Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help! Santana Rey created Business Solutions on October 1, 2019. The company has been successful, and Santana plans to expand her business. She believes that

help!

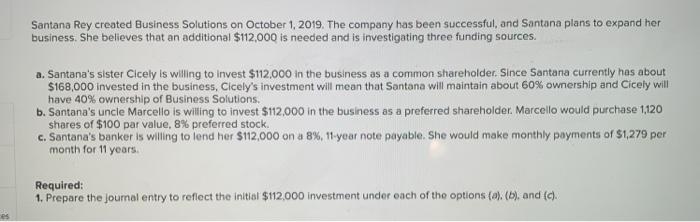

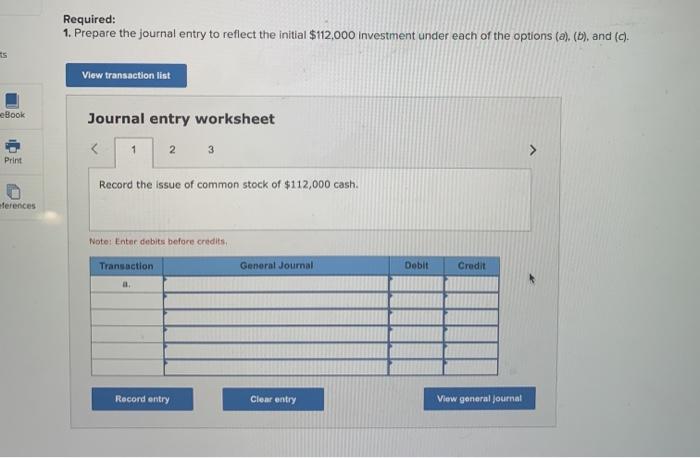

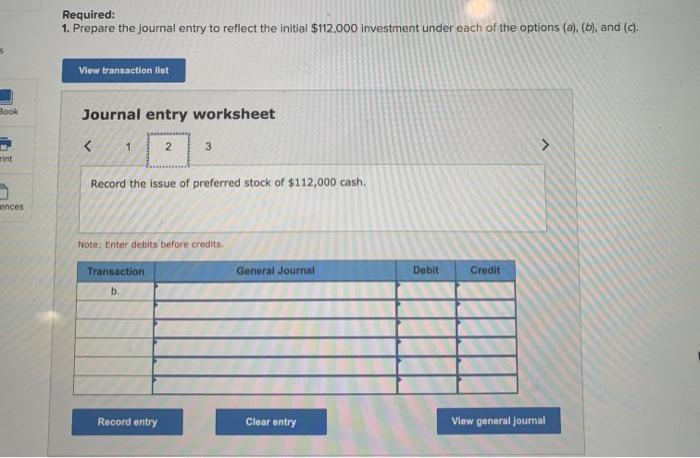

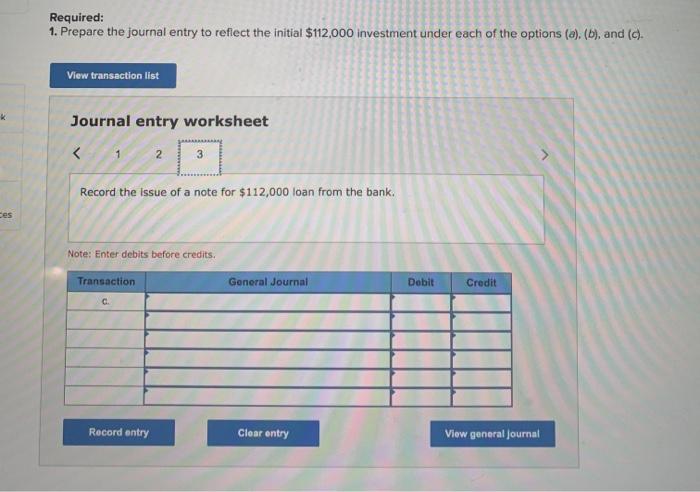

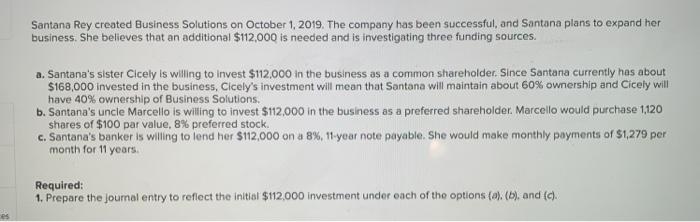

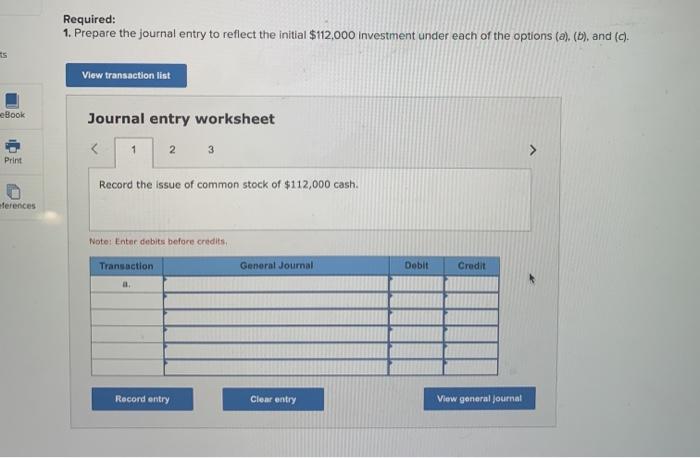

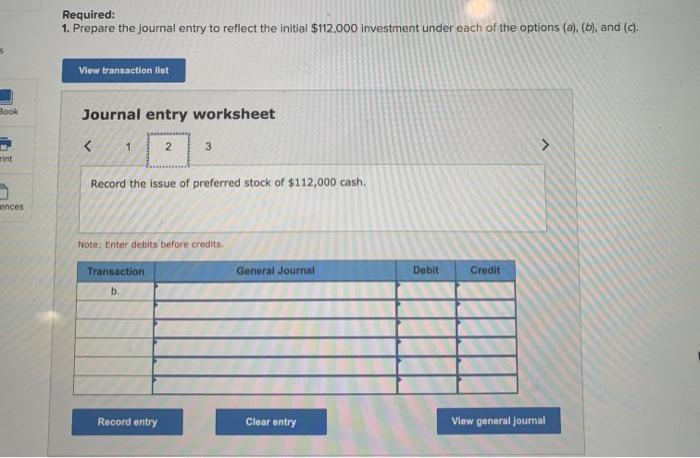

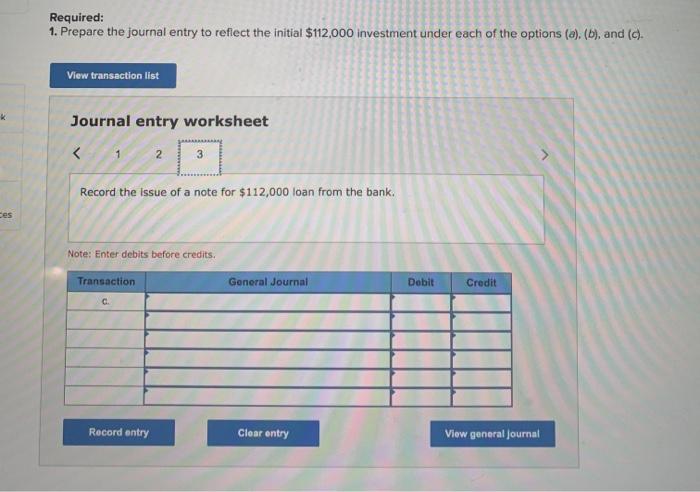

Santana Rey created Business Solutions on October 1, 2019. The company has been successful, and Santana plans to expand her business. She believes that an additional $112,000 is needed and is investigating three funding sources. a. Santana's sister Cicely is willing to invest $112,000 in the business as a common shareholder. Since Santana currently has about $168,000 invested in the business, Cicely's investment will mean that Santana will maintain about 60% ownership and Cicely will have 40% ownership of Business Solutions. b. Santana's uncle Marcello is willing to invest $112.000 in the business as a preferred shareholder. Marcello would purchase 1120 shares of $100 par value, 8% preferred stock. c. Santana's banker is willing to lend her $112,000 on a 8%, 11-year note payable. She would make monthly payments of S1,279 per month for 11 years Required: 1. Prepare the journal entry to reflect the initial $112,000 investment under each of the options (a), (b), and (c). Required: 1. Prepare the journal entry to reflect the initial $112,000 investment under each of the options (a), (b), and (c). View transaction list eBook Journal entry worksheet 2 3 1 Print Record the issue of common stock of $112,000 cash. Merences Note: Enter debits before credits Transaction General Journal Dobit Credit Record entry Clear entry View general Journal Required: 1. Prepare the journal entry to reflect the initial $112.000 investment under each of the options (a), (b), and (c). View transaction list Book Journal entry worksheet 1 2 3 Tint Record the issue of preferred stock of $112,000 cash. onces Note: Enter debits before credits Transaction General Journal Debit Credit b Record entry Clear entry View general Journal Required: 1. Prepare the journal entry to reflect the initial $112,000 investment under each of the options (a), (b), and (c). View transaction list K Journal entry worksheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started