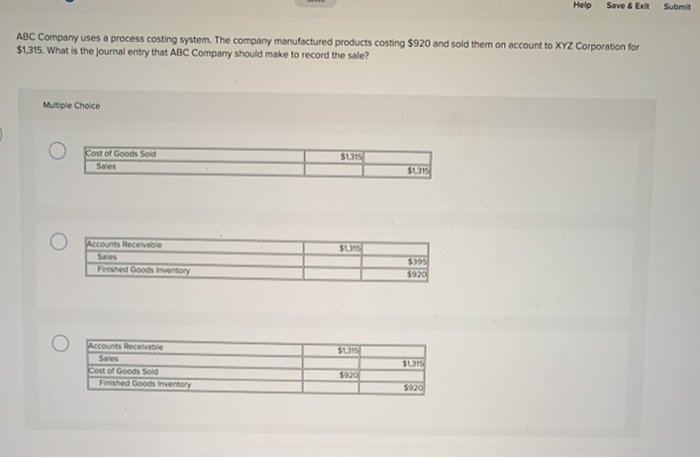

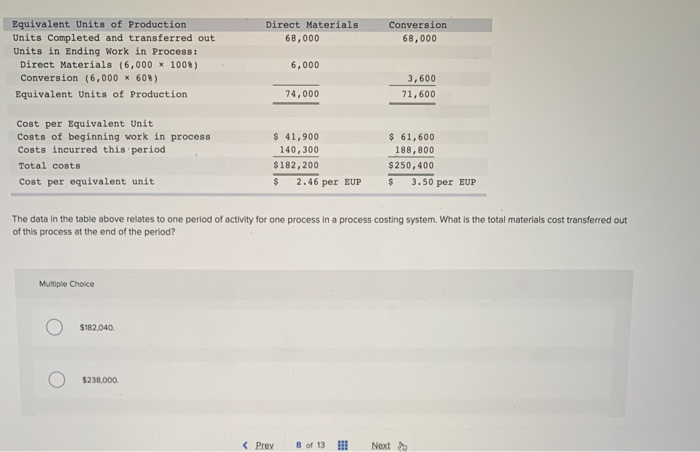

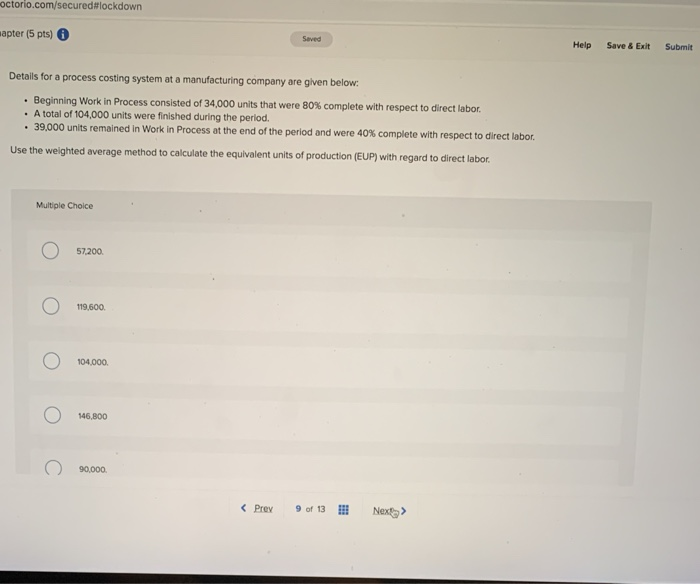

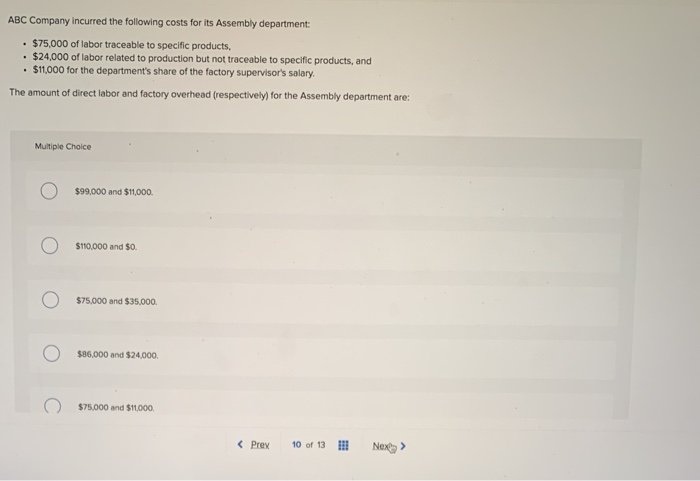

Help Save & Exit Submit ABC Company uses a process costing system. The company manufactured products costing $920 and sold them on account to XYZ Corporation for $1,315. What is the journal entry that ABC Company should make to record the sale? Multiple Choice Cost of Goods Sold Sales SU315 $1315 SUS Accounts Receivable Sales Finished Goods inventory $395 $920 $0315 Accounts Receivable Sales Cost of Goods Sold Finished Goods Inventory SLOS $920 $920 Direct Materials 68,000 Conversion 68,000 Equivalent Units of Production Units Completed and transferred out Units in Ending Work in Process: Direct Materials (6,000 * 100%) Conversion (6,000 * 60) Equivalent Units of Production 6,000 3,600 71,600 74,000 Cost per Equivalent Unit Costs of beginning work in process Costs incurred this period Total costs Cost per equivalent unit $ 41,900 140,300 $182,200 $ 2.46 per EUP $ 61,600 188,800 $ 250,400 $ 3.50 per EUP The data in the table above relates to one period of activity for one process in a process costing system. What is the total materials cost transferred out of this process at the end of the period? Multiple Choice $182,040 $238.000 octorio.com/secured#lockdown mapter (5 pts) Seved Help Save & Exit Submit Details for a process costing system at a manufacturing company are given below: Beginning Work in Process consisted of 34,000 units that were 80% complete with respect to direct labor. A total of 104,000 units were finished during the period. . 39,000 units remained in Work in Process at the end of the period and were 40% complete with respect to direct labor. Use the weighted average method to calculate the equivalent units of production (EUP) with regard to direct labor. Multiple Choice 57.200 119,600 104.000 146,800 90,000 ABC Company incurred the following costs for its Assembly department: $75,000 of labor traceable to specific products, $24,000 of labor related to production but not traceable to specific products, and $11,000 for the department's share of the factory supervisor's salary The amount of direct labor and factory overhead (respectively) for the Assembly department are: Multiple Choice $99,000 and $11,000. $110,000 and $0 $75,000 and $35,000 $86,000 and $24,000 $75,000 and $11,000