Answered step by step

Verified Expert Solution

Question

1 Approved Answer

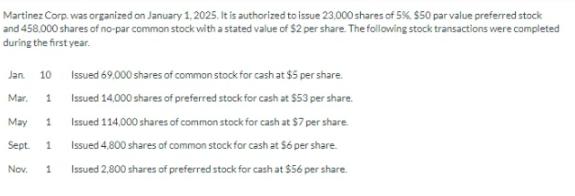

Martinez Corp. was organized on January 1, 2025. It is authorized to issue 23,000 shares of 5% $50 par value preferred stock and 458,000

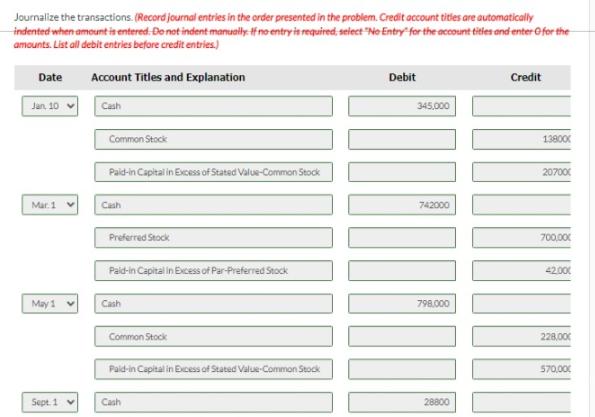

Martinez Corp. was organized on January 1, 2025. It is authorized to issue 23,000 shares of 5% $50 par value preferred stock and 458,000 shares of no-par common stock with a stated value of $2 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 69,000 shares of common stock for cash at $5 per share. Mar, 1 May 1 1 Sept. Nov. 1 Issued 14,000 shares of preferred stock for cash at $53 per share. Issued 114,000 shares of common stock for cash at $7 per share Issued 4,800 shares of common stock for cash at $6 per share. Issued 2,800 shares of preferred stock for cash at $56 per share. Journalize the transactions. (Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. List all debit entries before credit entries.) Date Account Titles and Explanation Jan 10 Cash Common Stock Paid-in Capital in Excess of Stated Value-Common Stock Mar 1 Cash Preferred Stock Paid-in Capital in Excess of Par-Preferred Stock May 1 Cash Common Stock Paid-in Capital in Excess of Stated Value-Common Stock Sept. 1 Cash Debit 345,000 742000 798,000 28800 Credit 13800 207000 700,000 42.000 228,000 570,000 Post to the stockholders' equity accounts. (Post entries in the order of journal entries posted in the previous part.) Preferred Stock 3/1 11/1 12/31 Bal Paid-in Capital in Excess of Par-Preferred Stock 3/1 11/1 700,000 140,000 840,000 42.000 16800 12/31 Bal 58,800 Common Stock 1/10 138000 Prepare the paid-in capital portion of the stockholders' equity section at December 31, 2025. (Enter account name only and do not provide descriptive information) MARTINEZ CORP. Partial Balance Sheet December 31, 2025

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started