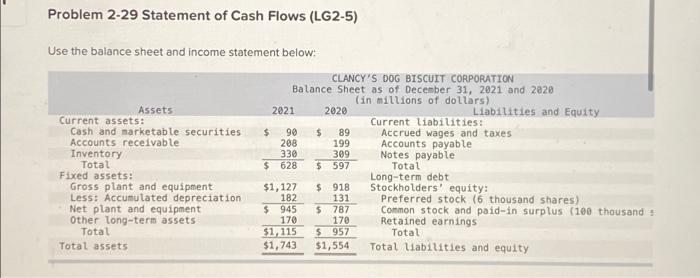

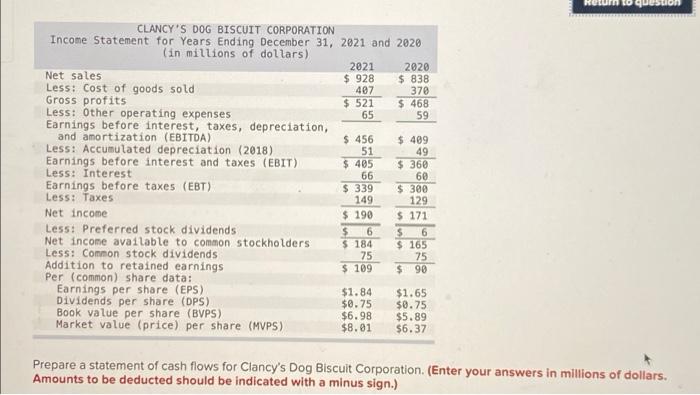

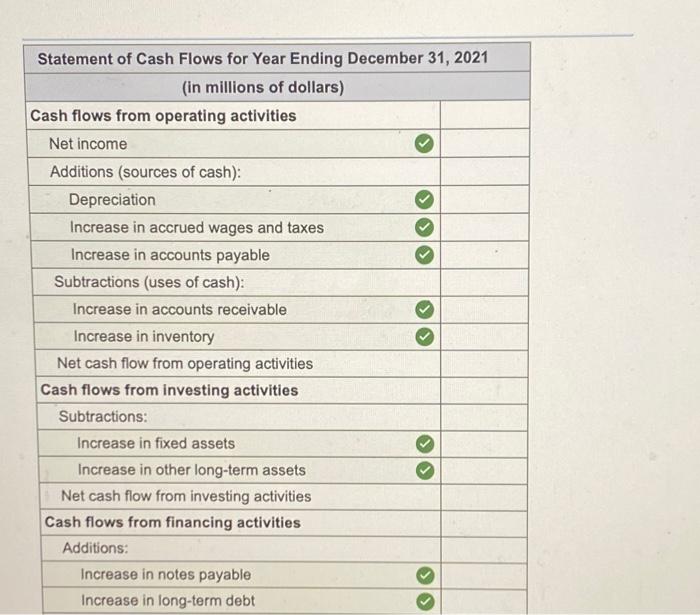

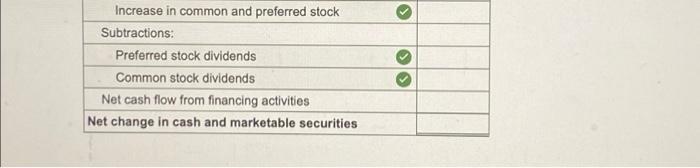

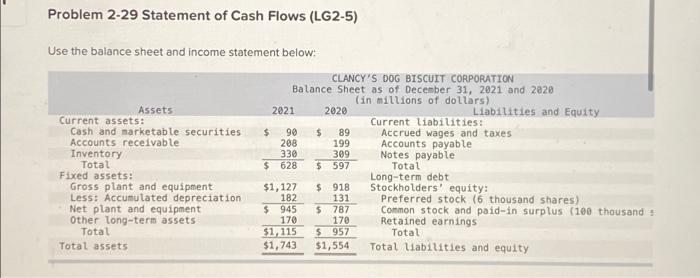

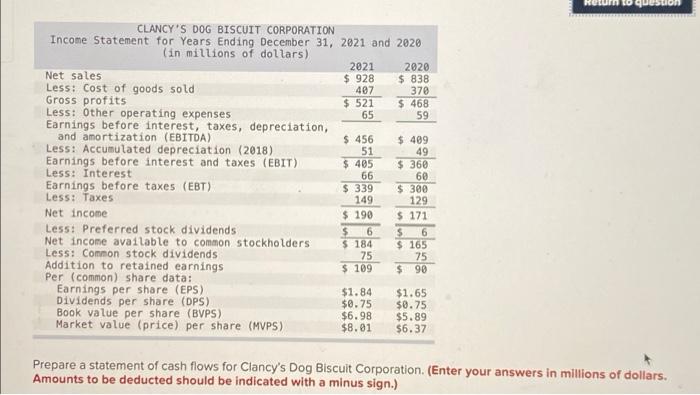

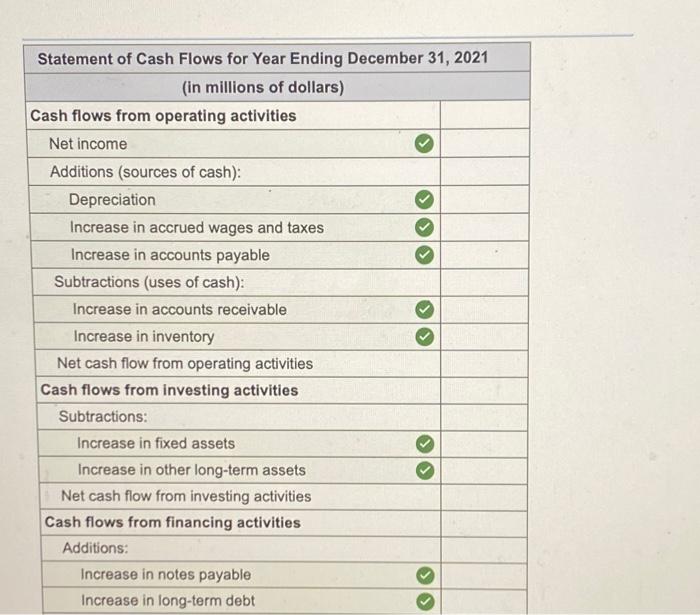

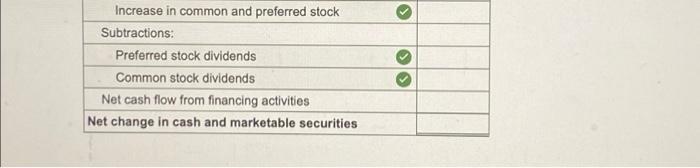

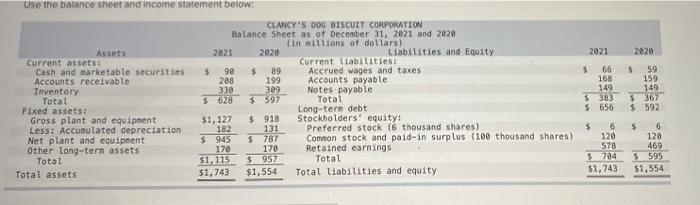

Problem 2-29 Statement of Cash Flows (LG2-5) Use the balance sheet and income statement below: Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets. al Total assets $ CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 90 $ 208 330 $ 628 2020 89 199 309 $ 597 $ 918 131 $ 787 $1,127 182 $945 170 170 $1,115 $ 957 $1,743 $1,554 Liabilities and Equity Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total Long-term debt Stockholders' equity: Preferred stock (6 thousand shares) Common stock and paid-in surplus (100 thousands Retained earnings Total Total liabilities and equity CLANCY'S DOG BISCUIT CORPORATION Income Statement for Years Ending December 31, 2021 and 2020 (in millions of dollars) Net sales Less: Cost of goods sold Gross profits Less: Other operating expenses Earnings before interest, taxes, depreciation, and amortization (EBITDA) Less: Accumulated depreciation (2018) Earnings before interest and taxes (EBIT) Less: Interest Earnings before taxes (EBT) Less: Taxes Net income Less: Preferred stock dividends Net income available to common stockholders Less: Common stock dividends Addition to retained earnings Per (common) share data: Earnings per share (EPS)) Dividends per share (DPS) Book value per share (BVPS) Market value (price) per share (MVPS) 2021 $ 928 407 $ 521 65 $ 456 51 $ 405 66 $ 339 149 $ 190 $6 $184 75 $ 109 $1.84 $0.75 $6.98 $8.01 2020 $838 370 $468 59 $ 409 49 $360 60 $300 129 $ 171 $ 6 $ 165 75 $.90 $1.65 $0.75 $5.89 $6.37 Return to question Prepare a statement of cash flows for Clancy's Dog Biscuit Corporation. (Enter your answers in millions of dollars. Amounts to be deducted should be indicated with a minus sign.) Statement of Cash Flows for Year Ending December 31, 2021 (in millions of dollars) Cash flows from operating activities Net income Additions (sources of cash): Depreciation Increase in accrued wages and taxes Increase in accounts payable Subtractions (uses of cash): Increase in accounts receivable Increase in inventory Net cash flow from operating activities Cash flows from investing activities Subtractions: Increase in fixed assets Increase in other long-term assets Net cash flow from investing activities Cash flows from financing activities Additions: Increase in notes payable Increase in long-term debt Increase in common and preferred stock Subtractions: Preferred stock dividends Common stock dividends Net cash flow from financing activities Net change in cash and marketable securities Use the balance sheet and income statement below: Assets Current assets: Cash and marketable securities Accounts receivable Inventory Total Fixed assets: Gross plant and equipment Less: Accumulated depreciation Net plant and equipment Other long-term assets Total Total assets S CLANCY'S DOG BISCUIT CORPORATION Balance Sheet as of December 31, 2021 and 2020 (in millions of dollars) 2021 90 288 330 $ 628 2020 89 199 309 $ 597 $ $1,127 $918 131 182 $945 $ 787 170 170 $1,115 $957 $1,743 $1,554 Liabilities and Equity Current liabilities: Accrued wages and taxes Accounts payable Notes payable Total Long-tere debt Stockholders' equity: Preferred stock (6 thousand shares). Common stock and paid-in surplus (100 thousand shares). Retained earnings Total. Total liabilities and equity 2021 $66 168 149 $ 383 $ 656 $ 6 120 578 $ 704 $1,743 2020 $ 59 159 149 $367 $592 6 120 469 $ 595 $1,554 $