Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help solution the required rate of return can be computed from 8% plus 1.3 times risk premium 7% (3) Assume that DCM Company is a

help solution

the required rate of return can be computed from

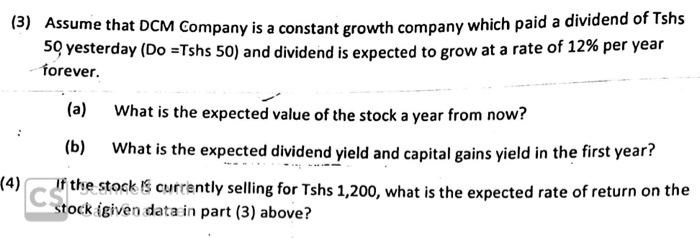

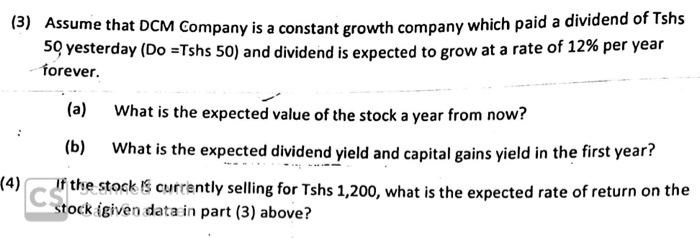

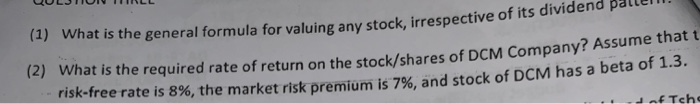

(3) Assume that DCM Company is a constant growth company which pa any is a constant growth company which paid a dividend of Tshs 59 yesterday (Do =Tshs 50) and dividend is expected to grow at a rate of 12% per year forever. (a) What is the expected value of the stock a year from now? (b) What is the expected dividend yield and capital gains yield in the first year? (4) If the stock is currently selling for Tshs 1,200, what is the expected rate of return on the stock (given data in part (3) above? QULJTUN TILL (1) What is the general formula for valuing an is the general formula for valuing any stock, irrespective of its dividend pattern. (2) What is the required rate of return on the stock/shares of DCM Company on the stock/shares of DCM Company? Assume that t risk-free rate is 8%, the market risk premium is 7% and stock of DCM has a beta on of Tche 8% plus 1.3 times risk premium 7%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started