Answered step by step

Verified Expert Solution

Question

1 Approved Answer

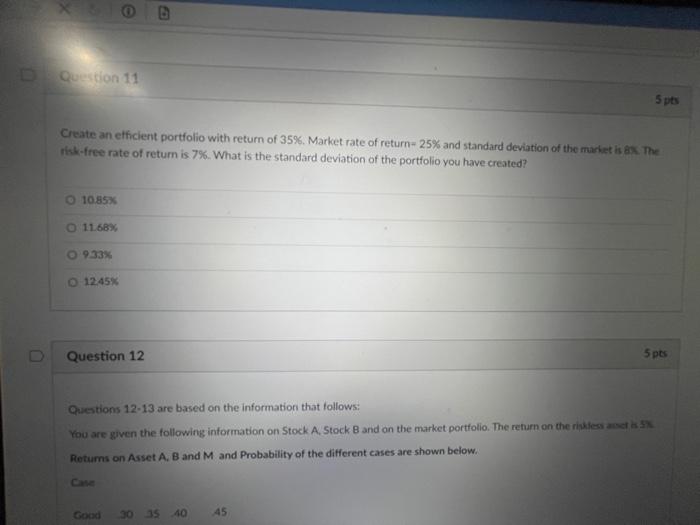

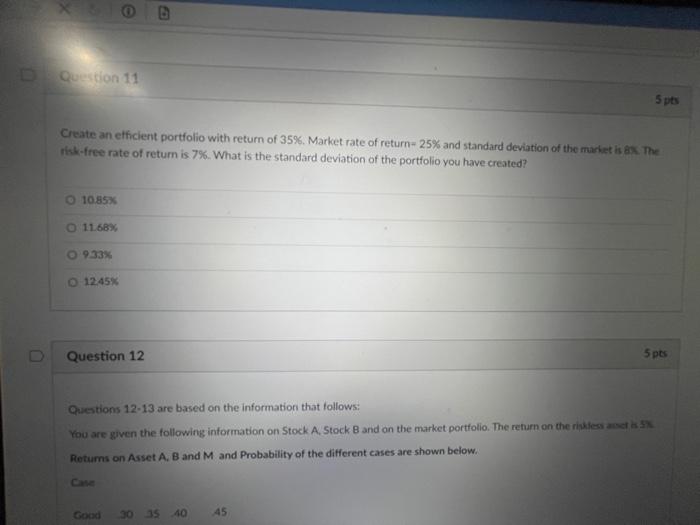

help Question 11 5 pts Create an efficient portfolio with return of 35%. Market rate of return- 25% and standard deviation of the market is

help

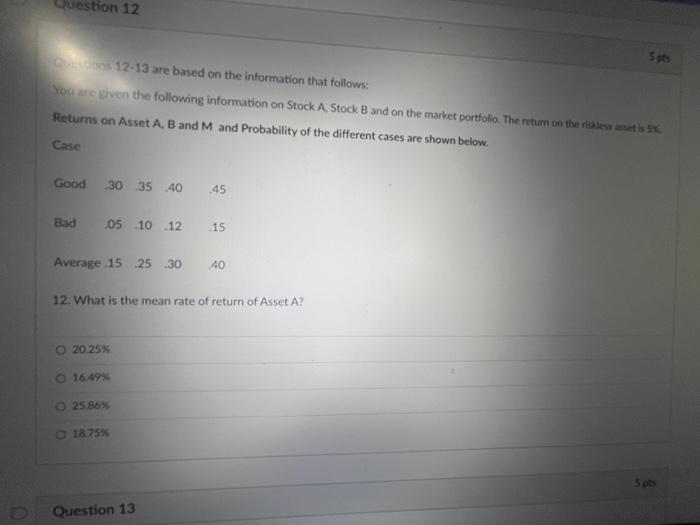

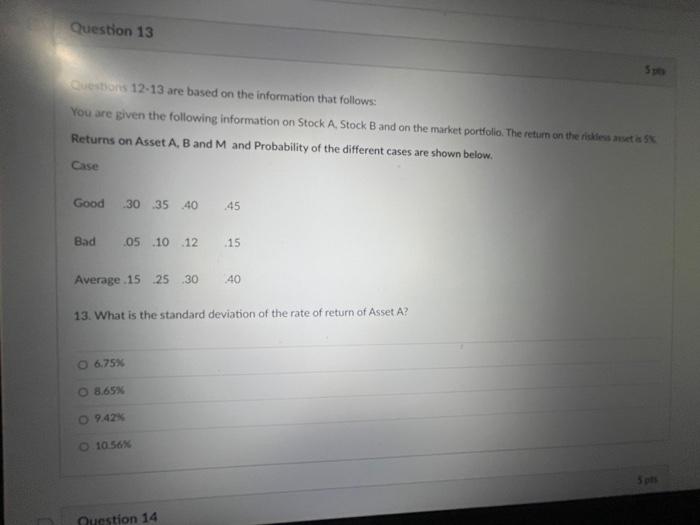

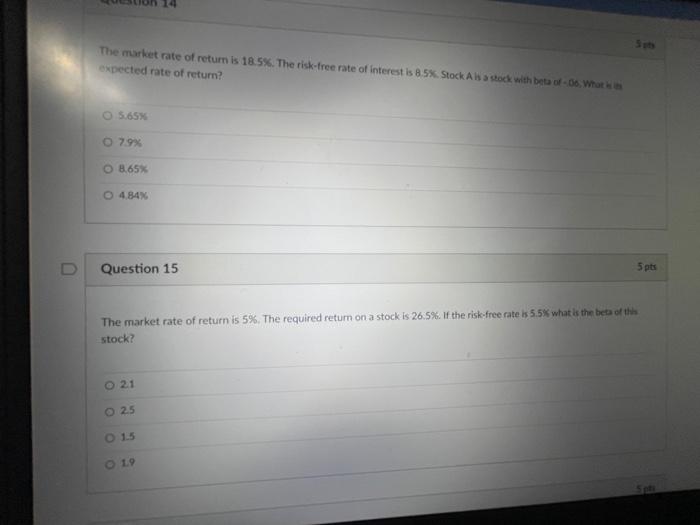

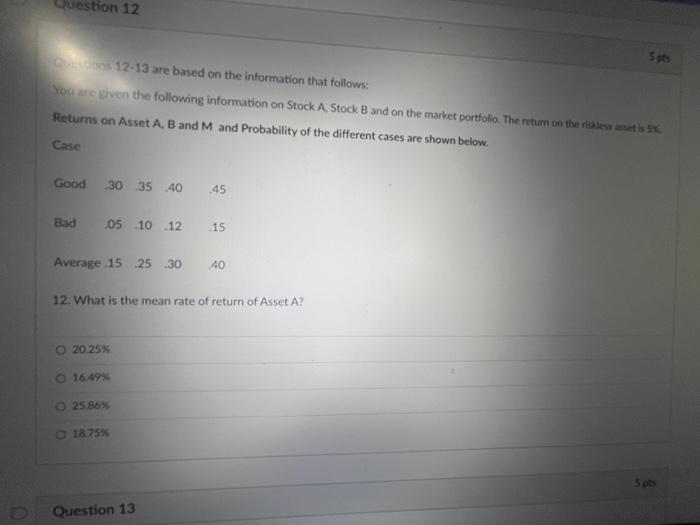

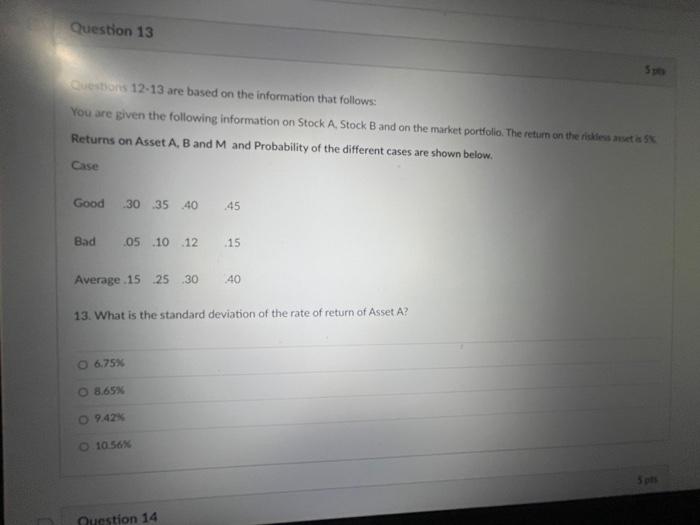

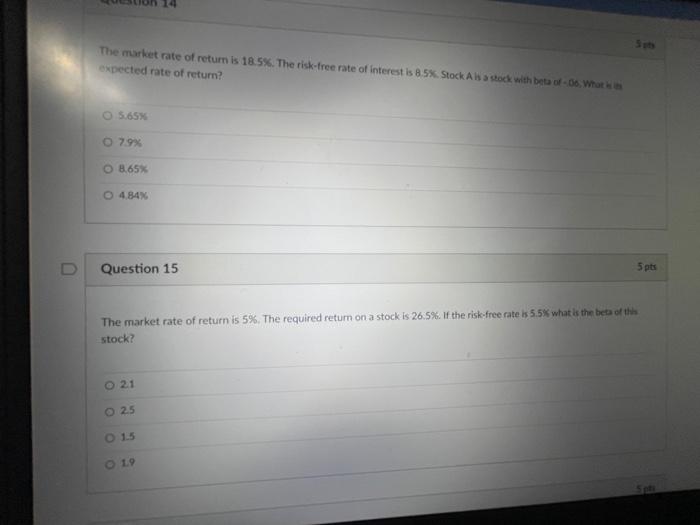

Question 11 5 pts Create an efficient portfolio with return of 35%. Market rate of return- 25% and standard deviation of the market is ex The risk-free rate of return is 7%. What is the standard deviation of the portfolio you have created? 10.85% O 11.68% 9.33% 12.45% Question 12 5 pts Questions 12-13 are based on the information that follows: You are given the following information on Stock A, Stock Band on the market portfolio. The return on the riskless and a Returns on Asset A. B and M and Probability of the different cases are shown below. Good 30 15 40 45 Question 12 QUE 12-13 are based on the information that follows: You are given the following information on Stock A. Stock B and on the market portfolio The return on the risks ant sx Returns on Asset A, B and M and Probability of the different cases are shown below. Case Good 30 35 40 45 Bad 05 10 12 .15 Average 15 25 30 -40 12. What is the mean rate of return of Asset A? 20.25% 16.49% 2586% 18.755 500 Question 13 Question 13 Questions 12-13 are based on the information that follows: You are given the following information on Stock A, Stock B and on the market portfolio. The return on the riskless set as Returns on Asset A, B and M and Probability of the different cases are shown below. Case Good 30 35 40 45 Bad 05 10 12 15 Average 15 25 30 40 13. What is the standard deviation of the rate of return of Asset A? 0 6.75% O 8,65% 0942% 10:56% Question 14 The market rate of return is 18.5%. The risk-free rate of interest is 8.5% Stock Als stock with beta of-06. What xpected rate of return? 5.65% 7.9% 8,65% 0 4,84% D Question 15 5 pts The market rate of return is 5%. The required return on a stock is 26.5%. If the risk-free rate is 5.5% what is the beta of this stock? 21 O 25 015 19

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started