Answered step by step

Verified Expert Solution

Question

1 Approved Answer

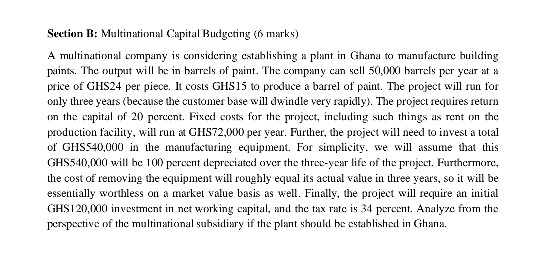

solve this question. Explain how the depreciation value was gotten. Thanks. Is very urgent Section R: Multinational Capital Budgeting (6 marks) A multinational company is

solve this question. Explain how the depreciation value was gotten. Thanks. Is very urgent

Section R: Multinational Capital Budgeting (6 marks) A multinational company is considering establishing a plant in Ghana to manufacture building prints. The output will be in barrels of paint. The company can sell 50,000 barrels per your price of GHS24 per piece. It costs GHS 15 to produce a barrel of paint. The project will run for only three years (because the customer base will dwindle very rapidly). The project requires return in the capital of 20 percent. Fixed ensts for the project, including such things is rent on the production facility, will run at GHS72,000 per year. Further, the project will need to invest a total of GHSS40,000 in the manufacturing equipment. For simplicity, we will assume that this GHS540,XI will he 100 percent depreciated over the three-year life of the project. Furthermore, the cost of removing the equipment will roughly equal its actual value in three years, so it will be essentially worthless on a market value basis as well. Finally, the project will require an initial GHS120,000 investment in not working capital, and the tax rate is 34 percent. Analyze from the perspective of the multinational subsidiary if the plant should be established in GhanaStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started