Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help Required information Exercise 8-7A (Algo) Effect of depreciation on the accounting equation and financial statements LO 8 -2 [The following information applies to the

help

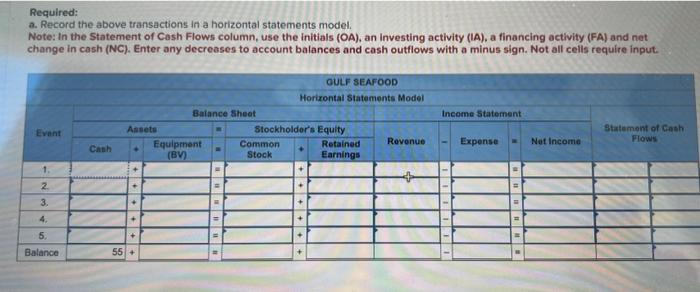

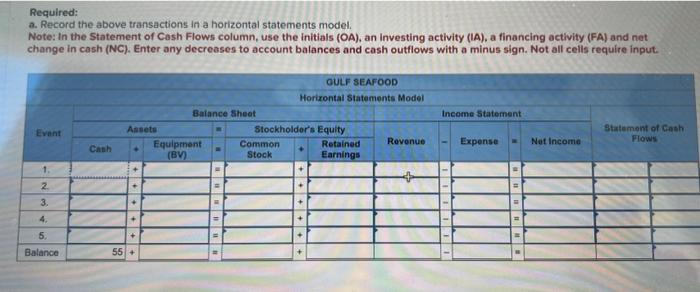

Required information Exercise 8-7A (Algo) Effect of depreciation on the accounting equation and financial statements LO 8 -2 [The following information applies to the questions displayed below.] The following events apply to Gulf Seafood for the Year 1 fiscal year: 1. The company started when it acquired $19,000 cash by issuing common stock. 2. Purchased a new cooktop that cost $16,000cash. 3. Earned $23,400 in cash revenue. 4. Paid $11,400 cash for salaries expense. 5. Adjusted the records to reflect the use of the cooktop. Purchased on January 1, Year 1 , the cooktop has an expected useful life of four years and an estimated salvage value of $2,600. Use straight-line depreciation. The adjustment was made as of December 31, Year 1 . Required: a. Record the above transactions in a horizontal statements model. Note: In the Statement of Cash Flows column, use the initiais (OA), an Investing activity (IA), a financing activity (FA) and net change in cash (NC). Enter any decreases to account balances and cash outflows with a minus sign. Not all cells require input

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started