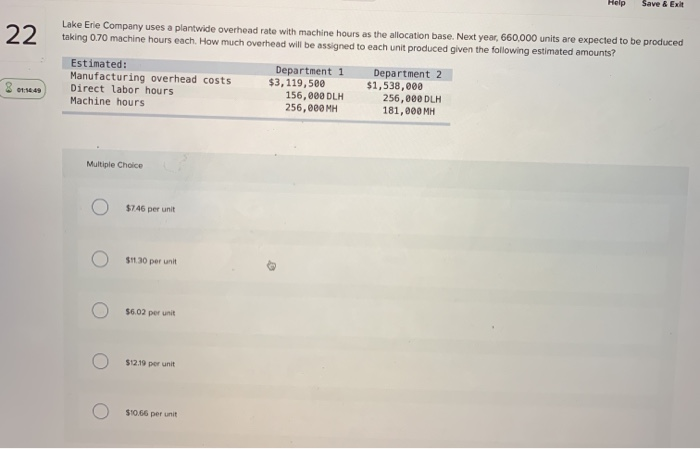

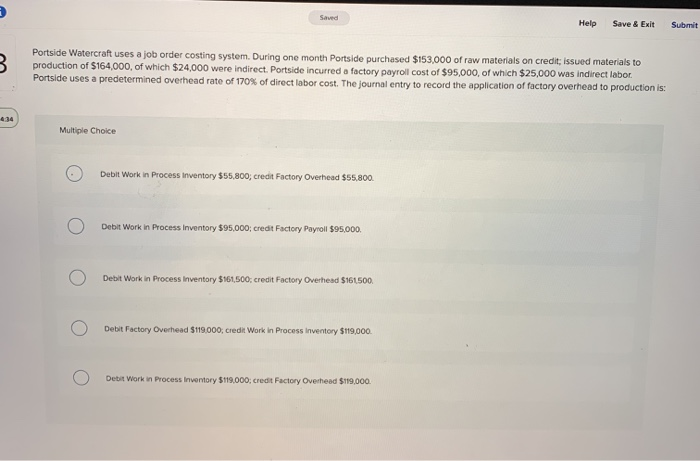

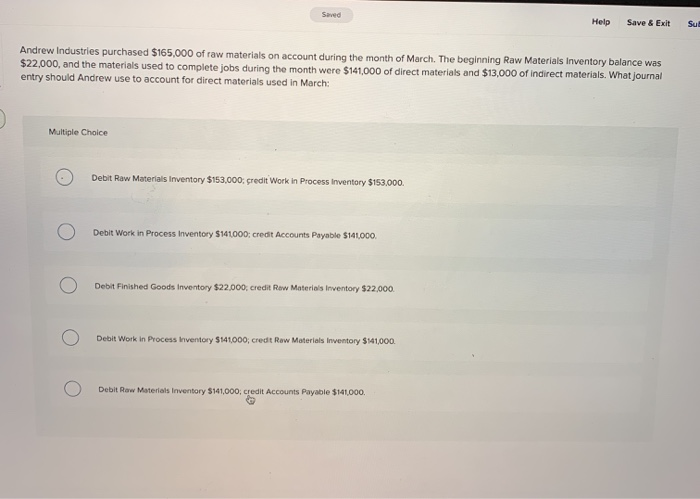

Help Save & Exit 22 Lake Erie Company uses a plantwide overhead rate with machine hours as the allocation base. Next year, 660,000 units are expected to be produced taking 0.70 machine hours each. How much overhead will be assigned to each unit produced given the following estimated amounts? Estimated: Manufacturing overhead costs Direct labor hours Machine hours 01:16:49 Department 1 $3,119,500 156,000 DLH 256,200 MH Department 2 $1,538,000 256,000 DLH 181,000 MH Multiple Choice $746 per unit $130 per unit $6.02 per unit $12.19 per unit $10.66 per unit Saved Help Save & Exit Submit B Portside Watercraft uses a job order costing system. During one month Portside purchased $153,000 of raw materials on credit; issued materials to production of $164,000, of which $24,000 were Indirect. Portside incurred a factory payroll cost of $95,000, of which $25,000 was indirect labor Portside uses a predetermined overhead rate of 170% of direct labor cost. The Journal entry to record the application of factory overhead to production is: 434 Multiple Choice Debit Work in Process Inventory $55,800, credit Factory Overhead $55,800 Debit Work in Process Inventory $95.000; credit Factory Payroll $95,000 Debit Work in Process inventory $161,500; credit Foctory Overhead $161.500. Debit Factory Overhead $19.000, credit Work in Process inventory $119,000 Debit Work in Process Inventory $119,000; credit Factory Overhead $119,000 Saved Help Save & Exit Sut Andrew Industries purchased $165,000 of raw materials on account during the month of March. The beginning Raw Materials inventory balance was $22,000, and the materials used to complete jobs during the month were $141,000 of direct materials and $13,000 of Indirect materials. What journal entry should Andrew use to account for direct materials used in March: Multiple Choice Debit Raw Materials Inventory $153,000 credit Work in Process Inventory $153.000. Debit Work in Process Inventory $141000; credit Accounts Payable $141,000. Debit Finished Goods Inventory $22.000, credit Raw Materials inventory $22,000. Debit Work in Process inventory $441,000, credt Raw Materials inventory $141,000 Debit Raw Materials Inventory S141,000, credit Accounts Payable $141,000