Help Save The PC Works assembles custom computers from components supplied by various manufacturers. The company is very small and its assembly shop and

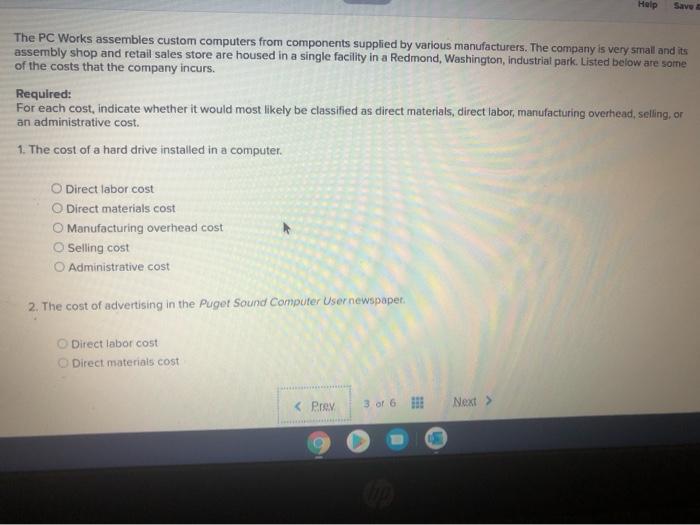

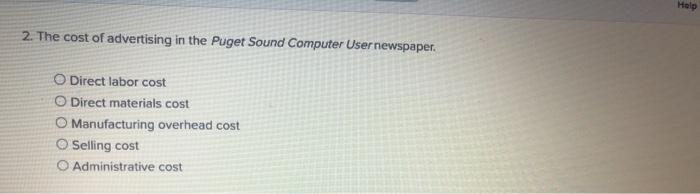

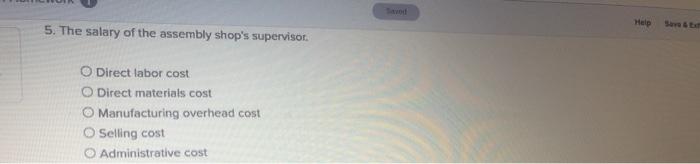

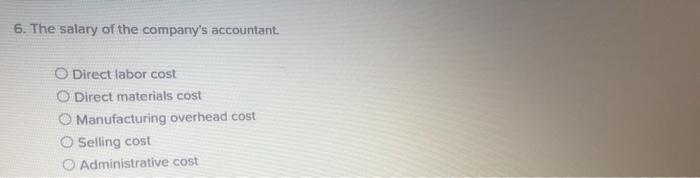

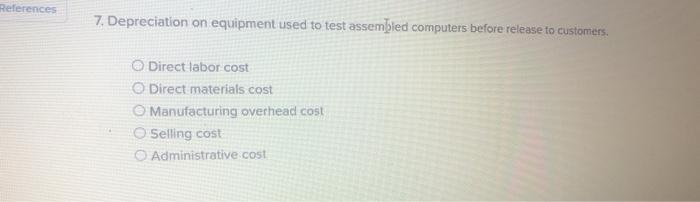

Help Save The PC Works assembles custom computers from components supplied by various manufacturers. The company is very small and its assembly shop and retail sales store are housed in a single facility in a Redmond, Washington, industrial park. Listed below are some of the costs that the company incurs. Required: For each cost, indicate whether it would most likely be classified as direct materials, direct labor, manufacturing overhead, selling, or an administrative cost. 1. The cost of a hard drive installed in a computer. Direct labor cost O Direct materials cost O Manufacturing overhead cost O Selling cost O Administrative cost 2. The cost of advertising in the Puget Sound Computer User newspaper. O Direct labor cost O Direct materials cost < Prev 3 of 6 Next Up

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started