Question

HELP REVISING PART D, E, AND G The market for Stardust is perfectly competitive. However, its marginal social costs exceed its marginal private costs. (a)

HELP REVISING PART D, E, AND G

The market for Stardust is perfectly competitive. However, its marginal social costs exceed its marginal private costs.

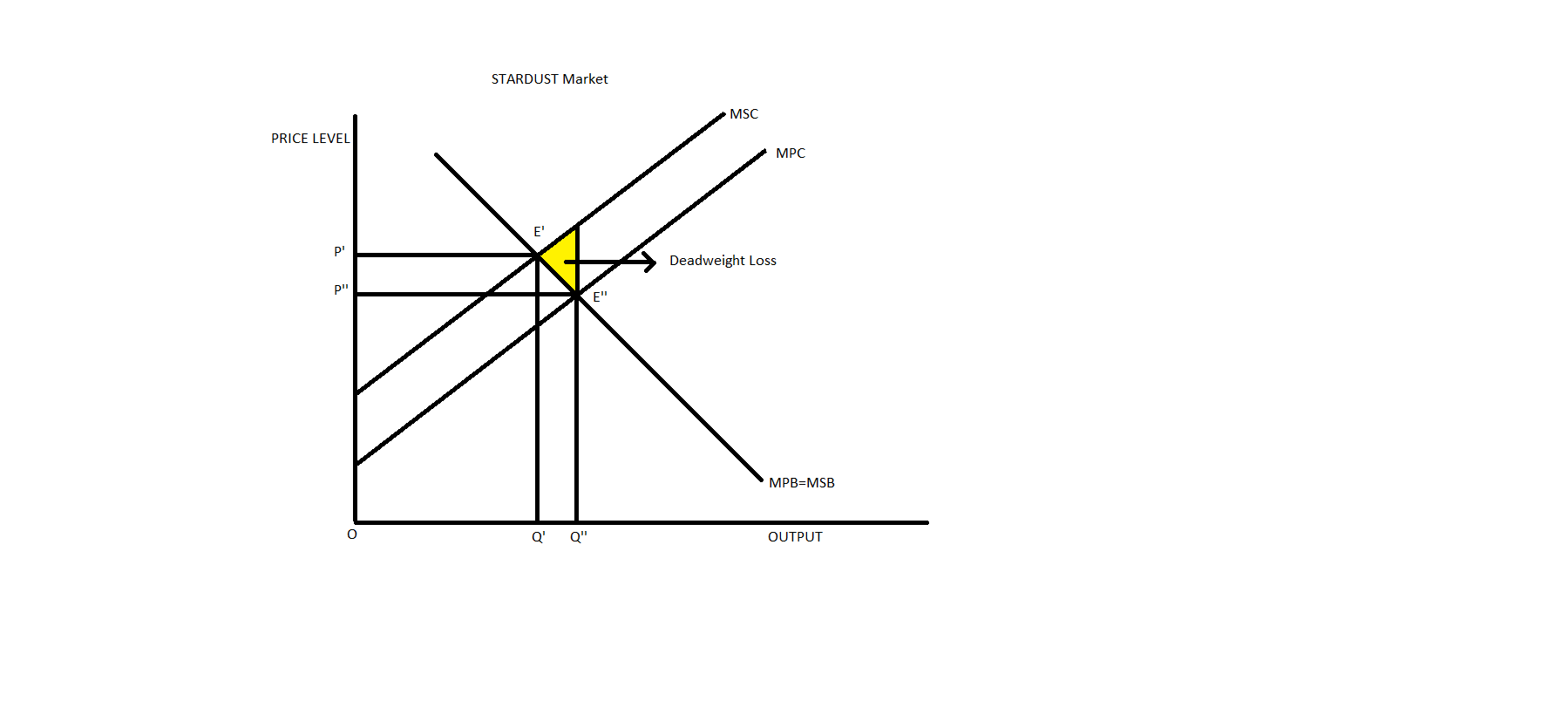

(a) Graph the market for Stardust, labeling the marginal private benefit (MPB), marginal social benefit (MSB), marginal private cost (MPC), and marginal social cost (MSC).

(b) What type of market failure does Stardust suffer from? Explain.

(c)Shade the deadweight loss, if any.

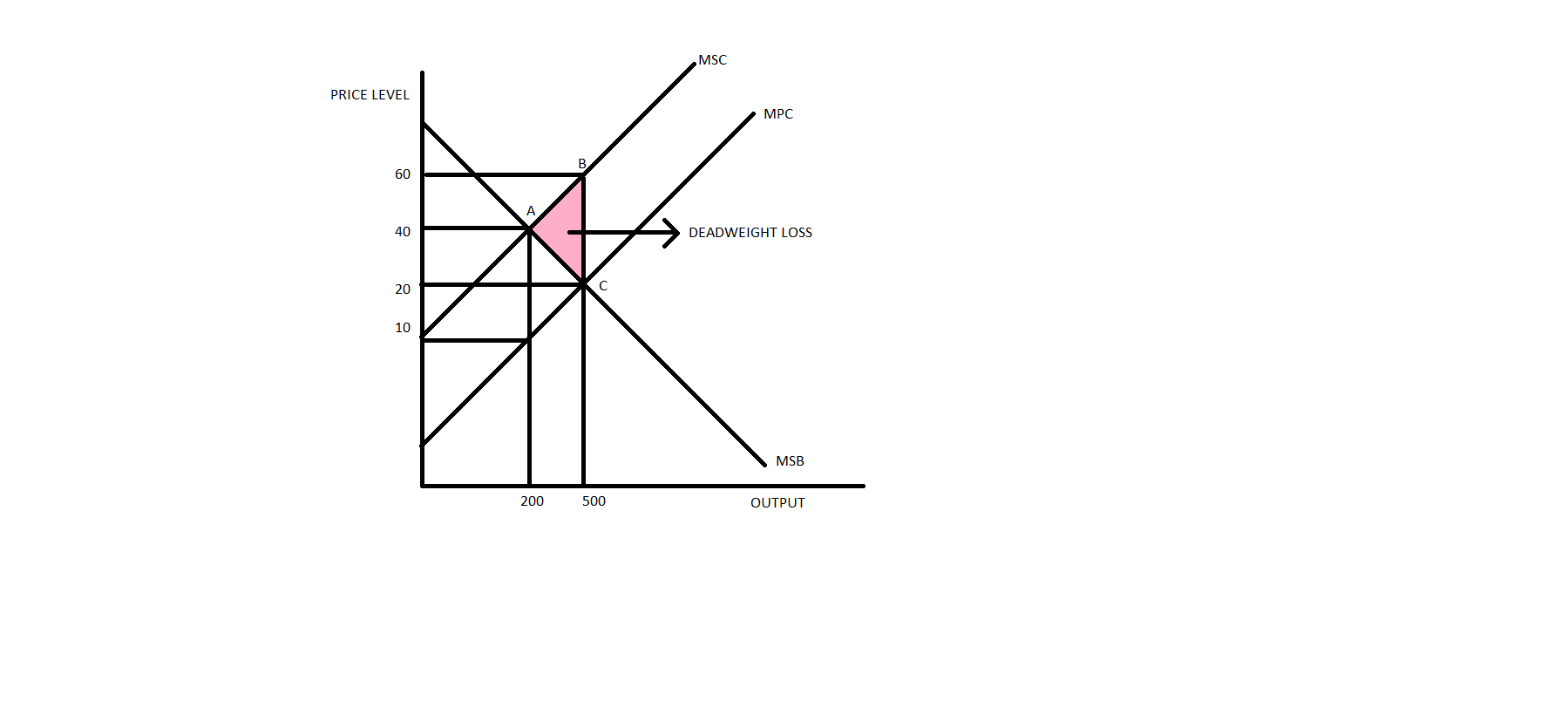

(d) The intersection of the MSC and the MSB occurs at a price of $40 and a quantity of 200 units. The MPC curve intersects 200 units at $10. The market without government intervention clears at $20 and 500 units. The MSC intersects 500 units at $60. Calculate the deadweight loss of this market failure.

(e) What is the per-unit cost of the externality?

(f) Without intervention, would the firm's total revenue at the socially optimal quantity be higher or lower than its total revenue at market equilibrium? Explain.

(g) What type of government intervention could achieve allocative efficiency in this market? Explain.

-----------------------------------------------------------------------------------------------------------------------------------------------------------------

I NEED HELP IN THE FOLLOWING: You did a great job graphing and explaining an externality here. Take another look at parts D, E and G. The triangle goes from 20up to 60 and from 200 over to 500. So the area of the deadweight loss is 40(300)1/2. So you have the right answer at $6000. But how you got it does not make sense. The answer to the equation you wrote out is not 6000. For part E, the per unit cost of the externality is the vertical distance between the MPC and MSC curves. What is that? For part G, the tax needs to be equal to the vertical distance between the 2 curves. So the per unit tax should be the same as your answer to E.

-------------------------------

HERE ARE MY ANSWERS:

PART A) Private Marginal Cost indicates the private cost of the firms to produce the output. It is the supply curve of the firm.

Social Marginal Cost curve includes both private cost and social cost of production. Social Cost is the marginal Damage to the people due to production of good.

Marginal Benefit Curve is the demand curve of the consumer for the product which shows the direct benefits derived by the consumer by consuming the good and it reflects the consumer's maximum willingness to pay.

Marginal Social Benefit Curve includes both private marginal benefits derived by the consumer and other costs or benefits that are imposed on the society without getting involved in the transaction.

The market for Stardust is shown in the diagram below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started