Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help solve for 17&18: The current price of a stock is $59.18 and the annual effective risk-free rate is 3.9 percent. A call option with

help solve for 17&18:

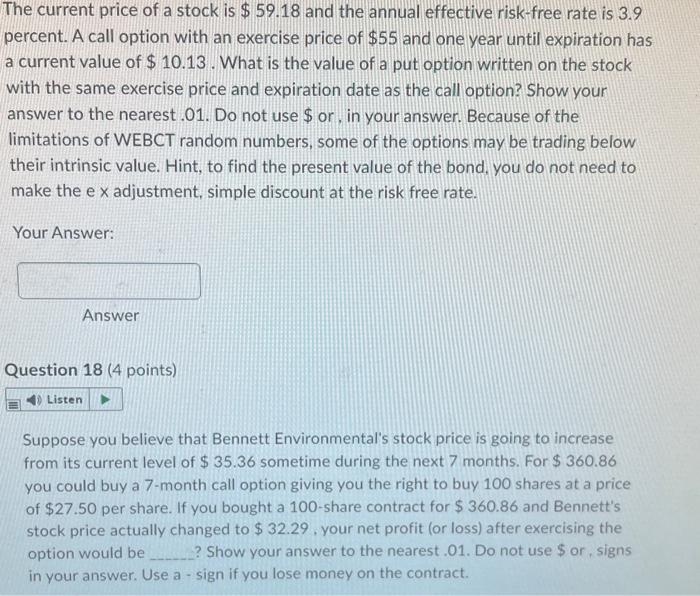

The current price of a stock is \$59.18 and the annual effective risk-free rate is 3.9 percent. A call option with an exercise price of $55 and one year until expiration has a current value of $10.13. What is the value of a put option written on the stock with the same exercise price and expiration date as the call option? Show your answer to the nearest .01. Do not use $ or, in your answer. Because of the limitations of WEBCT random numbers, some of the options may be trading below their intrinsic value. Hint, to find the present value of the bond, you do not need to make the ex adjustment, simple discount at the risk free rate. Your Answer: Answer Question 18 (4 points) Suppose you believe that Bennett Environmental's stock price is going to increase from its current level of $35.36 sometime during the next 7 months. For $360.86 you could buy a 7-month call option giving you the right to buy 100 shares at a price of $27.50 per share. If you bought a 100 -share contract for $360.86 and Bennett's stock price actually changed to $32.29, your net profit (or loss) after exercising the option would be ..... Show your answer to the nearest. 01. Do not use $ or. signs in your answer. Use a - sign if you lose money on the contract

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started