Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help Save & Exit Su The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling

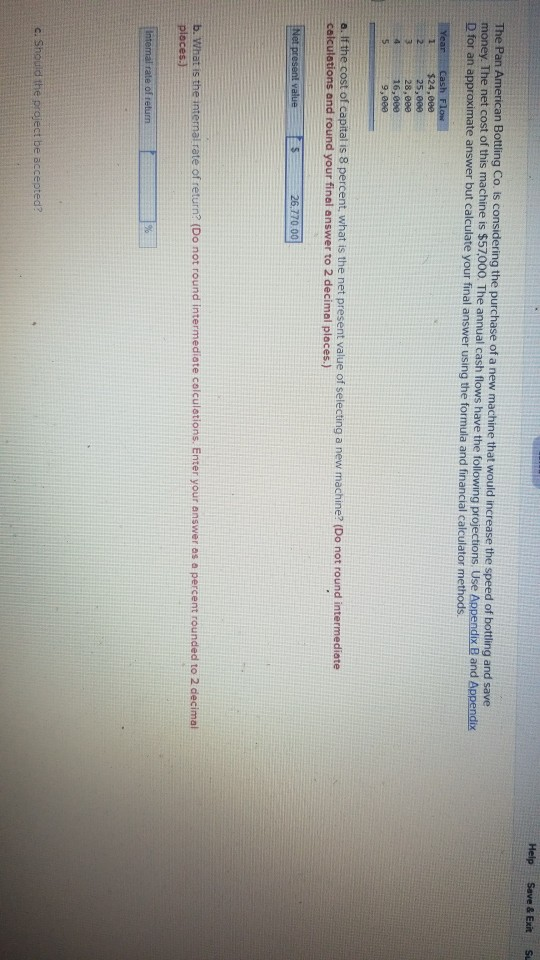

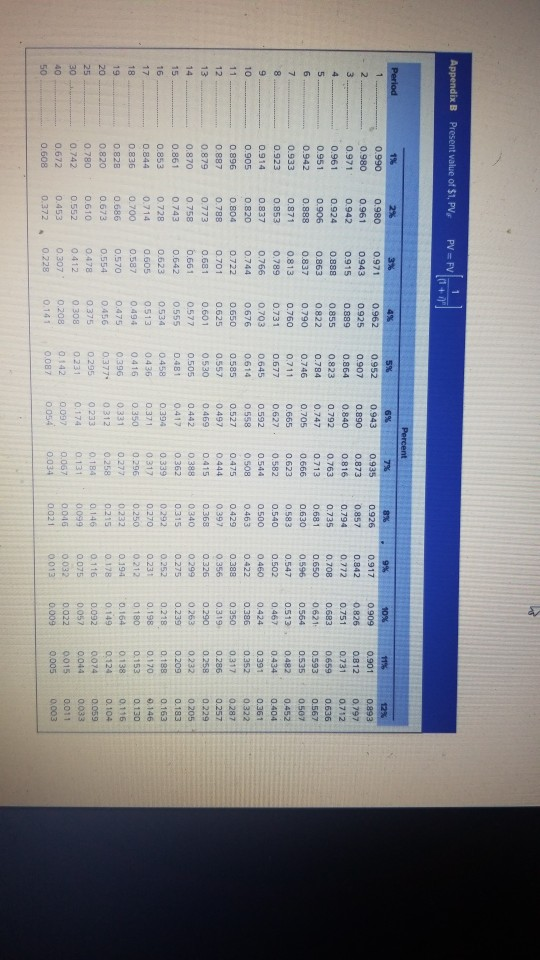

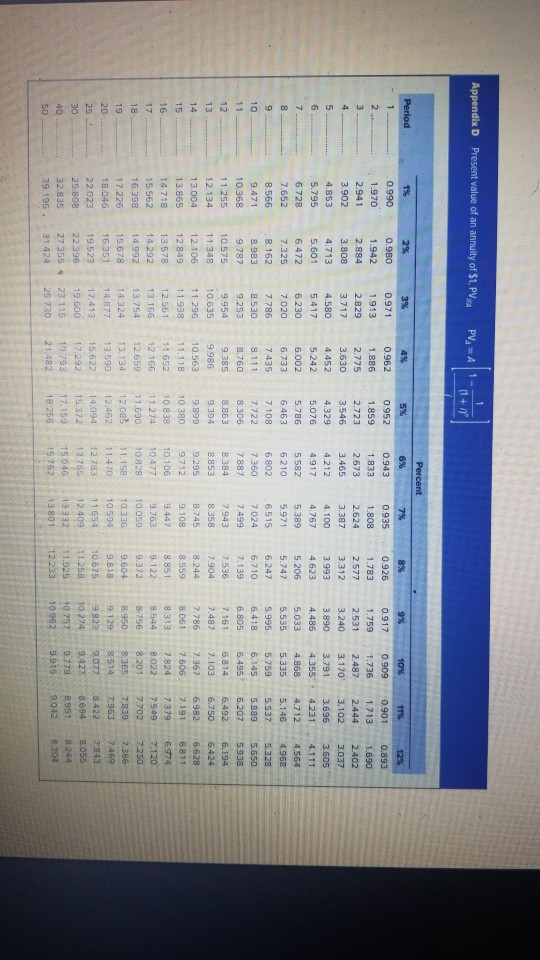

Help Save & Exit Su The Pan American Bottling Co. is considering the purchase of a new machine that would increase the speed of bottling and save money. The net cost of this machine is $57,000. The annual cash flows have the following projections. Use Appendix Band Appendix D for an approximate answer but calculate your final answer using the formula and financial calculator methods Year Cash Flow >24,068 25,000 28,000 -16,eee 9,000 a. If the cost of capital is 8 percent, what is the net present value of selecting a new machine? (Do not round intermediate calculations and round your final answer to 2 decimal places.) Net present value 26.770.00 b. What is the internal rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal proces Internal rate of return c. Should the project be accepted? Appendix B Present value of S1, PV PV = FVF Period 1 Nino 3% 0.971 0.943 0.915 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 0.914 0.905 0.896 0.887 0.879 0.870 0.861 0.853 0.844 0.836 0.828 0.820 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 0.837 0.820 0.804 0.788 0.773 0.758 0.743 0.728 0.714 0.700 0.686 0.673 0.610 0.552 0.453 0.372 0.863 0.837 0.813 0.789 0.766 0.744 0.722 0.701 0.681 6.661 0.642 0.623 0.605 0.587 0.570 0.554 0.478 0.412 0.307 0.228 N2OORH898 4% 0.962 0.925 0.889 0.855 0.822 0.790 0.760 0.731 0.703 0.676 0.650 0.625 0.601 0.577 0.555 0534 0.513 0.494 0.475 0.456 0.375 0.308 0.208 0.141 5% 0.952 0.907 0.864 0.823 0.784 0.746 0.711 0.677 0.645 0.614 0.585 0.557 0.530 0.505 0.481 0.458 0.436 0.416 0.396 0.377 0.295 0.231 0.142 0.087 Percent 6% 7% 0.943 0.935 0.890 0.873 0.840 0.816 0.792 0.763 0.747 0.713 0.705 0.666 0.665 0.623 0.627 0.582 0.592 0.544 0.558 0.508 0.527 0.475 0.497 0.444 0.469 0.415 0.442 0.388 0.417 0.362 0.394 0.339 0.371 0317 0.350 0.296 0 331 0.277 0.312 0.258 0.233 0.184 0.174 0.131 0.00 0.054 0.926 0.857 0.794 0.735 0.681 0.630 0.583 0.540 0.500 0.463 0.429 0.397 0.368 0.340 0.315 0.292 0.270 0.250 0.232 0.215 0.146 0.099 0.016 0.021 10% 0.909 0.826 0.751 0.683 0,621 0.564 0.513 0,467 0.424 0.386 0.350 0.319 0.290 0.263 0.239 0.917 0.842 0.772 0.708 0.650 0.596 0.547 0.502 0.460 0.422 0.388 0.356 0.326 0.299 0.275 0.252 0.231 0.212 0.194 0.178 0.116 0.075 0.032 0.013 11% 0.901 0.312 0.731 0.659 0.593 0.535 0.482 0.434 0.391 0.352 0.317 0.286 0.258 0232 0.209 0.188 0.170 0.153 0.138 0.124 0.074 0.044 0015 0.005 0.893 0.797 0.712 0.636 0.567 0.507 0.452 0.404 0.361 0.322 0.287 0.257 0.229 0.205 0.183 0.163 0.146 0.130 0.116 0.104 0.059 0.033 0.011 0.003 0218 0.198 0.180 0.164 0.149 0.092 0.057 0.022 0.009 0.780 0.742 0.672 0.608 Appendix D Present value of an annuity of $1. PVA PVA Period 3% 0.971 1.913 2.829 OOONSHAS 1% 0.990 1.970 2.941 3.902 4.853 5.795 6.728 7.652 8.566 9.471 10.368 11.255 12.134 13,004 13.865 14.718 15.562 16.398 17.225 18.046 22.023 25.808 32.835 39.196. 2% 0.980 1.942 2.884 3.808 4.713 5.601 6.472 7.325 8.162 8.983 9.787 10.575 11.348 12.106 12.849 13.578 14.292 14992 15.678 16:351 19.523 22.396 27355 31 424 4.580 5.417 6.230 7.020 7.786 8.530 9.253 9.954 10.635 11 296 11.938 12.561 13.166 13.754 14.324 14.877 17.413 19.600 23.115 25.730 4% 0.962 1.886 2.775 3.630 4.452 5.242 6.002 6.733 7435 8.111 8.760 9,385 9.986 10.563 11.118 11.652 12 166 12 659 13.134 13.590 15.622 17.292 19793 21.482 5% 0.952 1.859 2.723 3.546 4.329 5.076 5.786 6,463 7.108 7.722 8.306 8.863 9.394 9.899 10.380 10.838 11.274 11.690 12.08 12462 14,094 15.372 17.159 18.256 Percent 6% 0.943 0.935 1833 1808 2.673 2.624 3.465 3.387 4.212 4.100 4.917 4.767 5.582 5389 6210 5.971 6.802 6.515 7.360 7.024 7.887 7.499 8.384 7.943 8.853 8.358 9.295 8.745 9.712 9.108 10.106 9.447 10.477 9.763 10 828 10.059 11.158 10.336 11.470 10.594 12.783 11654 13755 12.409 15046 13.332 15.762 13.801 8% 0.926 1.783 2.577 3.312 -3.993 4.623 5 206 5.747 6.247 6.710 7.139 7.536 7.904 8.244 8.559 8.851 9.122 9.372 9.604 9.818 10.675 11.258 11.925 12.233 9% 0.917 1.759 2.531 3.240 3.890 4.486 5.033 5.535 5.995 6.418 6.805 7.161 7.487 7786 8.061 8.313 8.544 10% 0.909 1.736 2.487 3.170 3.791 4.355 4.868 5.335 5.759 6.145 6.495 6.814 7.103 7.367 7.606 7.824 8.022 8.201 8.365 8514 112 0.901 1.713 2.444 3.102 3.696 4.231 4.712 5.146 5.537 5.889 6.207 6.492 6.750 6.982 7.191 7379 7.549 7.702 7.839 7.963 8.422 8.694 8951 9.042 0.893 1.690 2.402 3.037 3.605 4.111 4.564 4.968 5.328 5.650 5.938 6.194 6.424 6.628 6811 6.974 7.120 7.250 7.366 7469 7.943 8.055 8.244 8.304 8.950 9.129 9.823 10 274 10757 10 962 00:00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started