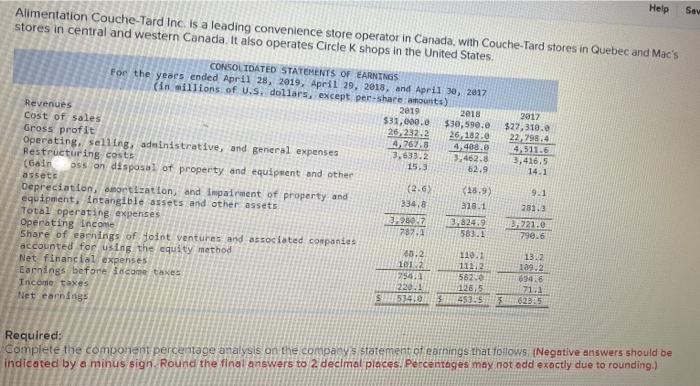

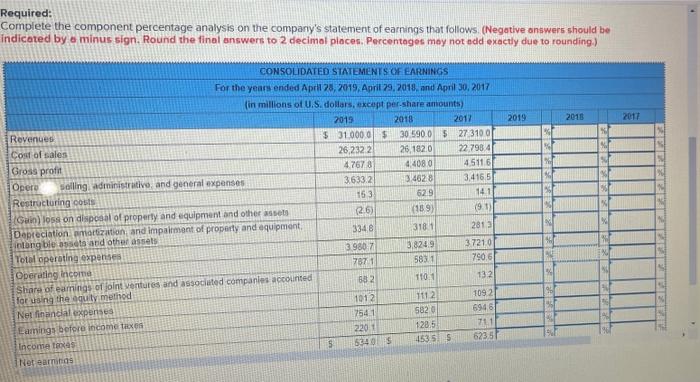

Help Say Alimentation Couche-Tard Inc. is a leading convenience store operator in Canada, with Couche-Tard stores in Quebec and Mac's stores in central and western Canada. It also operates Circle K shops in the United States 2017 $27,310.0 22,298.4 4.511.6 3,416.5 14.1 CONSOLIDATED STATEMENTS OF EARNINGS For the years ended April 28, 2019, April 29, 2018, and April 30, 2017 (in willions of U.S. dollars, except pen-share amounts) Revenues 2019 2018 Cost of sales $31,000.0 $30,590.0 26, 282.2 26,182.0 Gross profit 4,767,8 4,408.0 Operating, selling, administrative, and general expenses 3,633.2 3,462.8 Restructuring costs 15.3 62.9 (Goin oss on disposal of property and equipment and other assets (2.6) (18.9) Depreciation, amortization, and impairment of property and equipment, intangible assets and other assets 334.8 318.1 Total operating expenses 260.7 3.824.9 Operating Income 782.4 583.1 Share of earnings of foint ventures and associated companies accounted for using the equity method 00:2 110.1 1012 Net financial expenses 11112 Earnings before income taxes 254.1 5820 220.1 125.5 Income taxes 514.0 3 4539 Net earnings 9.1 281.3 34921.0 790.6 132 109.2 694.6 71.1 6235 Required: Complete the component percentage analysis on the company's statement of earnings that follows (Negative answers should be indicated by a minus sign Round the final answers to 2 decimal places. Percentages may not add exactly due to rounding.) Required: Complete the component percentage analysis on the company's statement of earnings that follows (Negative answers should be indicated by a minus sign. Round the final answers to 2 decimal places, Percentages may not add exactly due to rounding) 2019 2015 2017 CONSOLIDATED STATEMENTS OF EARNINGS For the years ended April 28, 2019. April 29,2018. and April 30, 2017 (in millions of U.S. dollars, except per share amounts) 2013 2018 2017 Revenge $ 31 000 $30 590 0 5 273100 Cost of sales 26,2322 26,182.0 227984 Gross profit 4.7678 44080 45116 Opera selling administrativo, and general expenses 3.633.2 3/4628 3,4165 Restructuring costs 153 62.9 141 Guin) loss on disposal of property and equipment and other set (2.6) (189 19.1 Depreciation amortization and impairment of property and equipment 3346 3181 2813 itong ble assets and other assets 39807 Total operating expenses 3,8249 37210 7871 5831 7906 Operating Income Share of earrings of joint ventures and associated companies accounted 582 1101 for using the equity method 1012 17112 1092 Net finandal expenses 7541 6946 Earings before income taxes 2201 128.5 7111 Income 623 51 5 453 5 5 53405 Net earnings NO 132 582 SU