Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help Question 17 (1 point) Partners A, B, and C have capital account balances of $60,000 each. The income and loss ratio is 5:2:3, respectively.

help

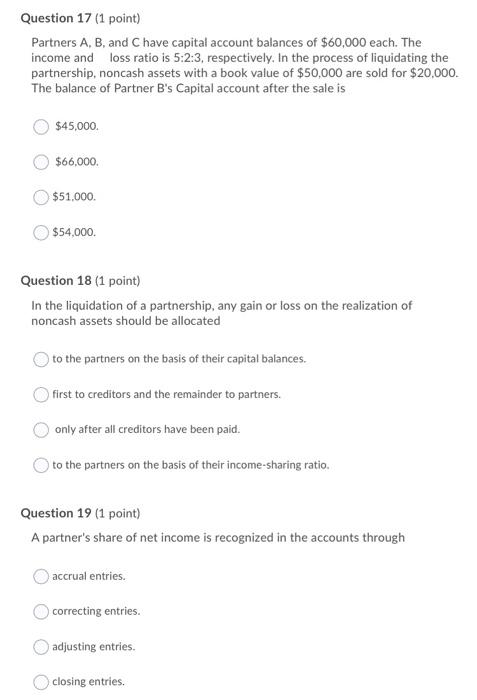

Question 17 (1 point) Partners A, B, and C have capital account balances of $60,000 each. The income and loss ratio is 5:2:3, respectively. In the process of liquidating the partnership, noncash assets with a book value of $50,000 are sold for $20,000. The balance of Partner B's Capital account after the sale is $45,000 $66.000 $51.000. $54,000 Question 18 (1 point) In the liquidation of a partnership, any gain or loss on the realization of noncash assets should be allocated to the partners on the basis of their capital balances. first to creditors and the remainder to partners. only after all creditors have been paid. to the partners on the basis of their income-sharing ratio. Question 19 (1 point) A partner's share of net income is recognized in the accounts through accrual entries. correcting entries. adjusting entries closing entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started