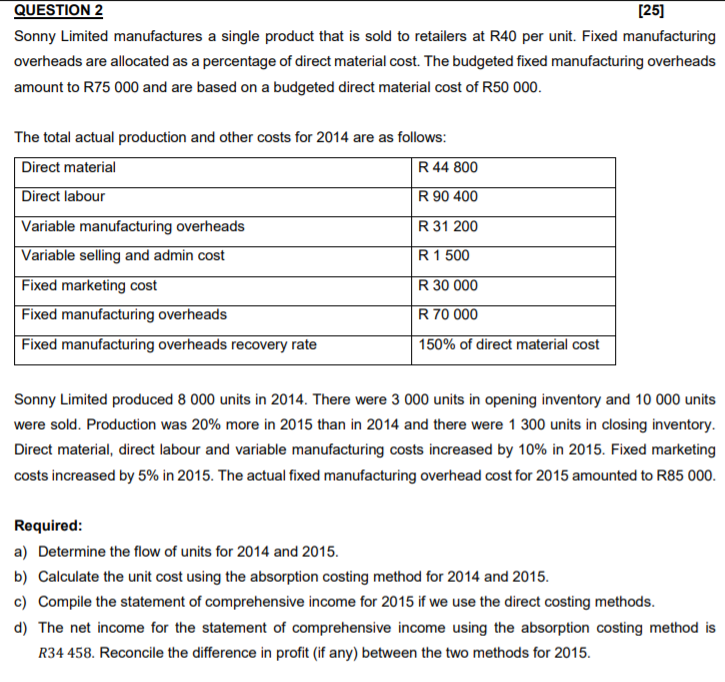

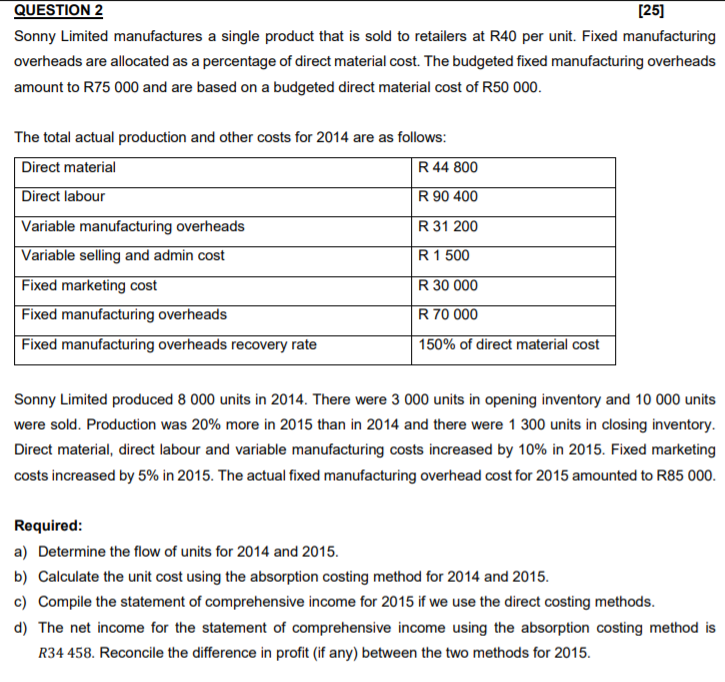

QUESTION 2 [25] Sonny Limited manufactures a single product that is sold to retailers at R40 per unit. Fixed manufacturing overheads are allocated as a percentage of direct material cost. The budgeted fixed manufacturing overheads amount to R75 000 and are based on a budgeted direct material cost of R50 000. The total actual production and other costs for 2014 are as follows: Direct material R 44 800 Direct labour R 90 400 Variable manufacturing overheads R 31 200 Variable selling and admin cost R 1 500 Fixed marketing cost R 30 000 Fixed manufacturing overheads R 70 000 Fixed manufacturing overheads recovery rate 150% of direct material cost Sonny Limited produced 8 000 units in 2014. There were 3 000 units in opening inventory and 10 000 units were sold. Production was 20% more in 2015 than in 2014 and there were 1 300 units in closing inventory. Direct material, direct labour and variable manufacturing costs increased by 10% in 2015. Fixed marketing costs increased by 5% in 2015. The actual fixed manufacturing overhead cost for 2015 amounted to R85 000. Required: a) Determine the flow of units for 2014 and 2015. b) Calculate the unit cost using the absorption costing method for 2014 and 2015. c) Compile the statement of comprehensive income for 2015 if we use the direct costing methods. d) The net income for the statement of comprehensive income using the absorption costing method is R34 458. Reconcile the difference in profit (if any) between the two methods for 2015. QUESTION 2 [25] Sonny Limited manufactures a single product that is sold to retailers at R40 per unit. Fixed manufacturing overheads are allocated as a percentage of direct material cost. The budgeted fixed manufacturing overheads amount to R75 000 and are based on a budgeted direct material cost of R50 000. The total actual production and other costs for 2014 are as follows: Direct material R 44 800 Direct labour R 90 400 Variable manufacturing overheads R 31 200 Variable selling and admin cost R 1 500 Fixed marketing cost R 30 000 Fixed manufacturing overheads R 70 000 Fixed manufacturing overheads recovery rate 150% of direct material cost Sonny Limited produced 8 000 units in 2014. There were 3 000 units in opening inventory and 10 000 units were sold. Production was 20% more in 2015 than in 2014 and there were 1 300 units in closing inventory. Direct material, direct labour and variable manufacturing costs increased by 10% in 2015. Fixed marketing costs increased by 5% in 2015. The actual fixed manufacturing overhead cost for 2015 amounted to R85 000. Required: a) Determine the flow of units for 2014 and 2015. b) Calculate the unit cost using the absorption costing method for 2014 and 2015. c) Compile the statement of comprehensive income for 2015 if we use the direct costing methods. d) The net income for the statement of comprehensive income using the absorption costing method is R34 458. Reconcile the difference in profit (if any) between the two methods for 2015