Answered step by step

Verified Expert Solution

Question

1 Approved Answer

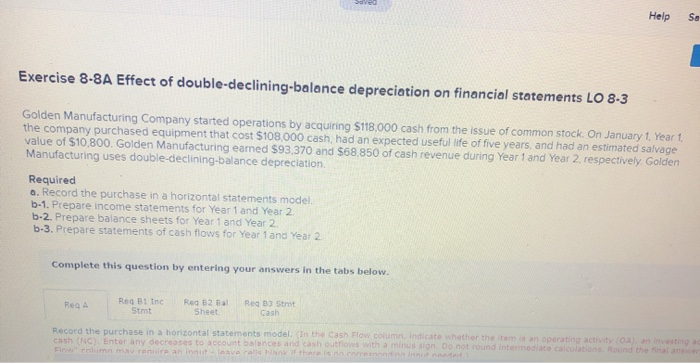

Help Sa Exercise 8-8A Effect of double-declining-balance depreciation on financial statements LO 8-3 Golden Manufacturing Company started operations by acquiring $110,000 cash from the issue

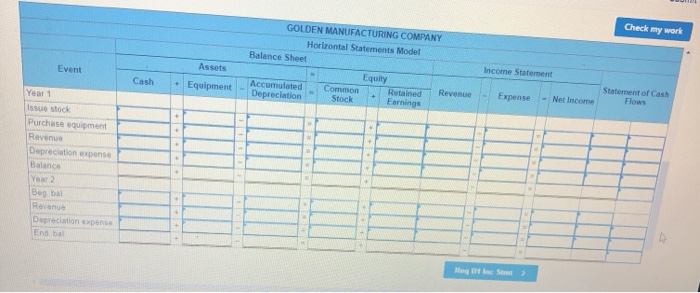

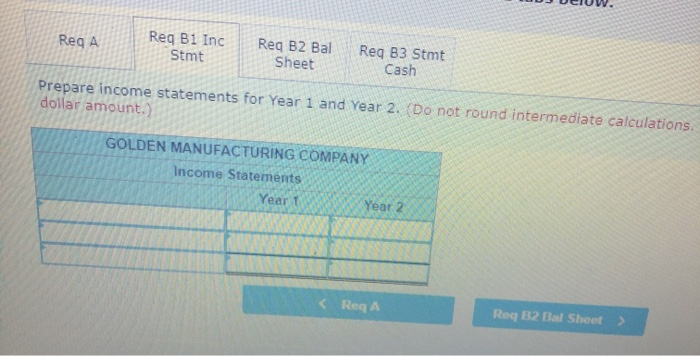

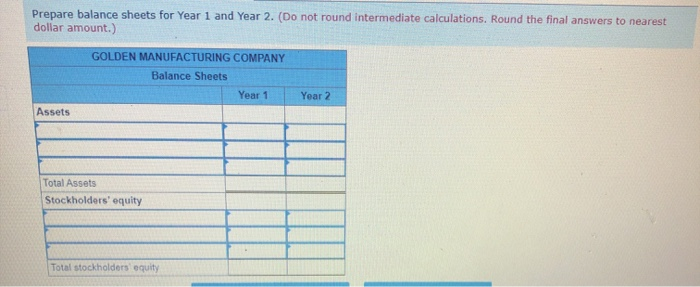

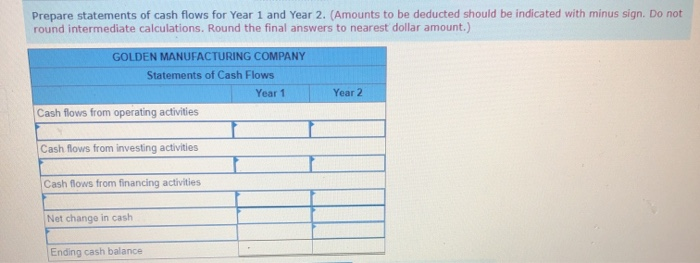

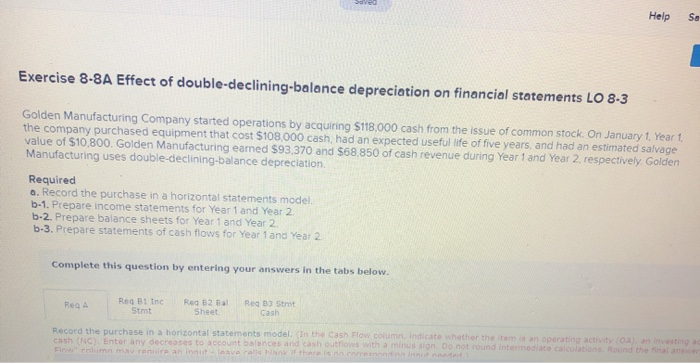

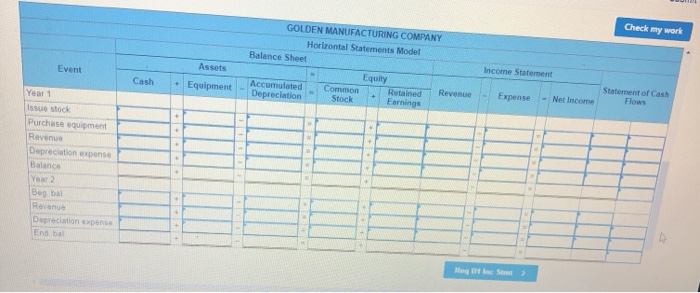

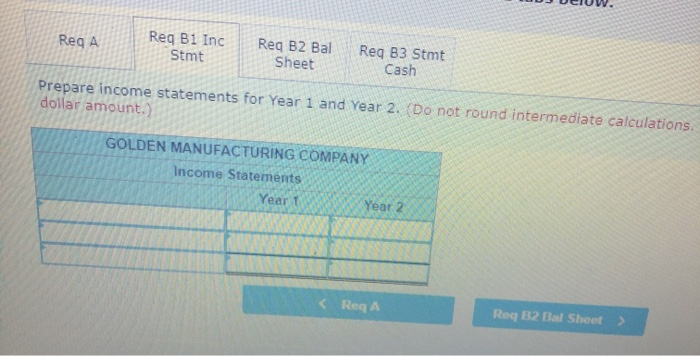

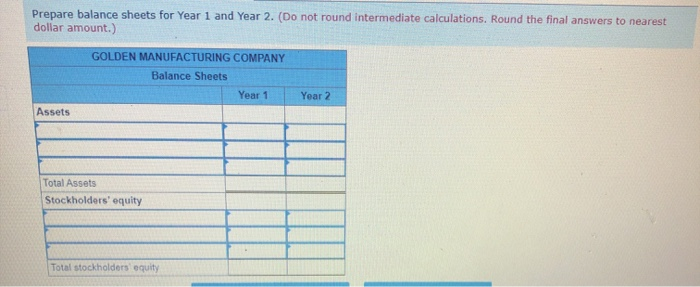

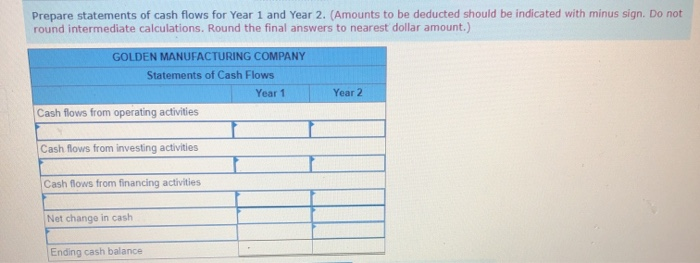

Help Sa Exercise 8-8A Effect of double-declining-balance depreciation on financial statements LO 8-3 Golden Manufacturing Company started operations by acquiring $110,000 cash from the issue of common stock. On January 1, Year 1 the company purchased equipment that cost $108.000 cash, had an expected useful life of five years, and had an estimated salvage value of $10,800. Golden Manufacturing earned $93.370 and $68.850 of cash revenue during Year 1 and Year 2, respectively. Golden Manufacturing uses double-declining balance depreciation Required a. Record the purchase in a horizontal statements model, b-1. Prepare income statements for Year 1 and Year 2 b-2. Prepare balance sheets for Year 1 and Year 2 b-3. Prepare statements of cash flows for Year 1 and Year 2 Complete this question by entering your answers in the tabs below ROOBI inc Reg 112 Bal Sheet Reg Da strot Cash Record the purchase in a horizontal statements model. In the cash flow column indicate whether the item is an operating activity (on an investing Check my work income Statement GOLDEN MANUFACTURING COMPANY Horizontal Statements Model Balance Sheet Equity Accumulated Comme Retained Revenue Depreciation Stock Earnings Statement of Cash Event Expense - Net Income Cash Equipment Year 1 Issue stock Purchase qu oment Depreclution exponse Balance You Depreciation des En bal UDJUCIUW Req A Req B1 Inc Req B2 Bal Stmt Sheet Reg B3 Stmt Cash Prepare income statements for Year 1 and Year 2. Do not round intermediate calculations. dollar amount.) GOLDEN MANUFACTURING COMPANY Income Statements Year 1 Year 2 s Rega Reg B2 Bal Sheet> Prepare balance sheets for Year 1 and Year 2. (Do not round intermediate calculations. Round the final answers to nearest dollar amount.) GOLDEN MANUFACTURING COMPANY Balance Sheets Year 1 Year 2 Assets Total Assets Stockholders' equity Total stockholders equity Prepare statements of cash flows for Year 1 and Year 2. (Amounts to be deducted should be indicated with minus sign. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) GOLDEN MANUFACTURING COMPANY Statements of Cash Flows Year 1 Cash flows from operating activities Year 2 Cash flows from investing activities Cash flows from financing activities Net change in cash Ending cash balance

Help Sa Exercise 8-8A Effect of double-declining-balance depreciation on financial statements LO 8-3 Golden Manufacturing Company started operations by acquiring $110,000 cash from the issue of common stock. On January 1, Year 1 the company purchased equipment that cost $108.000 cash, had an expected useful life of five years, and had an estimated salvage value of $10,800. Golden Manufacturing earned $93.370 and $68.850 of cash revenue during Year 1 and Year 2, respectively. Golden Manufacturing uses double-declining balance depreciation Required a. Record the purchase in a horizontal statements model, b-1. Prepare income statements for Year 1 and Year 2 b-2. Prepare balance sheets for Year 1 and Year 2 b-3. Prepare statements of cash flows for Year 1 and Year 2 Complete this question by entering your answers in the tabs below ROOBI inc Reg 112 Bal Sheet Reg Da strot Cash Record the purchase in a horizontal statements model. In the cash flow column indicate whether the item is an operating activity (on an investing Check my work income Statement GOLDEN MANUFACTURING COMPANY Horizontal Statements Model Balance Sheet Equity Accumulated Comme Retained Revenue Depreciation Stock Earnings Statement of Cash Event Expense - Net Income Cash Equipment Year 1 Issue stock Purchase qu oment Depreclution exponse Balance You Depreciation des En bal UDJUCIUW Req A Req B1 Inc Req B2 Bal Stmt Sheet Reg B3 Stmt Cash Prepare income statements for Year 1 and Year 2. Do not round intermediate calculations. dollar amount.) GOLDEN MANUFACTURING COMPANY Income Statements Year 1 Year 2 s Rega Reg B2 Bal Sheet> Prepare balance sheets for Year 1 and Year 2. (Do not round intermediate calculations. Round the final answers to nearest dollar amount.) GOLDEN MANUFACTURING COMPANY Balance Sheets Year 1 Year 2 Assets Total Assets Stockholders' equity Total stockholders equity Prepare statements of cash flows for Year 1 and Year 2. (Amounts to be deducted should be indicated with minus sign. Do not round intermediate calculations. Round the final answers to nearest dollar amount.) GOLDEN MANUFACTURING COMPANY Statements of Cash Flows Year 1 Cash flows from operating activities Year 2 Cash flows from investing activities Cash flows from financing activities Net change in cash Ending cash balance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started