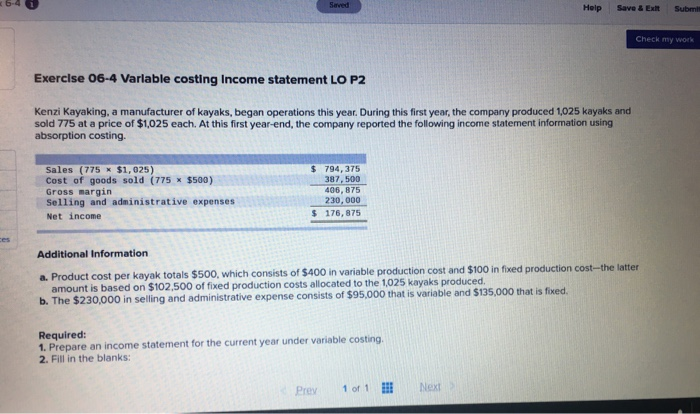

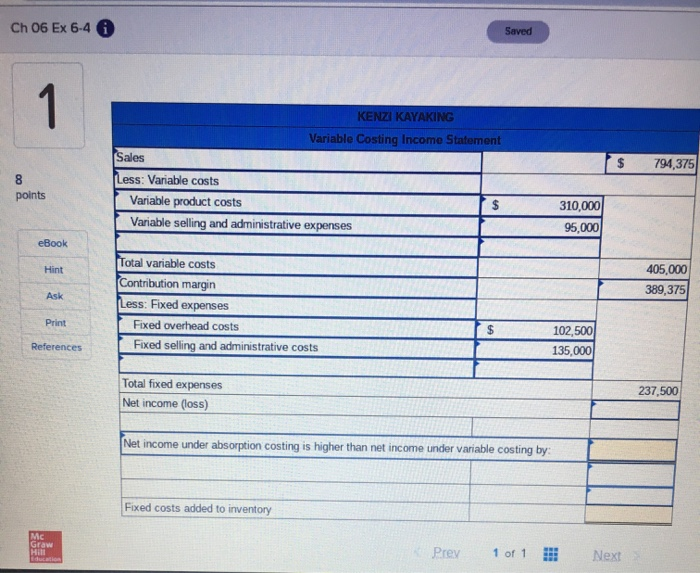

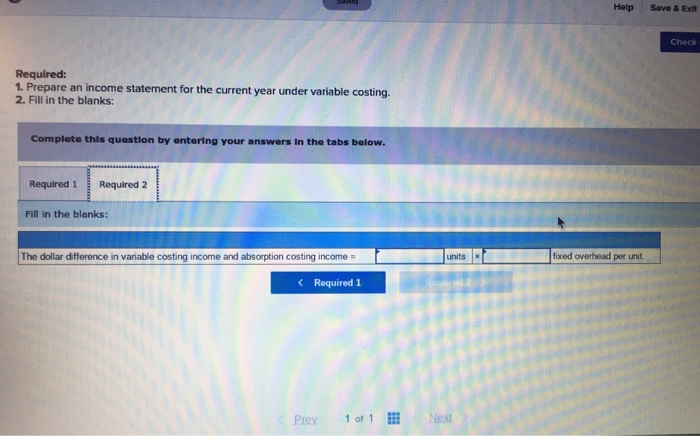

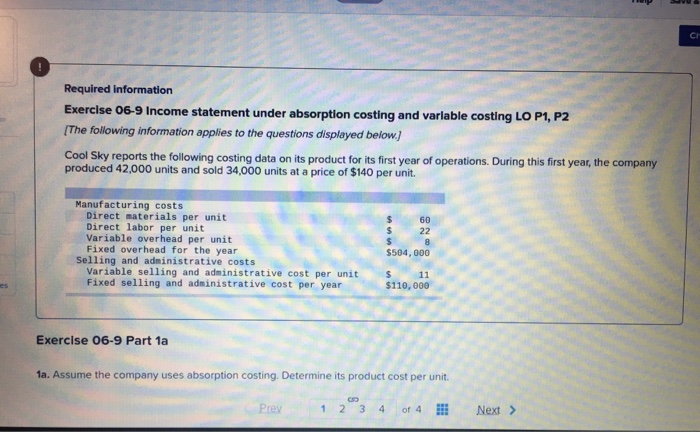

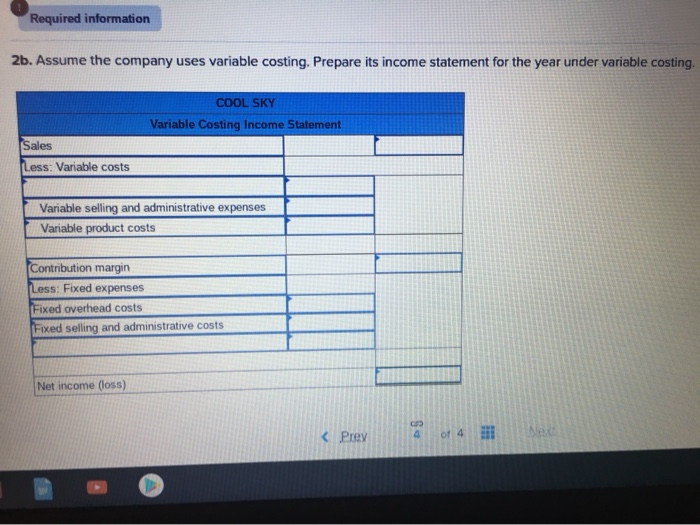

Help Save & Sub Check my work Exercise 06-4 Variable costing Income statement LO P2 Kenzi Kayaking, a manufacturer of kayaks, began operations this year. During this first year, the company produced 1,025 kayaks and sold 775 at a price of $1,025 each. At this first year-end, the company reported the following income statement information using absorption costing. $ Sales (775 * $1,025) Cost of goods sold (775 * $500) Gross margin Selling and administrative expenses Net income 794, 375 387.500 406,875 230,000 $ 176.875 Additional Information a. Product cost per kayak totals $500, which consists of $400 in variable production cost and $100 in fixed production cost--the latter amount is based on $102.500 of fixed production costs allocated to the 1,025 kayaks produced. b. The $230,000 in selling and administrative expense consists of $95.000 that is variable and $135,000 that is fixed. Required: 1. Prepare an income statement for the current year under variable costing 2. Fill in the blanks: Prey 1 of 1 !! Next Ch 06 Ex 6-4 6 Saved KENZI KAYAKING Variable Costing Income Statement Sales $ 794,375 Less: Variable costs points Variable product costs Variable selling and administrative expenses 310,000 95,000 eBook Hint 405,000 389,375 l Ask Total variable costs Contribution margin a Less: Fixed expenses Fixed overhead costs Fixed selling and administrative costs Print 102,500 135,000 References 237,500 Total foxed expenses Net income (oss) Net income under absorption costing is higher than net income under variable costing by: Fixed costs added to inventory Prey 1 of 1 !! Next Help Save & Ex Check Required: 1. Prepare an income statement for the current year under variable costing. 2. Fill in the blanks Complete this question by entering your answers in the tabs below. Required 1 Required 2 Fill in the blanks: The dollar difference in variable costing income and absorption costing income faxed overhead per unit Required information 2b. Assume the company uses variable costing. Prepare its income statement for the year under variable costing. COOL SKY Variable Costing Income Statement Less: Variable costs Variable selling and administrative expenses Variable product costs Contribution margin Less: Fixed expenses Fixed overhead costs Fixed selling and administrative costs Net income (loss)