Answered step by step

Verified Expert Solution

Question

1 Approved Answer

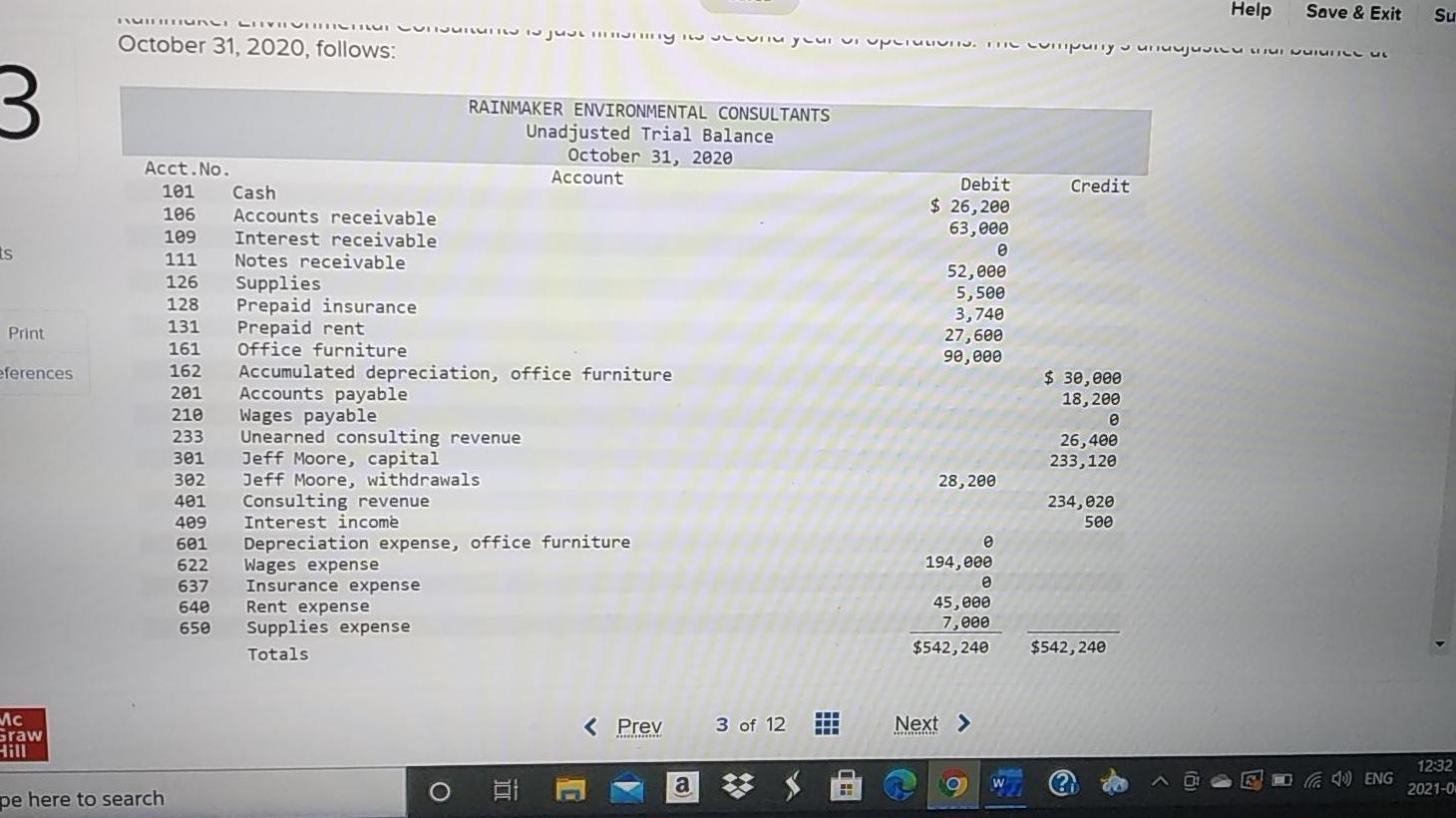

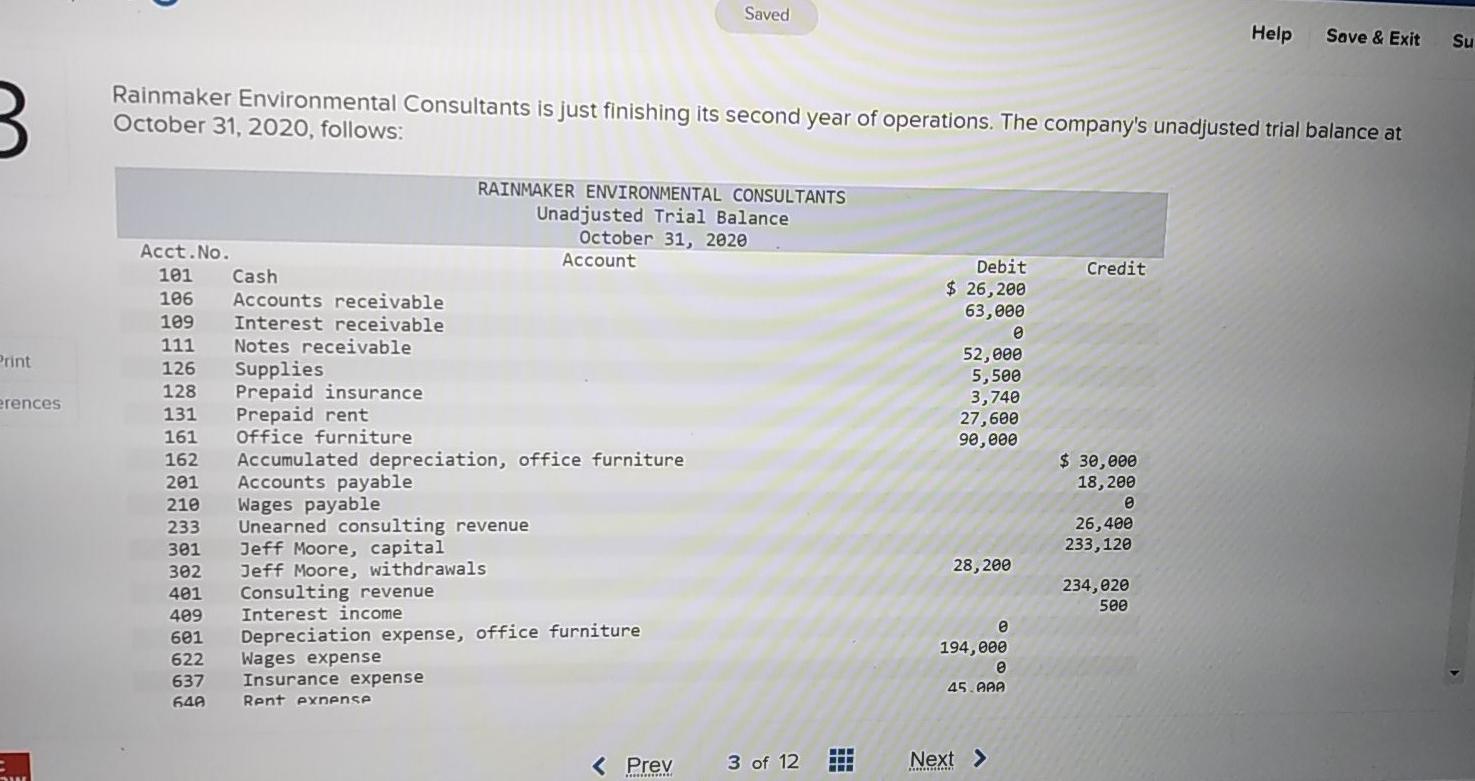

Help Save & Exit INUTILINCI LIIVICIILUI CUIJUILIIN Su October 31, 2020, follows: J . 3 Credit Debit $ 26,200 63,000 is 128 52,000 5,500 3,740

Help Save & Exit INUTILINCI LIIVICIILUI CUIJUILIIN Su October 31, 2020, follows: J . 3 Credit Debit $ 26,200 63,000 is 128 52,000 5,500 3,740 27,600 90,000 Print eferences RAINMAKER ENVIRONMENTAL CONSULTANTS Unadjusted Trial Balance October 31, 2020 Acct.No. Account 101 Cash 106 Accounts receivable 109 Interest receivable 111 Notes receivable 126 Supplies Prepaid insurance 131 Prepaid rent 161 Office furniture 162 Accumulated depreciation, office furniture 201 Accounts payable 210 Wages payable 233 Unearned consulting revenue 301 Jeff Moore, capital 302 Jeff Moore, withdrawals 401 Consulting revenue Interest income 601 Depreciation expense, office furniture 622 Wages expense 637 Insurance expense 640 Rent expense Supplies expense Totals $ 30,000 18,200 26,400 233,120 28, 200 234,020 500 489 194, eee 650 45,000 7,000 $542, 240 $542, 240 HA Mc araw Hill E 1232 2021-0 DIE Da ) ENG a pe here to search Saved Help Save & Exit Su B Rainmaker Environmental Consultants is just finishing its second year of operations. The company's unadjusted trial balance at October 31, 2020, follows: Credit Debit $ 26,200 63,000 Print 126 erences RAINMAKER ENVIRONMENTAL CONSULTANTS Unadjusted Trial Balance October 31, 2020 Acct. No. Account 101 Cash 106 Accounts receivable 109 Interest receivable 111 Notes receivable Supplies 128 Prepaid insurance 131 Prepaid rent 161 Office furniture 162 Accumulated depreciation, office furniture 201 Accounts payable 210 Wages payable 233 Unearned consulting revenue 301 Jeff Moore, capital 302 Jeff Moore, withdrawals 401 Consulting revenue 409 Interest income 601 Depreciation expense, office furniture 622 Wages expense 637 Insurance expense 64A Rent exnense 52,000 5,500 3,740 27,600 90,000 $ 30,000 18,200 26,400 233,120 28, 200 234,020 500 e 194,000 45. AAA 3 of 12 BEN Help Save & Exit INUTILINCI LIIVICIILUI CUIJUILIIN Su October 31, 2020, follows: J . 3 Credit Debit $ 26,200 63,000 is 128 52,000 5,500 3,740 27,600 90,000 Print eferences RAINMAKER ENVIRONMENTAL CONSULTANTS Unadjusted Trial Balance October 31, 2020 Acct.No. Account 101 Cash 106 Accounts receivable 109 Interest receivable 111 Notes receivable 126 Supplies Prepaid insurance 131 Prepaid rent 161 Office furniture 162 Accumulated depreciation, office furniture 201 Accounts payable 210 Wages payable 233 Unearned consulting revenue 301 Jeff Moore, capital 302 Jeff Moore, withdrawals 401 Consulting revenue Interest income 601 Depreciation expense, office furniture 622 Wages expense 637 Insurance expense 640 Rent expense Supplies expense Totals $ 30,000 18,200 26,400 233,120 28, 200 234,020 500 489 194, eee 650 45,000 7,000 $542, 240 $542, 240 HA Mc araw Hill E 1232 2021-0 DIE Da ) ENG a pe here to search Saved Help Save & Exit Su B Rainmaker Environmental Consultants is just finishing its second year of operations. The company's unadjusted trial balance at October 31, 2020, follows: Credit Debit $ 26,200 63,000 Print 126 erences RAINMAKER ENVIRONMENTAL CONSULTANTS Unadjusted Trial Balance October 31, 2020 Acct. No. Account 101 Cash 106 Accounts receivable 109 Interest receivable 111 Notes receivable Supplies 128 Prepaid insurance 131 Prepaid rent 161 Office furniture 162 Accumulated depreciation, office furniture 201 Accounts payable 210 Wages payable 233 Unearned consulting revenue 301 Jeff Moore, capital 302 Jeff Moore, withdrawals 401 Consulting revenue 409 Interest income 601 Depreciation expense, office furniture 622 Wages expense 637 Insurance expense 64A Rent exnense 52,000 5,500 3,740 27,600 90,000 $ 30,000 18,200 26,400 233,120 28, 200 234,020 500 e 194,000 45. AAA 3 of 12 BEN

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started