Help!

Help!

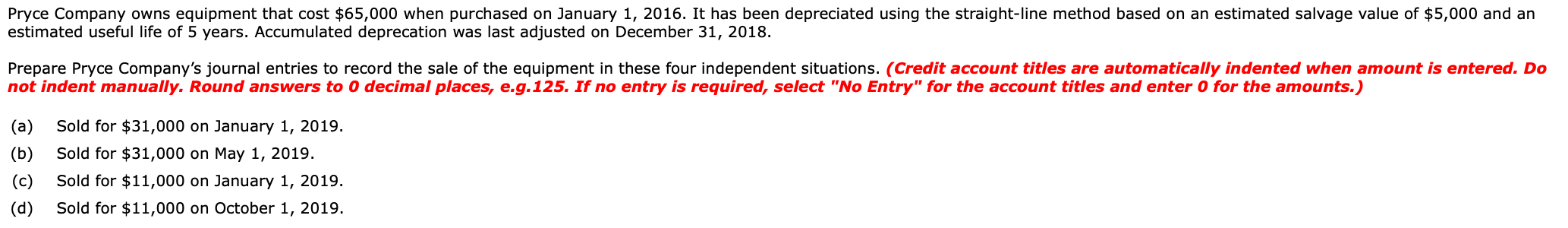

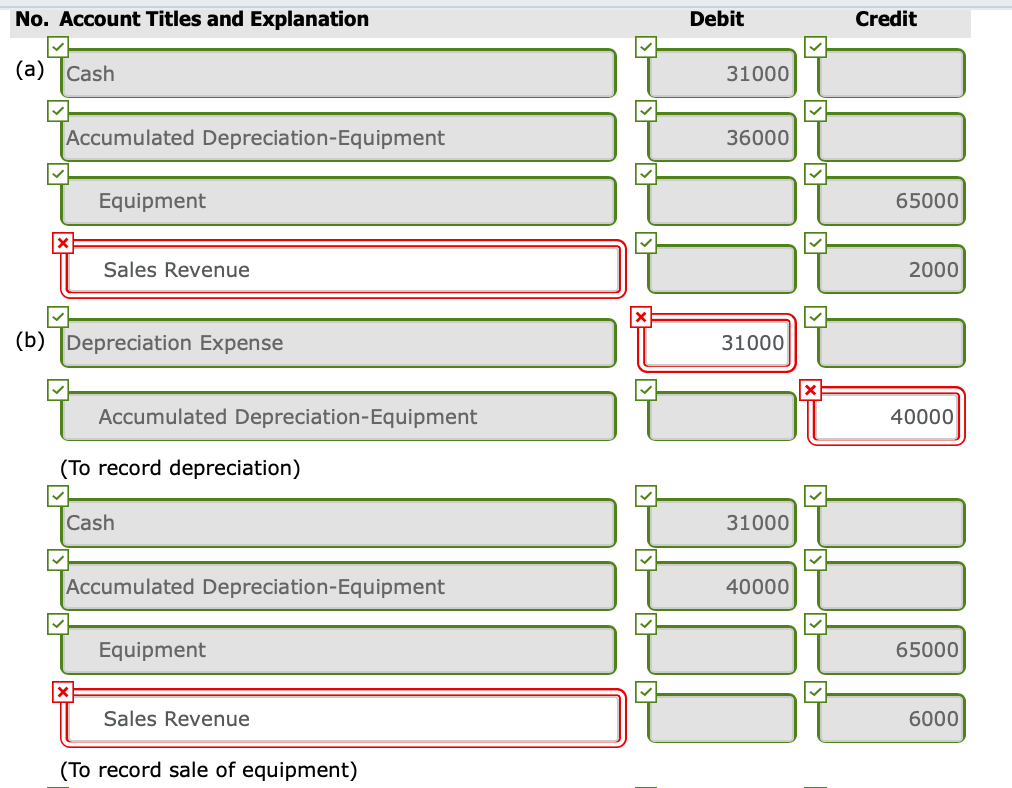

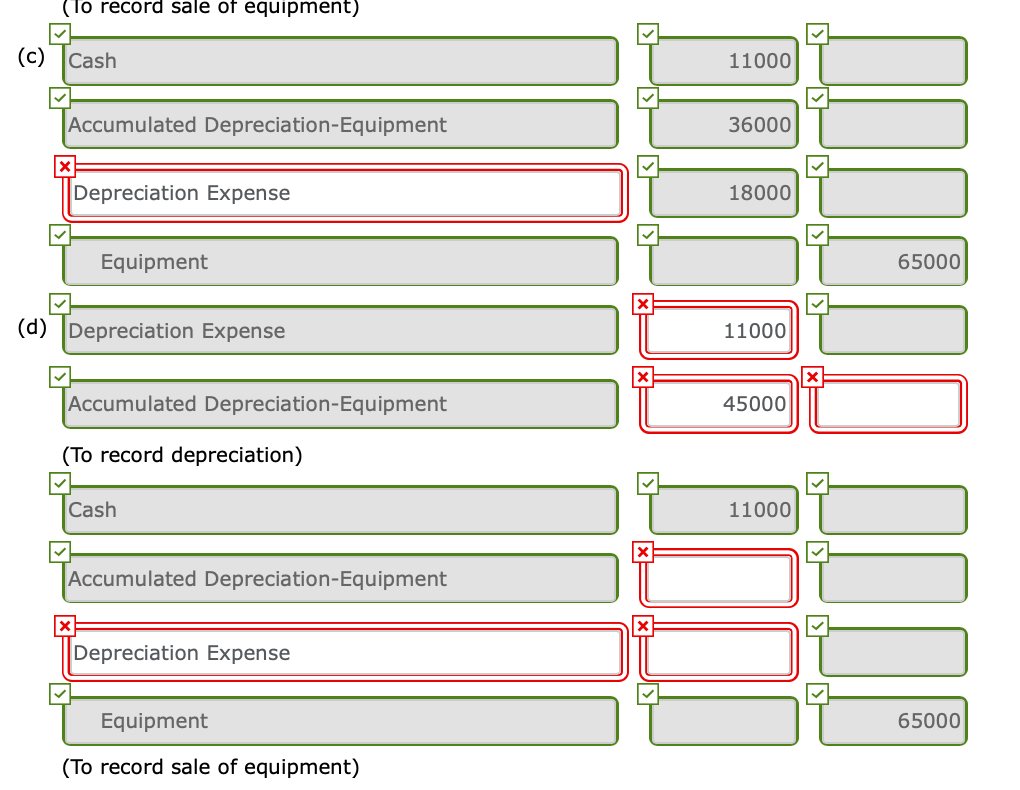

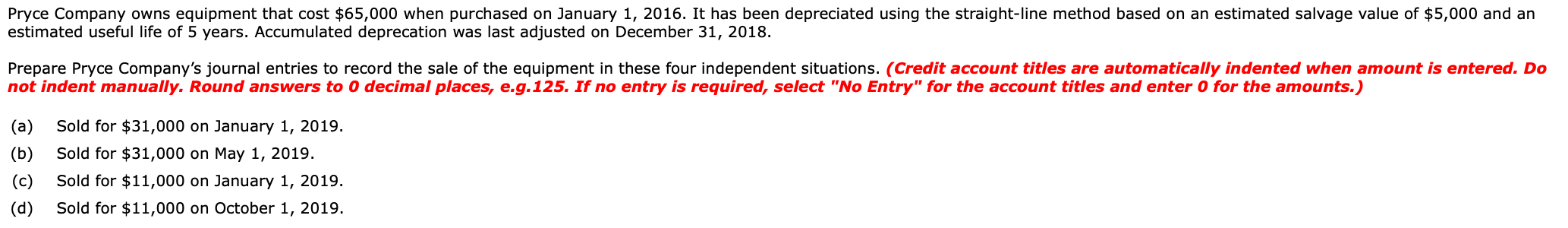

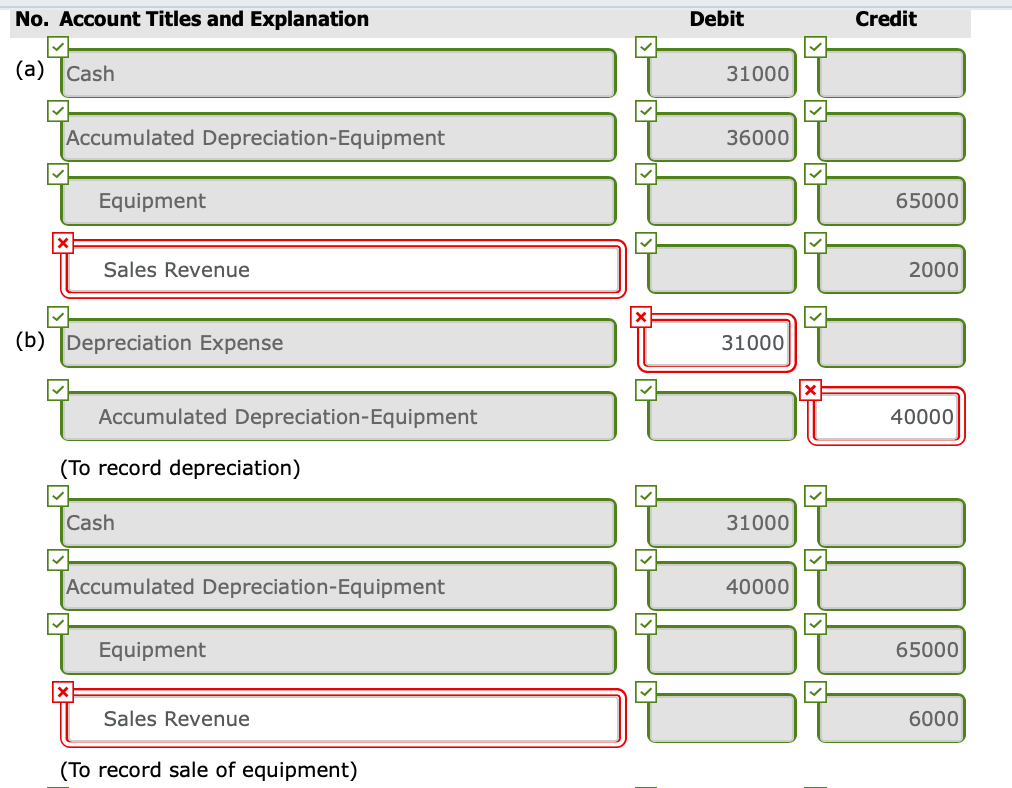

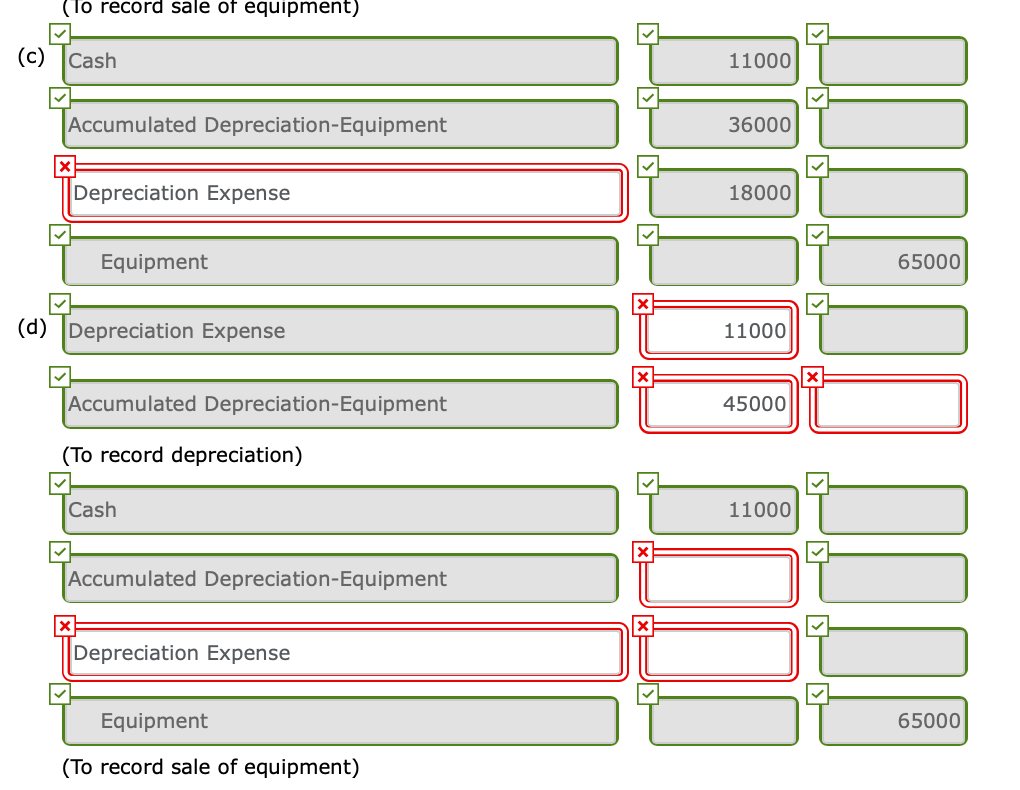

Pryce Company owns equipment that cost $65,000 when purchased on January 1, 2016. It has been depreciated using the straight-line method based on an estimated salvage value of $5,000 and an estimated useful life of 5 years. Accumulated deprecation was last adjusted on December 31, 2018. Prepare Pryce Company's journal entries to record the sale of the equipment in these four independent situations. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 125. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) (a) (b) (c) (d) Sold for $31,000 on January 1, 2019. Sold for $31,000 on May 1, 2019. Sold for $11,000 on January 1, 2019. Sold for $11,000 on October 1, 2019. No. Account Titles and Explanation Debit Credit (a) Cash 31000 Accumulated Depreciation-Equipment 36000 Equipment 65000 X Sales Revenue 2000 (b) Depreciation Expense 31000 Accumulated Depreciation-Equipment 40000 (To record depreciation) Cash 31000 Accumulated Depreciation-Equipment 40000 Equipment 65000 Sales Revenue 6000 (To record sale of equipment) (To record sale of equipment) (C) Cash 11000 Accumulated Depreciation Equipment 36000 Depreciation Expense 18000 Equipment 65000 (d) Depreciation Expense 11000 X Accumulated Depreciation-Equipment 45000 (To record depreciation) Cash 11000 Accumulated Depreciation-Equipment Depreciation Expense Equipment 65000 (To record sale of equipment) List Of Accounts Exercise 9-10 Accounts Payable Accounts Receivable Accumulated Depletion Accumulated Depreciation-Buildings Accumulated Depreciation Equipment Accumulated Depreciation-Machine Accumulated Depreciation-Truck Advertising Expense Allowance for Doubtful Accounts Amortization Expense Bad Debt Expense Buildings Cash Coal Mine Common Stock Copyrights Cost of Goods Sold Depletion Expense Depreciation Expense Dividends Equipment Franchises Freight-In Gain on Disposal of Plant Assets Goodwill Insurance Expense Interest Expense Interest Payable Interest Receivable Interest Revenue Inventory Land Land Improvements Loss on Disposal of Plant Assets Machine Maintenance and Repairs Expense Miscellaneous Expense No Entry Notes Payable Notes Receivable Ore Mine Other Operating Expenses Patents Prepaid Insurance Rent Revenue Research and Development Expense Retained Earnings Salaries and Wages Expense Salaries and Wages Payable Sales Revenue Truck Unearned Rent Revenue

Help!

Help!