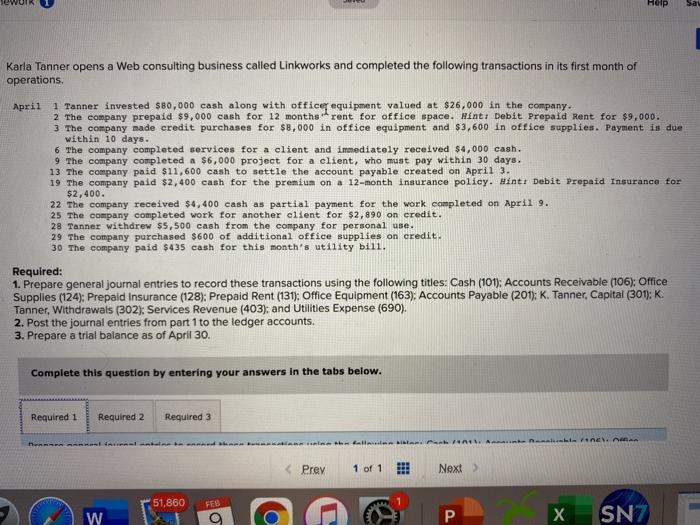

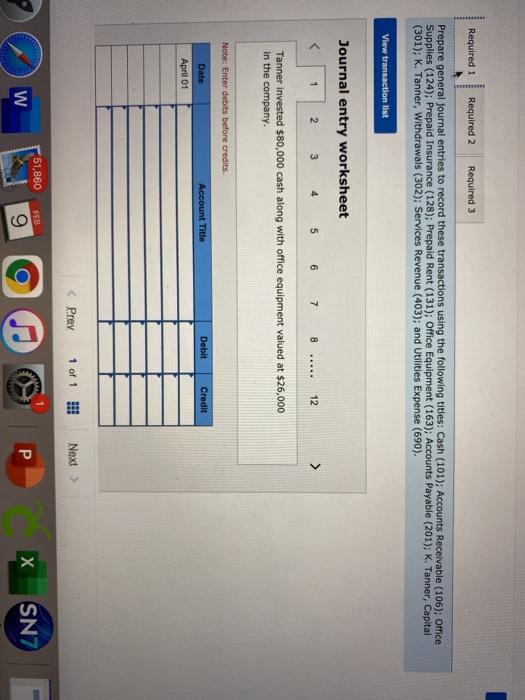

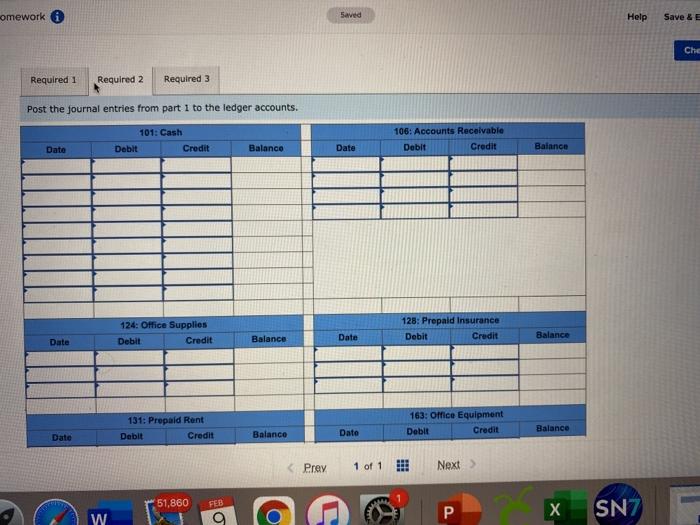

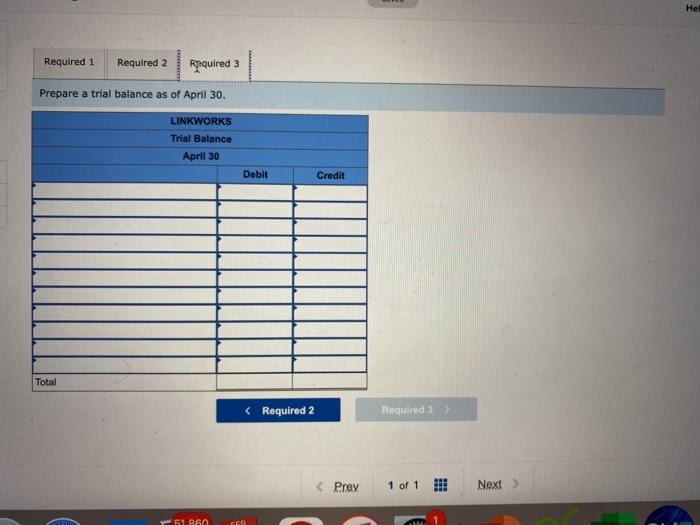

Help Sa Karla Tanner opens a Web consulting business called Linkworks and completed the following transactions in its first month of operations April 1 Tanner invested $80,000 cash along with officer equipment valued at $26,000 in the company. 2 The company prepaid $9,000 cash for 12 months rent for office space. Hint: Debit Prepaid Rent for $9,000. 3 The company made credit purchases for $8,000 in office equipment and $3,600 in office supplies. Payment is due within 10 days. 6 The company completed services for a client and immediately received $4,000 cash. 9 The company completed a $6,000 project for a client, who must pay within 30 days. 13 The company paid $11,600 cash to settle the account payable created on April 3. 19 The company paid $2,400 cash for the premium on a 12-month insurance policy. Hint: Debit Prepaid Insurance for $2,400. 22 The company received $4,400 cash as partial payment for the work completed on April 9. 25 The company completed work for another client for $2,890 on credit. 28 Tanner withdrew $5,500 cash from the company for personal use. 29 The company purchased $600 of additional office supplies on credit. 30 The company paid $435 cash for this month's utility bill. Required: 1. Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106): Office Supplies (124); Prepaid Insurance (128): Prepaid Rent (131): Office Equipment (163): Accounts Payable (201): K. Tanner, Capital (301): K. Tanner, Withdrawals (302): Services Revenue (403); and Utilities Expense (690). 2. Post the journal entries from part 1 to the ledger accounts. 3. Prepare a trial balance as of April 30. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 TRAR antalla de Antenne Prey 1 of 1 !!! Next > 51,860 FEB W P X SN7 Required 1 Required 2 Required 3 Prepare general journal entries to record these transactions using the following titles: Cash (101); Accounts Receivable (106); Office Supplies (124); Prepaid Insurance (128); Prepaid Rent (131); Office Equipment (163); Accounts Payable (201); K. Tanner, Capital (301); K. Tanner, withdrawals (302); Services Revenue (403); and Utilities Expense (690). View transaction list Journal entry worksheet 2 3 4 5 6 7 8 . 12 Tanner invested $80,000 cash along with office equipment valued at $26,000 in the company. Note: Enter debits before credits Account Title Debit Credit Date April 01 Prey 1 of 1 : Next > 51,860 FEB W X SNZ 9 omework Saved Help Save & E Che Required 1 Required 2 Required 3 Post the journal entries from part 1 to the ledger accounts. 101: Cash Debit Credit 106: Accounts Receivable Debit Credit Date Balance Date Balance 124: Office Supplies Debit Credit 128: Prepaid Insurance Debit Credit Date Balance Date Balance 131: Prepaid Rent Dabit Credit 163: Office Equipment Debit Credit Date Balance Date Balance Prey 1 of 1 !!! Next > 51,860 FEB o 9 P W SN7 Hel Required 1 Required 2 Arquired 3 Prepare a trial balance as of April 30. LINKWORKS Trial Balance April 30 Debit Credit Total