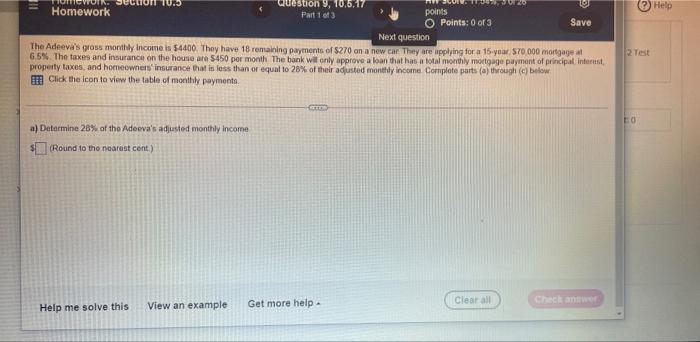

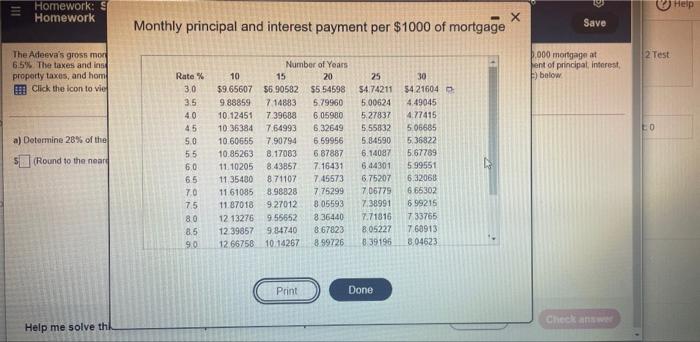

Help Question , 10.6.17 Homework Part 1 of 3 points O Points: 0 of 3 Save Next question The Adeevi's gross monthly income is 54400. They have 18 remaining payments of $270 on a new car. They are applying for a 15-year 570 000 mortgage 6.5%. The taxes and insurance on the house are $450 per month The bank wil only approve a loan that has a total monthly mortgage payment of principal interest property taxes, and homeowners insurance that is less than or equal to 28% of their adjusted monthly income Complete parts (a) through (c) below Click the icon to view the table of monthly payments (2 Test EO a) Determine 28% of the Adeva's adjusted monthly income (Round to the nearest cont.) Help me solve this Clear all View an example Get more help Help Homework: S Homework X Monthly principal and interest payment per $1000 of mortgage Save 2 Test The Adeeva's gross mor 6.5% The taxes and in property taxes, and hom Click the icon to vie 9.000 mortgage at ent of principal, interest ) below LO a) Determine 28% of the Rate % 3.0 3.5 40 45 50 55 60 65 70 7.5 80 8.5 90 Number of Years 10 15 20 $9.65607 $690582 $554598 9.88859 7 14883 5.79960 10.12451 7 39688 6.05980 10 36384 7.64993 6.32649 10.60655 7.90794 6.59956 10.86263 8.17083 6 87887 11.10205 843867 7.16431 11 35480 871107 7.45573 11 61085 8.98828 7.75299 1187018 9.27012 805593 12 13276 9.55652 836440 12 39857 984740 8 67823 12 66758 10 14267 899726 (Round to the near 25 $4.74211 500624 5.27837 555832 5.84590 6.14087 6.44301 6.75207 7 06779 7.38991 7.71816 805227 839195 30 $421604 4,49045 4.77415 506685 5.36822 5.67789 599551 6.32068 665302 6 99215 733765 7.68913 8,04623 Print Done Cheka Help me solve thl Help Question , 10.6.17 Homework Part 1 of 3 points O Points: 0 of 3 Save Next question The Adeevi's gross monthly income is 54400. They have 18 remaining payments of $270 on a new car. They are applying for a 15-year 570 000 mortgage 6.5%. The taxes and insurance on the house are $450 per month The bank wil only approve a loan that has a total monthly mortgage payment of principal interest property taxes, and homeowners insurance that is less than or equal to 28% of their adjusted monthly income Complete parts (a) through (c) below Click the icon to view the table of monthly payments (2 Test EO a) Determine 28% of the Adeva's adjusted monthly income (Round to the nearest cont.) Help me solve this Clear all View an example Get more help Help Homework: S Homework X Monthly principal and interest payment per $1000 of mortgage Save 2 Test The Adeeva's gross mor 6.5% The taxes and in property taxes, and hom Click the icon to vie 9.000 mortgage at ent of principal, interest ) below LO a) Determine 28% of the Rate % 3.0 3.5 40 45 50 55 60 65 70 7.5 80 8.5 90 Number of Years 10 15 20 $9.65607 $690582 $554598 9.88859 7 14883 5.79960 10.12451 7 39688 6.05980 10 36384 7.64993 6.32649 10.60655 7.90794 6.59956 10.86263 8.17083 6 87887 11.10205 843867 7.16431 11 35480 871107 7.45573 11 61085 8.98828 7.75299 1187018 9.27012 805593 12 13276 9.55652 836440 12 39857 984740 8 67823 12 66758 10 14267 899726 (Round to the near 25 $4.74211 500624 5.27837 555832 5.84590 6.14087 6.44301 6.75207 7 06779 7.38991 7.71816 805227 839195 30 $421604 4,49045 4.77415 506685 5.36822 5.67789 599551 6.32068 665302 6 99215 733765 7.68913 8,04623 Print Done Cheka Help me solve thl