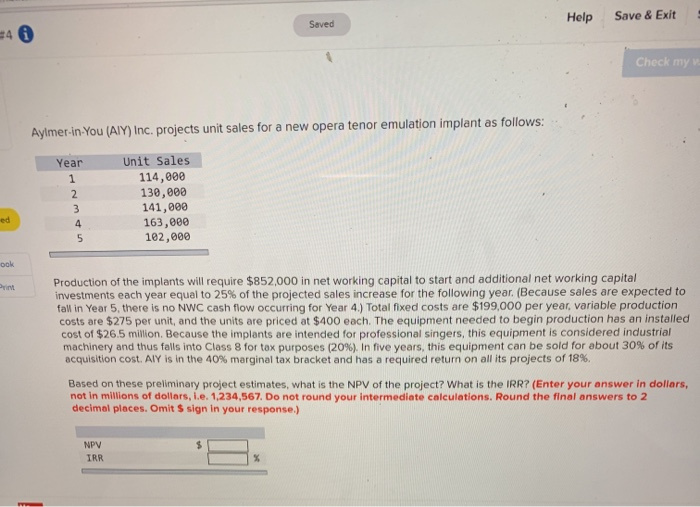

Question: Help Save & Exit Saved 40 Check my Aylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Year Unit

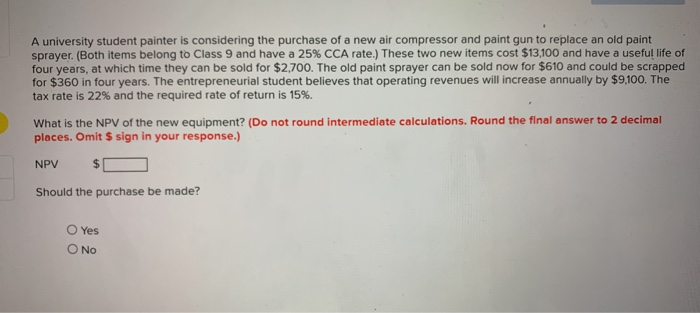

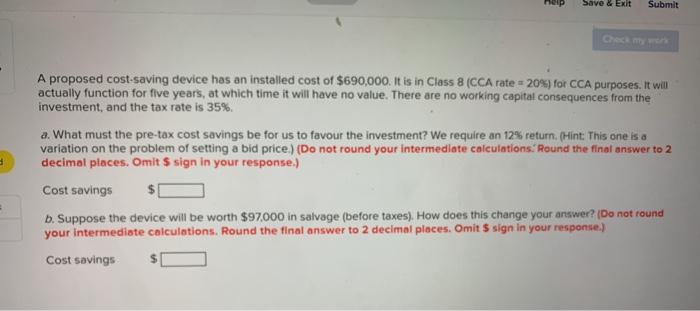

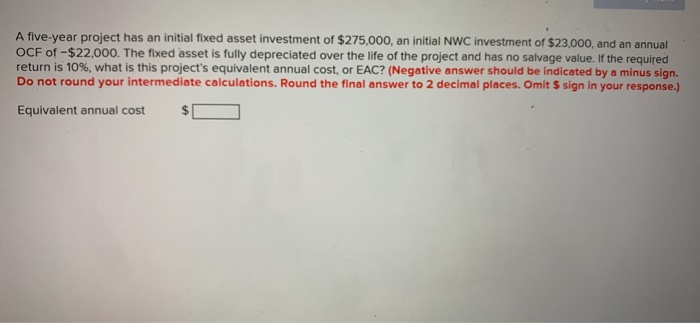

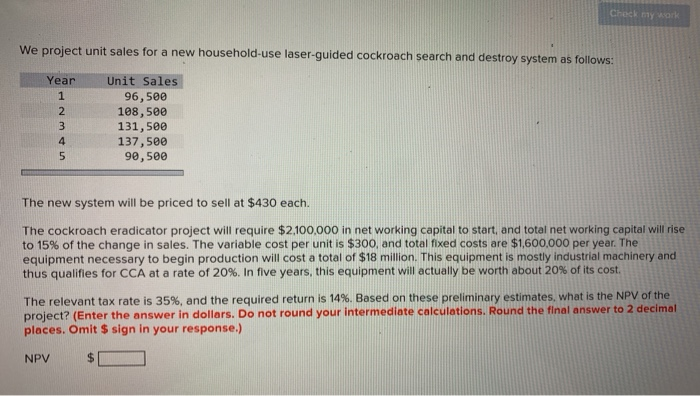

Help Save & Exit Saved 40 Check my Aylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Year Unit Sales 1 114,000 130,000 141,000 163,000 102,000 ed 2 3 4 5 Dok Print Production of the implants will require $852,000 in net working capital to start and additional networking capital investments each year equal to 25% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5, there is no NWC cash flow occurring for Year 4.) Total fixed costs are $199,000 per year, variable production costs are $275 per unit, and the units are priced at $400 each. The equipment needed to begin production has an installed cost of $26.5 milion. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus falls into Class 8 for tax purposes (20%). in five years, this equipment can be sold for about 30% of its acquisition cost. AlY is in the 40% marginal tax bracket and has a required return on all its projects of 18% Based on these preliminary project estimates, what is the NPV of the project? What is the IRR? (Enter your answer in dollars, not in millions of dollars, i.e. 1,234,567. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit S sign in your response.) NPV IRR A university student painter is considering the purchase of a new air compressor and paint gun to replace an old paint sprayer. (Both items belong to Class 9 and have a 25% CCA rate.) These two new items cost $13,100 and have a useful life of four years, at which time they can be sold for $2,700. The old paint sprayer can be sold now for $610 and could be scrapped for $360 in four years. The entrepreneurial student believes that operating revenues will increase annually by $9,100. The tax rate is 22% and the required rate of return is 15%. What is the NPV of the new equipment? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $1 Should the purchase be made? Yes O No help Save & Exit Submit Check my work A proposed cost-saving device has an installed cost of $690,000. It is in Class 8 (CCA rate = 20%) for CCA purposes. It will actually function for five years, at which time it will have no value. There are no working capital consequences from the investment, and the tax rate is 35%. a. What must the pre-tax cost savings be for us to favour the investment? We require an 12% return. (Hint: This one is a variation on the problem of setting a bid price. (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $ b. Suppose the device will be worth $97,000 in salvage (before taxes). How does this change your answer? (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit S sign in your response.) Cost savings $ A five-year project has an initial fixed asset investment of $275,000, an initial NWC investment of $23,000, and an annual OCF of - $22,000. The fixed asset is fully depreciated over the life of the project and has no salvage value. If the required return is 10%, what is this project's equivalent annual cost, or EAC? (Negative answer should be indicated by a minus sign. Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit S sign in your response.) Equivalent annual cost $ We project unit sales for a new household-use laser-guided cockroach search and destroy system as follows: Year 1 2 3 4 5 Unit Sales 96,500 108,500 131,500 137,500 90,500 The new system will be priced to sell at $430 each. The cockroach eradicator project will require $2,100,000 in net working capital to start, and total net working capital will rise to 15% of the change in sales. The variable cost per unit is $300, and total fixed costs are $1,600,000 per year. The equipment necessary to begin production will cost a total of $18 million. This equipment is mostly industrial machinery and thus qualifies for CCA at a rate of 20%. In five years, this equipment will actually be worth about 20% of its cost. The relevant tax rate is 35%, and the required return is 14%. Based on these preliminary estimates, what is the NPV of the project? (Enter the answer in dollars. Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV Help Save & Exit Saved 40 Check my Aylmer-in-You (AIY) Inc. projects unit sales for a new opera tenor emulation implant as follows: Year Unit Sales 1 114,000 130,000 141,000 163,000 102,000 ed 2 3 4 5 Dok Print Production of the implants will require $852,000 in net working capital to start and additional networking capital investments each year equal to 25% of the projected sales increase for the following year. (Because sales are expected to fall in Year 5, there is no NWC cash flow occurring for Year 4.) Total fixed costs are $199,000 per year, variable production costs are $275 per unit, and the units are priced at $400 each. The equipment needed to begin production has an installed cost of $26.5 milion. Because the implants are intended for professional singers, this equipment is considered industrial machinery and thus falls into Class 8 for tax purposes (20%). in five years, this equipment can be sold for about 30% of its acquisition cost. AlY is in the 40% marginal tax bracket and has a required return on all its projects of 18% Based on these preliminary project estimates, what is the NPV of the project? What is the IRR? (Enter your answer in dollars, not in millions of dollars, i.e. 1,234,567. Do not round your intermediate calculations. Round the final answers to 2 decimal places. Omit S sign in your response.) NPV IRR A university student painter is considering the purchase of a new air compressor and paint gun to replace an old paint sprayer. (Both items belong to Class 9 and have a 25% CCA rate.) These two new items cost $13,100 and have a useful life of four years, at which time they can be sold for $2,700. The old paint sprayer can be sold now for $610 and could be scrapped for $360 in four years. The entrepreneurial student believes that operating revenues will increase annually by $9,100. The tax rate is 22% and the required rate of return is 15%. What is the NPV of the new equipment? (Do not round intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV $1 Should the purchase be made? Yes O No help Save & Exit Submit Check my work A proposed cost-saving device has an installed cost of $690,000. It is in Class 8 (CCA rate = 20%) for CCA purposes. It will actually function for five years, at which time it will have no value. There are no working capital consequences from the investment, and the tax rate is 35%. a. What must the pre-tax cost savings be for us to favour the investment? We require an 12% return. (Hint: This one is a variation on the problem of setting a bid price. (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) Cost savings $ b. Suppose the device will be worth $97,000 in salvage (before taxes). How does this change your answer? (Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit S sign in your response.) Cost savings $ A five-year project has an initial fixed asset investment of $275,000, an initial NWC investment of $23,000, and an annual OCF of - $22,000. The fixed asset is fully depreciated over the life of the project and has no salvage value. If the required return is 10%, what is this project's equivalent annual cost, or EAC? (Negative answer should be indicated by a minus sign. Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit S sign in your response.) Equivalent annual cost $ We project unit sales for a new household-use laser-guided cockroach search and destroy system as follows: Year 1 2 3 4 5 Unit Sales 96,500 108,500 131,500 137,500 90,500 The new system will be priced to sell at $430 each. The cockroach eradicator project will require $2,100,000 in net working capital to start, and total net working capital will rise to 15% of the change in sales. The variable cost per unit is $300, and total fixed costs are $1,600,000 per year. The equipment necessary to begin production will cost a total of $18 million. This equipment is mostly industrial machinery and thus qualifies for CCA at a rate of 20%. In five years, this equipment will actually be worth about 20% of its cost. The relevant tax rate is 35%, and the required return is 14%. Based on these preliminary estimates, what is the NPV of the project? (Enter the answer in dollars. Do not round your intermediate calculations. Round the final answer to 2 decimal places. Omit $ sign in your response.) NPV

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts