Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Required. Expert Help need. Question 5 Arman Inc. and Burbe Inc. are both in the eyewear retail business. All sales are on credit. Below

Help Required. Expert Help need.

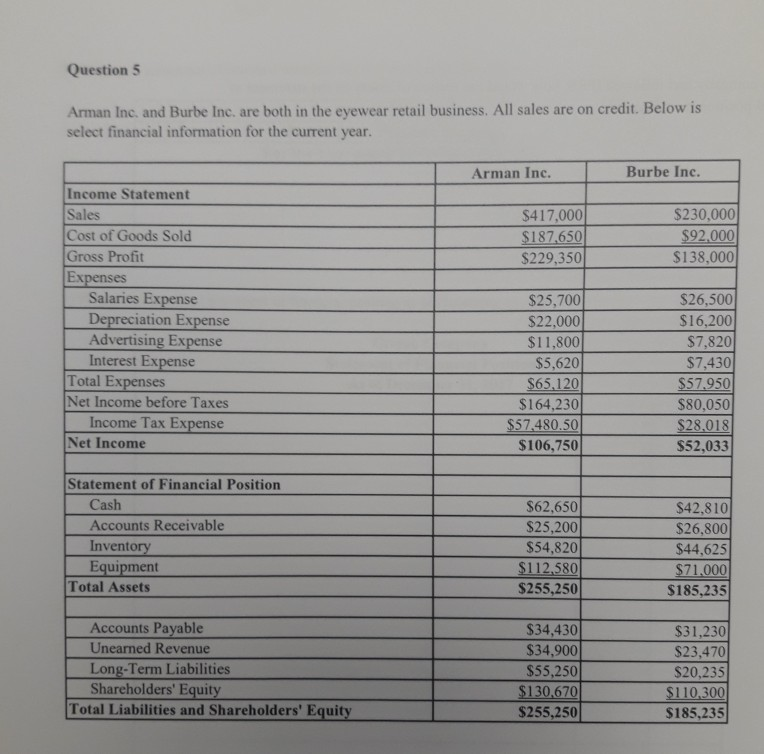

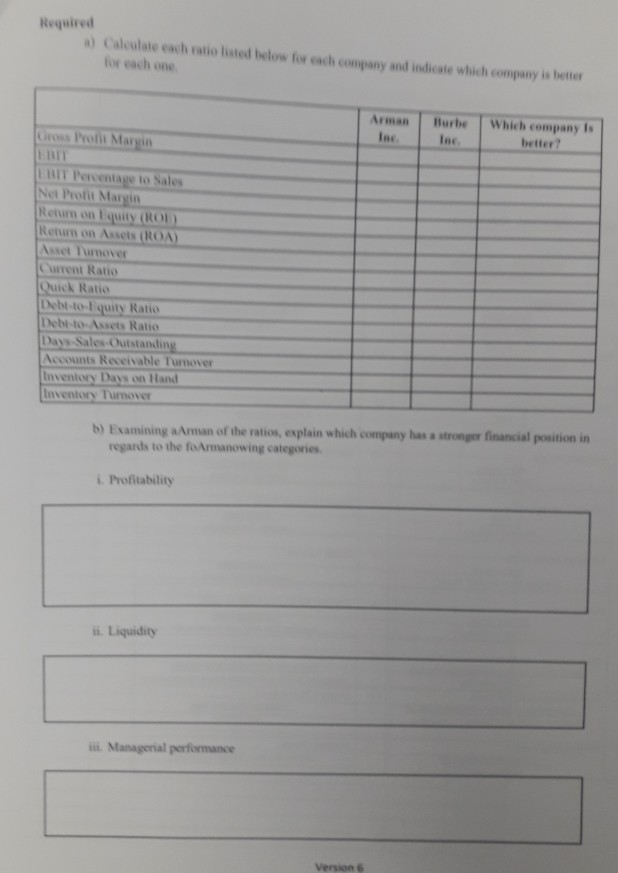

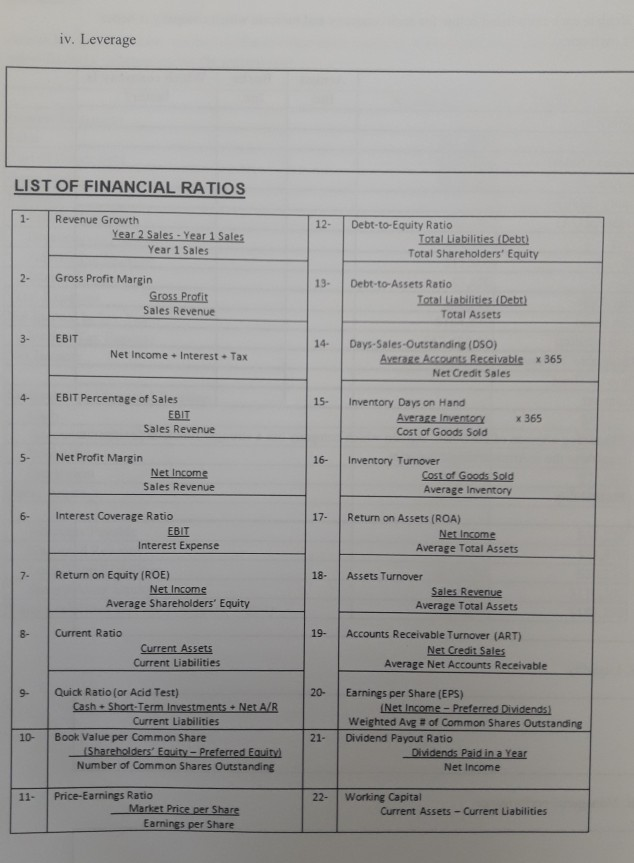

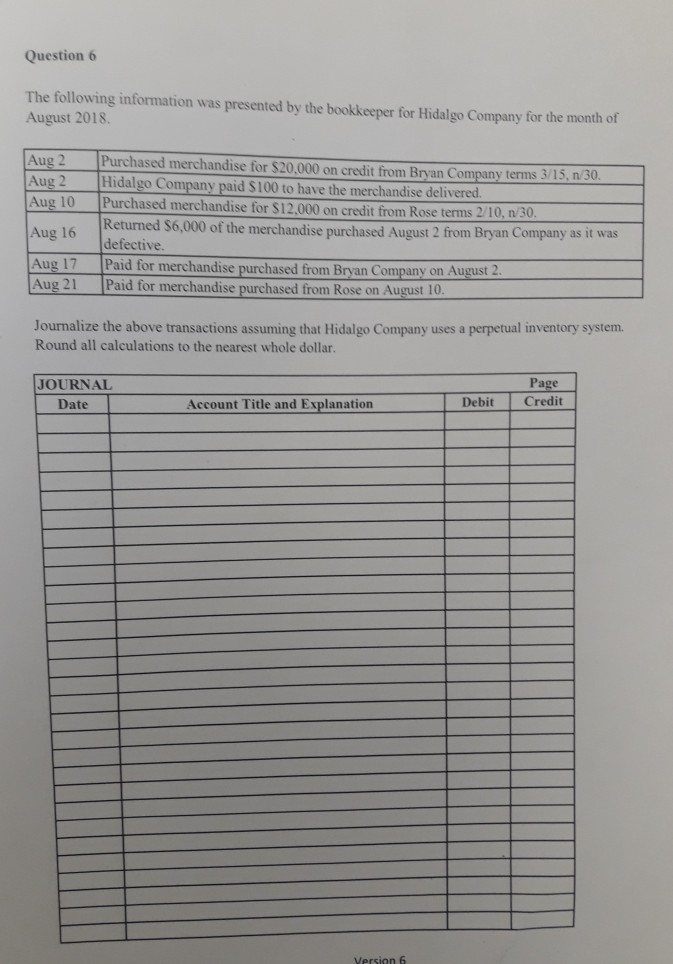

Question 5 Arman Inc. and Burbe Inc. are both in the eyewear retail business. All sales are on credit. Below is select financial information for the current year Arman Inc. Burbe Inc. Income Statement Sales $417,000 $187.650 $229,350 $230,000 $92,000 $138,000 Gross Profit Salaries Expense Depreciation Expense Advertising Expense Interest Expense $25,700 $22,000 $11,800 $5,620 S65,120 $164,230 $57480.50 $106,750 $26,500 S16,200 $7,820 $7,430 $57.950 $80,050 Net Income before Taxes Net Income Statement of Financial Position Income Tax Expense $52,033 Cash Accounts Receivable Inventory $62,650 $25,200 S54,820 112,580 $255,250 $42,810 $26,800 $44,625 71.000 $185,235 Total Assets Accounts Payable Unearned Revenue Long-Term Liabilities Shareholders' Equity $34,430 $34,900 $55,250 $130.670 $255,250 $31,230 $23,470 $20,235 $110,300 $185,235 Total Liabilities and Shareholders' Equity i Required a) Calbulate each ratio listed helow for each company and indicate which company is better for each one Arman Burbe Which company Is Ine Ine better? rs Proft Marin nn HIT Percentage to Sales Net Profit Margin Return on Equity (RO Return on Assets (ROA) Asset Tumover Current Ratio Quick Ratio Debt-to-I quity Ratio ebt to Assets Ratio Days-Sales Outstandin Accounts Receivable Turnover Inventory Days on Hand Inventory Tumover b) Examining aArman of the ratios, explain which company has a stronger financial position in regards to the fo Armanowing categories i Profitability i. Liquidity ui. Managerial performance Version 6 iv. Leverage LIST OF FINANCIAL RATIOS 1 Revenue Growth 12- Debt-to-Equity Ratio Year 1 Sales Total Shareholders' Equity 2 Gross Profit Margin 13 Debt-to-Assets Ratio Gross Profit Sales Revenue Total Assets 3- EBIT 14 Days-Sales-Outstanding (DSO) Net Income+ Interest Tax e Assounte Receivabis x365 Net Credit Sales 4 EBIT Percentage of Sales 15- Inventory Days on Hand EBIT Sales Revenue Averaze Inventony Cost of Goods Sold x365 5 Net Profit Margin 16- Inventory Turnover Net Income Sales Revenue Cost of Goods Sold Average Inventory 6 Interest Coverage Ratio 17 Return on Assets (ROA) EBIT Interest Expense Average Total Assets 7 Return on Equity (ROE) 18- Assets Turnover Sales Revenue Average Shareholders' Equity 8- Current Ratio 19 Accounts Receivable Turnover (ART) Current Assets Current Liabilities Average Net Accounts Receivable 9- Quick Ratio(or Acid Test) 20 Earnings per Share (EPS) Current Liabilities | Weighted Avg # of Common Shares Outstanding 10-1 Book Value per Common Share 21- Dividend Payout Ratio Shareholders' Equity-Preferred Equitv) Number of Common Shares Outstanding Net Income 11-1 Price-Earnings Ratio 22- Working Capital Market Prise per Share Earnings per Share Current Assets- Current Liabilities Question 6 The following information was presented by the bookkeeper for Hidalgo Company for the month of August 2018. Aug 2Purchased merchandise for $20.000 on credit from Bryan Company terms 3/15. n/30 Aug2 Hidalgo Company paid S100 to have the merchandise delivered Aug 10 Purchased merchandise for $12,000 on credit from Rose terms 210, n/80 Returned S6,000 of the merchandise purchased August 2 from Bryan Company as it was defective Aug 17 Paid for merchandise purchased from Bryan Company on August 2 Aug 21 Paid for merchandise purchased from Rose on August 10 Journalize the above transactions assuming that Hidalgo Company uses a perpetual inventory system. Round all calculations to the nearest whole dollar. Page JOURNAL Date Account Title and Explanation Debit Credit Version 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started