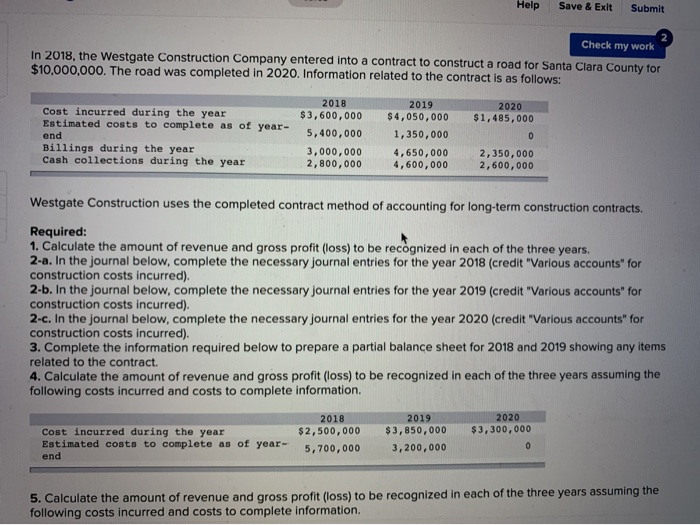

Help Save & Exit Submit Check my work In 2018, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2020. Information related to the contract is as follows: 2020 $1,485,000 Cost incurred during the year Estimated costs to complete as of year- end Billings during the year Cash collections during the year 2018 $3,600,000 5,400,000 3,000,000 2,800,000 2019 $4,050,000 1,350,000 4,650,000 4,600,000 2,350,000 2,600,000 Westgate Construction uses the completed contract method of accounting for long-term construction contracts. Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. 2-a. In the journal below, complete the necessary journal entries for the year 2018 (credit "Various accounts for construction costs incurred). 2-b. In the journal below, complete the necessary journal entries for the year 2019 (credit "Various accounts" for construction costs incurred). 2-c. In the journal below, complete the necessary journal entries for the year 2020 (credit "Various accounts for construction costs incurred). 3. Complete the information required below to prepare a partial balance sheet for 2018 and 2019 showing any items related to the contract. 4. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. 2018 $2,500,000 5.700,000 Cost incurred during the year Estimated costs to complete as of year - end 2019 $3,850,000 3,200,000 2020 $3,300,000 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. Help Save & Exit Submit Check my work In 2018, the Westgate Construction Company entered into a contract to construct a road for Santa Clara County for $10,000,000. The road was completed in 2020. Information related to the contract is as follows: 2020 $1,485,000 Cost incurred during the year Estimated costs to complete as of year- end Billings during the year Cash collections during the year 2018 $3,600,000 5,400,000 3,000,000 2,800,000 2019 $4,050,000 1,350,000 4,650,000 4,600,000 2,350,000 2,600,000 Westgate Construction uses the completed contract method of accounting for long-term construction contracts. Required: 1. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years. 2-a. In the journal below, complete the necessary journal entries for the year 2018 (credit "Various accounts for construction costs incurred). 2-b. In the journal below, complete the necessary journal entries for the year 2019 (credit "Various accounts" for construction costs incurred). 2-c. In the journal below, complete the necessary journal entries for the year 2020 (credit "Various accounts for construction costs incurred). 3. Complete the information required below to prepare a partial balance sheet for 2018 and 2019 showing any items related to the contract. 4. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information. 2018 $2,500,000 5.700,000 Cost incurred during the year Estimated costs to complete as of year - end 2019 $3,850,000 3,200,000 2020 $3,300,000 5. Calculate the amount of revenue and gross profit (loss) to be recognized in each of the three years assuming the following costs incurred and costs to complete information