help

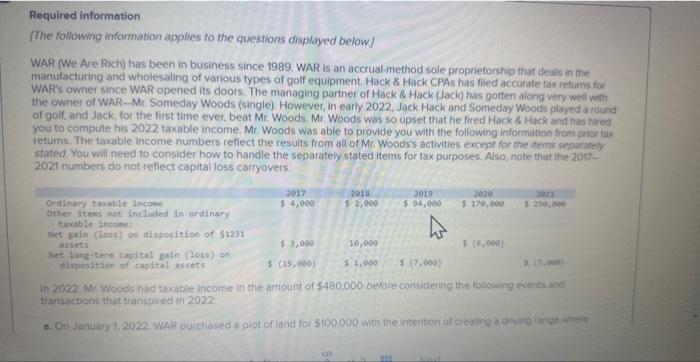

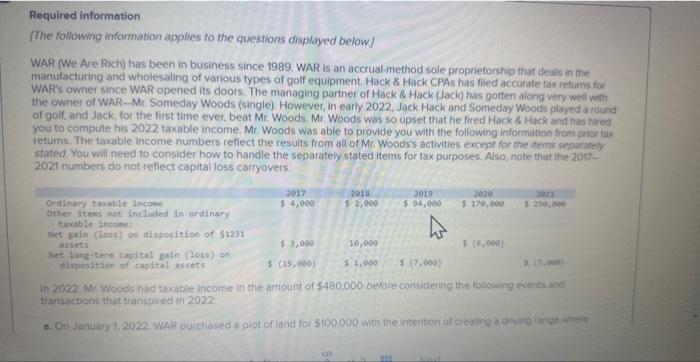

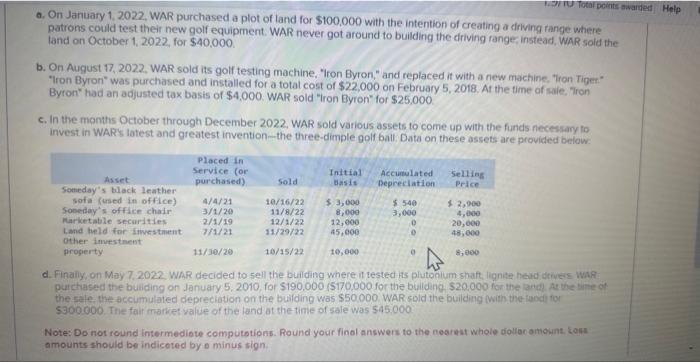

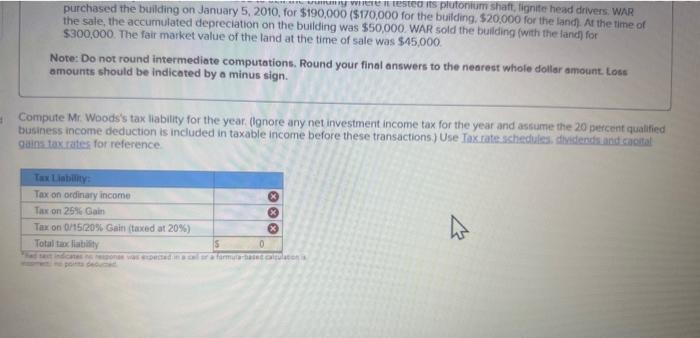

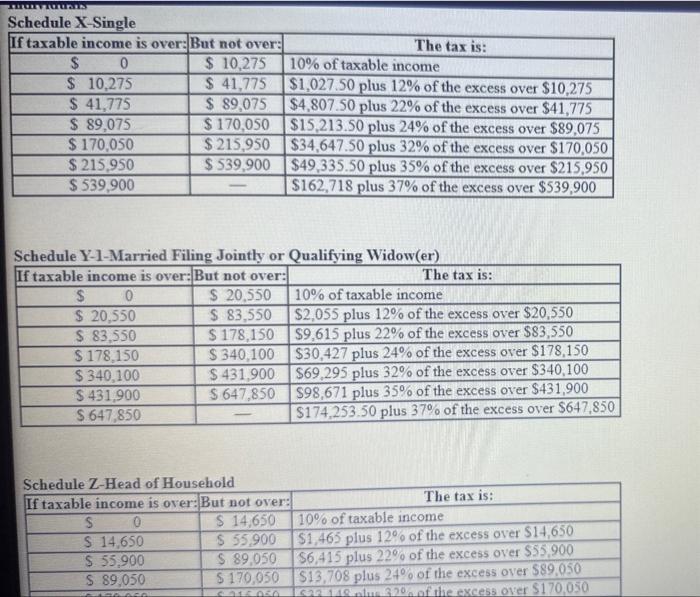

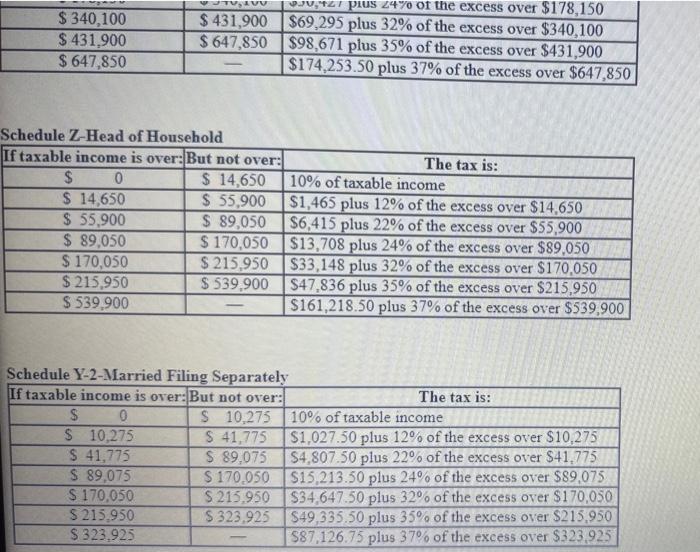

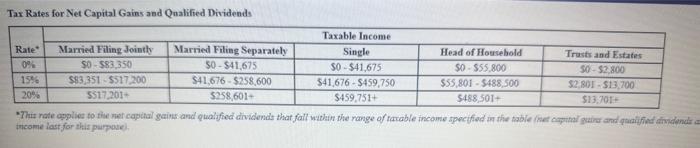

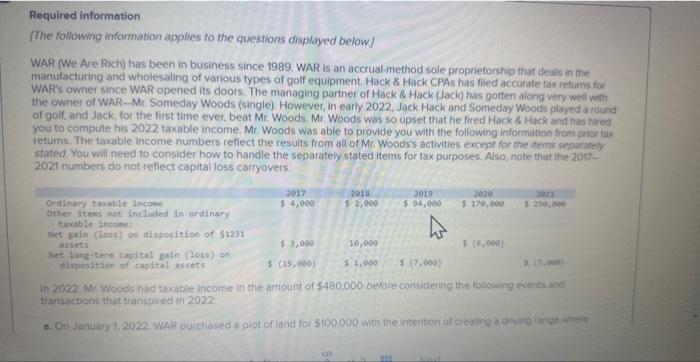

Required information [The following information applies to the questions displayed below] WAR (We Are Rich) has been in business since 1989. WAR is an accrual-method sole proprieforship that deals in the manufacturing and wholesaling of various types of golf equipment. Hack \& Hack CPAs has filed accurate fax refums for WAR's owner since WAR opened its doors. The managing parther of Hack \& Hack (Jack) has gotten along very well with the owner of WAR- Me Someday Woods (single). However, in early 2022, Jack Hack and Someday Woods played a tound of golf, and Jack. for the first time ever, beat Mr. Woods. Mr. Woods was so upset that he fired Hack 6 Hack and has hared you to compute hits 2022 taxable income. Mr. Woods was able to provide you with the following information fiom pror tax returns. The taxable income numbers reflect the results from all of Mr. Woods's activities except for the thems separafory stated You will need to consider how to handle the separately stated items for tax purposes. Also, note that the 20t?2021 numbers do not rellect capital loss carryovers In 2022. Mr Woods had taxable income in the amount of $480.000 before considering the following en ents and trarisactions that transpired in 2022 . 0. On January 1. 202.2. WAR purchased s plot of land for $100,000 with the intention of creating aldriving aspech-ete a. On January 1. 2022. WAR purchased a plot of land for $100,000 with the intention of creating a driving fange where patrons could test their new golf equipment. WAR never got around to building the driving range; instead, WAR sold the land on October 1, 2022, for $40,000 b. On August 17, 2022. WAR sold its golf testing machine. "Iron Byron," and replaced it with a new machine, "Iron Tigen" "Iron Byron" was purchased and installed for a fotal cost of $22,000 on February 5, 2018. At the time of maie, "lion Byron" had an adjusted tax basts of $4,000. WAR sold "Iron Byron" for $25,000 c. In the months October through December 2022. WAR sold various assets to come up with the funds necessary to invest in WARs latest and greatest invention-the three-dimple golf ball. Data on these assets are provided below: d. Finaliy, on May 7, 2022. WhR decided to sell the building where it tested is plutonium shaft, lignite heid diveis WuA purchased the builing on January 5,2010 , for 5190,000 , 5170,000 for the buliding $20,000 for the land at at the tilne of the sale; the accimulated depreciation on the bulding was $50000. WAR sold the building (with the fand for 5300000 . Tre fair mraricet value of the land at the time of sale was $45,000 Note: Do not round intermediote computstions. Round your finol answers to the neareat whole dollon amownt. omk amounts should be indiceted by e minus sign. purchased the building on January 5, 2010, for $190,000 (\$170,000 for its plutonitim shaft, lignite head drivers, WAR the sale, the accurnulated depreciation on the building was $50,000. WAR sold the bulding (with the land). Ar the time of $300,000. The fair market value of the land at the time of sale was $15,000. Note: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount. Loss amounts should be indicated by a minus sign. Compute Mr. Woods's tax liability for the year. (lgnore any net investment income tax for the year and assume the 20 percent qualified gains taxidates for reference. Schedule X-Single \begin{tabular}{|c|c|l|} If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $162,718 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$ & $20,550 & 10% of taxable income \\ \hline$20,550 & $83,550 & $2,055 plus 12% of the excess over $20,550 \\ \hline$83,550 & $178,150 & $9,615 plus 22% of the excess over $83,550 \\ \hline$178,150 & $340,100 & $30,427 plus 24% of the excess over $178,150 \\ \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & - & $174,253,50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household The tax is: \begin{tabular}{|c|c|c|c|} \hline If taxable income is over: But not over: & The tax is: \\ \hline S0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 120 of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$9,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & - & $174,253.50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335,50 plus 35% of the excess over $215,950 \\ \hline$323,925 & - & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Tax Rates for Net Capital Gains and Qnalified Dividends tneame last for this purpote. Required information [The following information applies to the questions displayed below] WAR (We Are Rich) has been in business since 1989. WAR is an accrual-method sole proprieforship that deals in the manufacturing and wholesaling of various types of golf equipment. Hack \& Hack CPAs has filed accurate fax refums for WAR's owner since WAR opened its doors. The managing parther of Hack \& Hack (Jack) has gotten along very well with the owner of WAR- Me Someday Woods (single). However, in early 2022, Jack Hack and Someday Woods played a tound of golf, and Jack. for the first time ever, beat Mr. Woods. Mr. Woods was so upset that he fired Hack 6 Hack and has hared you to compute hits 2022 taxable income. Mr. Woods was able to provide you with the following information fiom pror tax returns. The taxable income numbers reflect the results from all of Mr. Woods's activities except for the thems separafory stated You will need to consider how to handle the separately stated items for tax purposes. Also, note that the 20t?2021 numbers do not rellect capital loss carryovers In 2022. Mr Woods had taxable income in the amount of $480.000 before considering the following en ents and trarisactions that transpired in 2022 . 0. On January 1. 202.2. WAR purchased s plot of land for $100,000 with the intention of creating aldriving aspech-ete a. On January 1. 2022. WAR purchased a plot of land for $100,000 with the intention of creating a driving fange where patrons could test their new golf equipment. WAR never got around to building the driving range; instead, WAR sold the land on October 1, 2022, for $40,000 b. On August 17, 2022. WAR sold its golf testing machine. "Iron Byron," and replaced it with a new machine, "Iron Tigen" "Iron Byron" was purchased and installed for a fotal cost of $22,000 on February 5, 2018. At the time of maie, "lion Byron" had an adjusted tax basts of $4,000. WAR sold "Iron Byron" for $25,000 c. In the months October through December 2022. WAR sold various assets to come up with the funds necessary to invest in WARs latest and greatest invention-the three-dimple golf ball. Data on these assets are provided below: d. Finaliy, on May 7, 2022. WhR decided to sell the building where it tested is plutonium shaft, lignite heid diveis WuA purchased the builing on January 5,2010 , for 5190,000 , 5170,000 for the buliding $20,000 for the land at at the tilne of the sale; the accimulated depreciation on the bulding was $50000. WAR sold the building (with the fand for 5300000 . Tre fair mraricet value of the land at the time of sale was $45,000 Note: Do not round intermediote computstions. Round your finol answers to the neareat whole dollon amownt. omk amounts should be indiceted by e minus sign. purchased the building on January 5, 2010, for $190,000 (\$170,000 for its plutonitim shaft, lignite head drivers, WAR the sale, the accurnulated depreciation on the building was $50,000. WAR sold the bulding (with the land). Ar the time of $300,000. The fair market value of the land at the time of sale was $15,000. Note: Do not round intermediate computations. Round your final answers to the nearest whole dollar amount. Loss amounts should be indicated by a minus sign. Compute Mr. Woods's tax liability for the year. (lgnore any net investment income tax for the year and assume the 20 percent qualified gains taxidates for reference. Schedule X-Single \begin{tabular}{|c|c|l|} If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $49,335.50 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $162,718 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$ & $20,550 & 10% of taxable income \\ \hline$20,550 & $83,550 & $2,055 plus 12% of the excess over $20,550 \\ \hline$83,550 & $178,150 & $9,615 plus 22% of the excess over $83,550 \\ \hline$178,150 & $340,100 & $30,427 plus 24% of the excess over $178,150 \\ \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & - & $174,253,50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household The tax is: \begin{tabular}{|c|c|c|c|} \hline If taxable income is over: But not over: & The tax is: \\ \hline S0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 120 of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$9,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|} \hline$340,100 & $431,900 & $69,295 plus 32% of the excess over $340,100 \\ \hline$431,900 & $647,850 & $98,671 plus 35% of the excess over $431,900 \\ \hline$647,850 & - & $174,253.50 plus 37% of the excess over $647,850 \\ \hline \end{tabular} Schedule Z-Head of Household \begin{tabular}{|c|c|l|} \hline If taxable income is over: & But not over: & \multicolumn{1}{|c|}{ The tax is: } \\ \hline$0 & $14,650 & 10% of taxable income \\ \hline$14,650 & $55,900 & $1,465 plus 12% of the excess over $14,650 \\ \hline$55,900 & $89,050 & $6,415 plus 22% of the excess over $55,900 \\ \hline$89,050 & $170,050 & $13,708 plus 24% of the excess over $89,050 \\ \hline$170,050 & $215,950 & $33,148 plus 32% of the excess over $170,050 \\ \hline$215,950 & $539,900 & $47,836 plus 35% of the excess over $215,950 \\ \hline$539,900 & - & $161,218.50 plus 37% of the excess over $539,900 \\ \hline \end{tabular} Schedule Y-2-Married Filing Separately \begin{tabular}{|c|c|c|} \hline If taxable income is over: & But not over: & The tax is: \\ \hline$0 & $10,275 & 10% of taxable income \\ \hline$10,275 & $41,775 & $1,027.50 plus 12% of the excess over $10,275 \\ \hline$41,775 & $89,075 & $4,807.50 plus 22% of the excess over $41,775 \\ \hline$89,075 & $170,050 & $15,213.50 plus 24% of the excess over $89,075 \\ \hline$170,050 & $215,950 & $34,647.50 plus 32% of the excess over $170,050 \\ \hline$215,950 & $323,925 & $49,335,50 plus 35% of the excess over $215,950 \\ \hline$323,925 & - & $87,126.75 plus 37% of the excess over $323,925 \\ \hline \end{tabular} Tax Rates for Net Capital Gains and Qnalified Dividends tneame last for this purpote