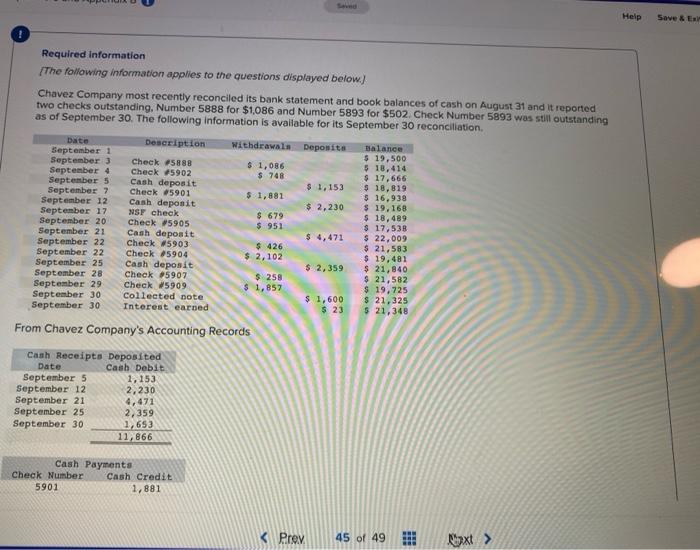

Help Save & E Required information The following information applies to the questions displayed below) Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, Number 5888 for $1,086 and Number 5893 for $502. Check Number 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation Date Description Withdrawal September 1 Deposits Balance $ 19,500 September 3 Check 5888 $ 1,086 September 4 Check 45902 $ 18,414 $ 748 $ 17,666 September 5 Cash deposit $ 1,153 $ 18,819 September 7 Check 5901 $ 1,881 $ 16,939 September 12 Cash deposit $ 2,230 $ 19,168 September 17 NSF check $ 679 $ 18,489 September 20 Check #5905 $ 951 $ 17,538 September 21 Cash deposit $ 4,471 $ 22,009 September 22 Check #5903 $ 426 $ 21,583 September 22 Check 45904 $ 2,102 $ 19,481 September 25 Cash deposit $ 2,359 $ 21,840 September 28 Check #5907 $ 258 $ 21,582 September 29 Check #5909 $ 1,857 $ 19,725 September 30 Collected pote $ 1,600 $ 21,325 September 30 Interest earned $ 23 $ 21,348 From Chavez Company's Accounting Records Cash Receipts Deposited Date Cash Debit September 5 1,153 September 12 2,230 September 21 4,471 September 25 2,359 September 30 1,653 11,866 Cash Payments Check Number Cash Credit 5901 1,881 Help Save & E Required information The following information applies to the questions displayed below) Chavez Company most recently reconciled its bank statement and book balances of cash on August 31 and it reported two checks outstanding, Number 5888 for $1,086 and Number 5893 for $502. Check Number 5893 was still outstanding as of September 30. The following information is available for its September 30 reconciliation Date Description Withdrawal September 1 Deposits Balance $ 19,500 September 3 Check 5888 $ 1,086 September 4 Check 45902 $ 18,414 $ 748 $ 17,666 September 5 Cash deposit $ 1,153 $ 18,819 September 7 Check 5901 $ 1,881 $ 16,939 September 12 Cash deposit $ 2,230 $ 19,168 September 17 NSF check $ 679 $ 18,489 September 20 Check #5905 $ 951 $ 17,538 September 21 Cash deposit $ 4,471 $ 22,009 September 22 Check #5903 $ 426 $ 21,583 September 22 Check 45904 $ 2,102 $ 19,481 September 25 Cash deposit $ 2,359 $ 21,840 September 28 Check #5907 $ 258 $ 21,582 September 29 Check #5909 $ 1,857 $ 19,725 September 30 Collected pote $ 1,600 $ 21,325 September 30 Interest earned $ 23 $ 21,348 From Chavez Company's Accounting Records Cash Receipts Deposited Date Cash Debit September 5 1,153 September 12 2,230 September 21 4,471 September 25 2,359 September 30 1,653 11,866 Cash Payments Check Number Cash Credit 5901 1,881