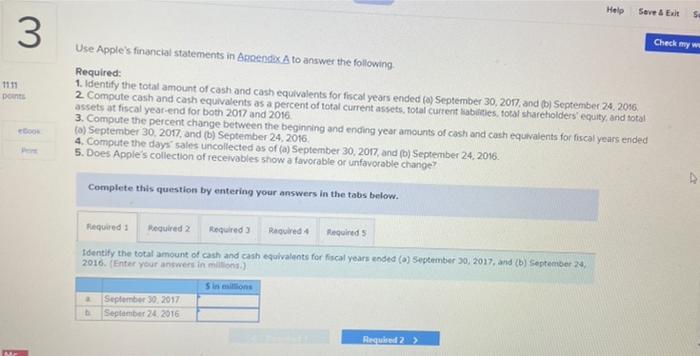

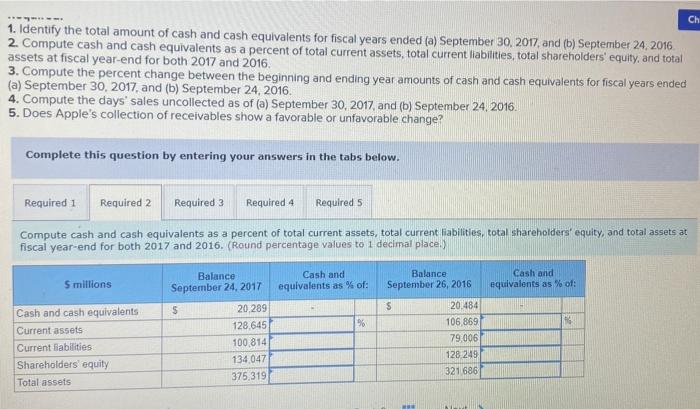

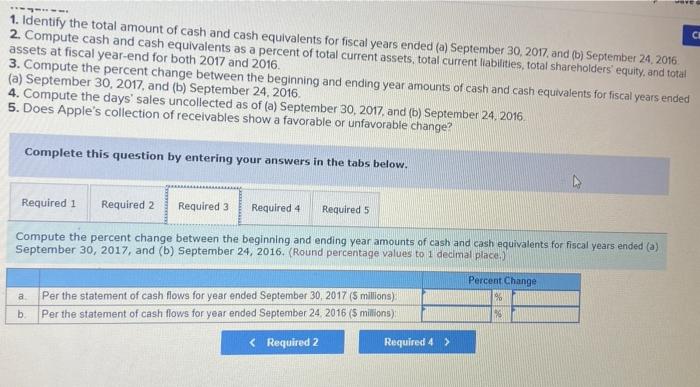

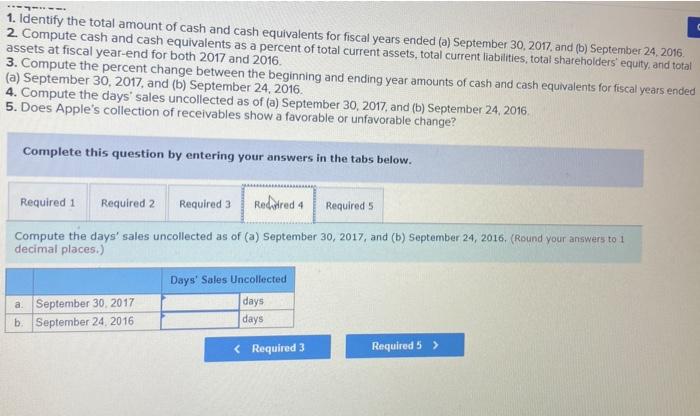

Help Save & Ext 5 3 Check my w 1111 DO Use Apple's financial statements in Brendex A to answer the following Required: 1. Identify the total amount of cash and cash equivalents for fiscal years ended () September 30, 2017 and ) September 24, 2016 2. Compute cash and cash equivalents as a percent of total current assets, total current anties, total shareholders equity, and total 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended 4. Compute the days sales uncollected as of (a) September 30, 2017, and (b) September 24, 2016. 5. Does Apple's collection of receivables show a favorable or unfavorable change? 600 Complete this question by entering your answers in the tabs below. Required Required 2 Required Ragined Required 5 Identify the total amount of cash and cash equivalents for fiscal years ended() September 30, 2017 and (b) September 24, 2016. Enter your answers in mi) Sinons September 30, 2017 September 24, 2016 Required 2 > Ch 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 30, 2017 and (b) September 24, 2016 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2017 and 2016, 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 30, 2017, and (b) September 24, 2016. 4. Compute the days' sales uncollected as of (a) September 30, 2017, and (b) September 24, 2016. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2017 and 2016. (Round percentage values to 1 decimal place.) Smillions Cash and equivalents as % of: Cash and equivalents as of: Cash and cash equivalents Current assets Current liabilities Shareholders' equity Total assets Balance September 24, 2017 $ 20.289 128,645 100 814 134 047 375,319 Balance September 26, 2016 $ 20,484 106,869 79.006 128 249 321686 ve CI 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 30, 2017 and (b) September 24, 2016 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2017 and 2016. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 30, 2017, and (b) September 24, 2016 4. Compute the days' sales uncollected as of (a) September 30, 2017 and (b) September 24, 2016 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 30, 2017, and (b) September 24, 2016. (Round percentage values to 1 decimal place.) Percent Change % a Per the statement of cash flows for year ended September 30, 2017 (5 millions) Per the statement of cash flows for year ended September 24 2016 (5 milions) b 98 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 30, 2017, and (b) September 24, 2016. 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total shareholders' equity, and total assets at fiscal year-end for both 2017 and 2016. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equivalents for fiscal years ended (a) September 30, 2017, and (b) September 24, 2016. 4. Compute the days' sales uncollected as of (a) September 30, 2017, and (b) September 24, 2016, 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Redwired 4 Required 5 Compute the days' sales uncollected as of (a) September 30, 2017, and (b) September 24, 2016. (Round your answers to i decimal places.) Days' Sales Uncollected days a. September 30, 2017 b. September 24, 2016 days 1. Identify the total amount of cash and cash equivalents for fiscal years ended (a) September 30, 2017 am 2. Compute cash and cash equivalents as a percent of total current assets, total current liabilities, total st assets at fiscal year-end for both 2017 and 2016. 3. Compute the percent change between the beginning and ending year amounts of cash and cash equi (a) September 30, 2017, and (b) September 24, 2016. 4. Compute the days' sales uncollected as of (a) September 30, 2017, and (b) September 24, 2016. 5. Does Apple's collection of receivables show a favorable or unfavorable change? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 Required 4 Required 5 Does Apple's collection of receivables show a favorable or unfavorable change? Does Apple's collection of receivables show a favorable or unfavorable change? Required 4