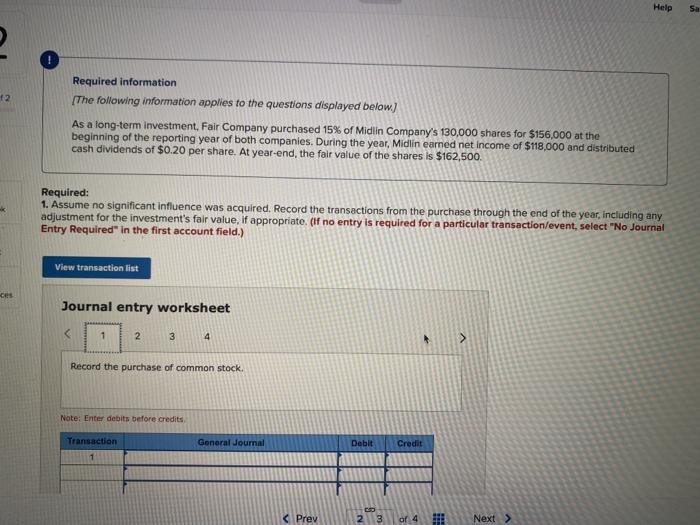

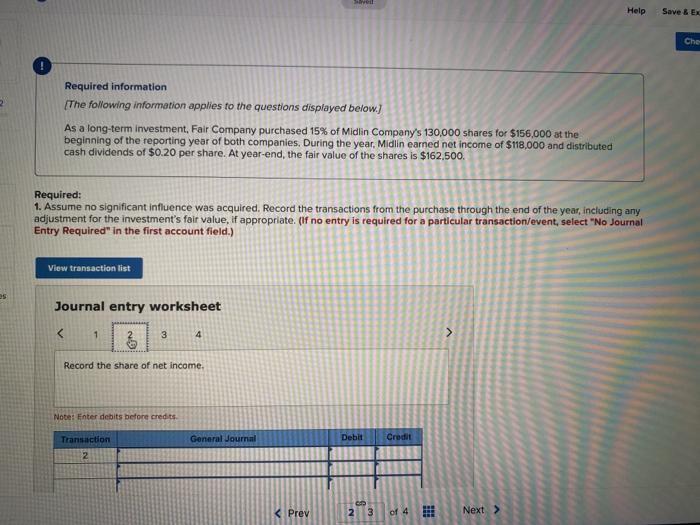

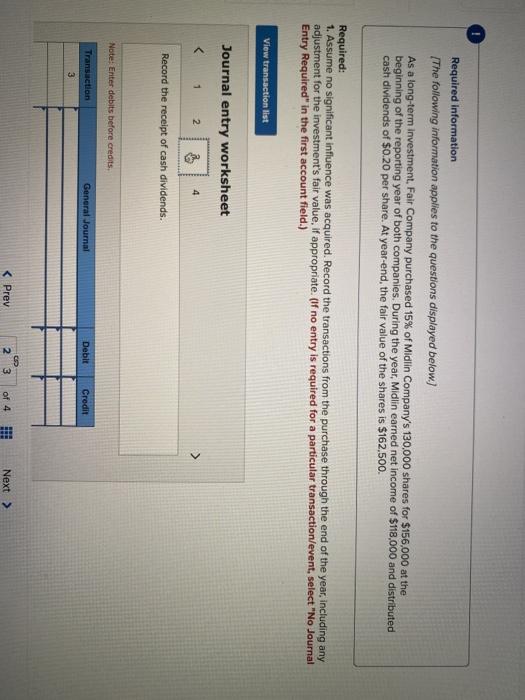

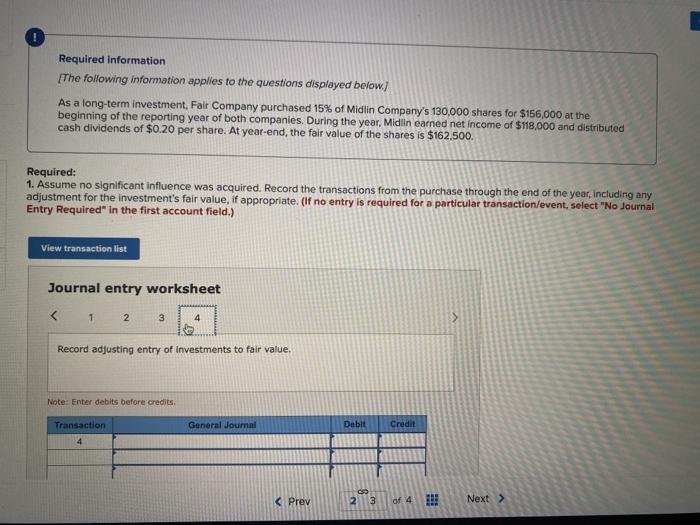

Help Sa 2 Required information [The following information applies to the questions displayed below) As a long-term investment, Fair Company purchased 15% of Midlin Company's 130,000 shares for $156,000 at the beginning of the reporting year of both companies. During the year, Midlin earned net income of $118.000 and distributed cash dividends of $0.20 per share. At year-end, the fair value of the shares is $162,500. Required: 1. Assume no significant influence was acquired. Record the transactions from the purchase through the end of the year, including any adjustment for the investment's fair value, if appropriate. (If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field.) View transaction list ces Journal entry worksheet 1 2 3 4 Record the purchase of common stock. Note: Enter debits before credits Transaction Goneral Journal Debit Credit 1 el Help Save & EX Che Required information The following information applies to the questions displayed below) As a long-term investment, Fair Company purchased 15% of Midlin Company's 130,000 shares for $156,000 at the beginning of the reporting year of both companies. During the year, Midlin earned net income of $118,000 and distributed cash dividends of $0.20 per share. At year-end, the fair value of the shares is $162,500. Required: 1. Assume no significant influence was acquired. Record the transactions from the purchase through the end of the year, including any adjustment for the investment's fair value, if appropriate. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list as Journal entry worksheet 1 > Required information [The following information applies to the questions displayed below.) As a long-term investment, Fair Company purchased 15% of Midlin Company's 130,000 shares for $156,000 at the beginning of the reporting year of both companies. During the year, Midlin earned net income of $118,000 and distributed cash dividends of $0.20 per share. At year-end, the fair value of the shares is $162,500. Required: 1. Assume no significant influence was acquired. Record the transactions from the purchase through the end of the year, including any adjustment for the investment's fair value. If appropriate. (If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet Required information [The following information applies to the questions displayed below.) As a long-term investment, Fair Company purchased 15% of Midlin Company's 130,000 shares for $156,000 at the beginning of the reporting year of both companies. During the year, Midlin earned net income of $118,000 and distributed cash dividends of $0.20 per share. At year-end, the fair value of the shares is $162.500. Required: 1. Assume no significant influence was acquired. Record the transactions from the purchase through the end of the year, including any adjustment for the investment's fair value, if appropriate. (If no entry is required for a particular transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet 2. 3 4 Record adjusting entry of investments to fair value. Note: Enter debits before credits Transaction General Journal Debit Credit