help solve in excel.

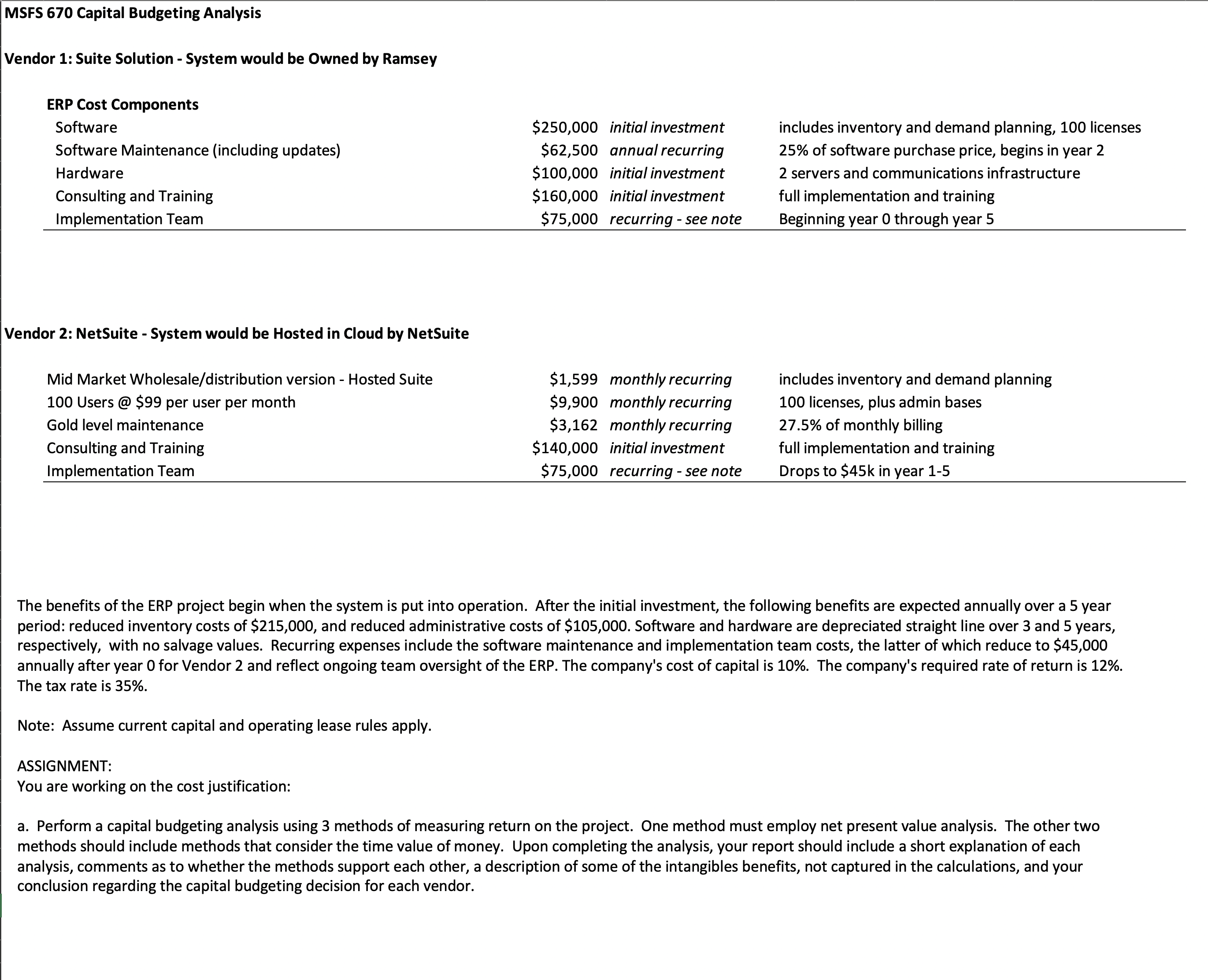

MSFS 670 Capital Budgeting Analysis Vendor 1: Suite Solution - System would be Owned by Ramsey ERP Cost Components Software $250,000 initial investment includes inventory and demand planning, 100 licenses Software Maintenance (including updates) $62,500 annual recurring 25% of software purchase price, begins in year 2 Hardware $100,000 initial investment 2 servers and communications infrastructure Consulting and Training $160,000 initial investment full implementation and training Implementation Team $75,000 recurring - see note Beginning year 0 through year 5 Vendor 2: NetSuite - System would be Hosted in Cloud by NetSuite Mid Market Wholesale/distribution version - Hosted Suite $1,599 monthly recurring includes inventory and demand planning 100 Users @ $99 per user per month $9,900 monthly recurring 100 licenses, plus admin bases Gold level maintenance $3,162 monthly recurring 27.5% of monthly billing Consulting and Training $140,000 initial investment full implementation and training Implementation Team $75,000 recurring - see note Drops to $45k in year 1-5 The benefits ofthe ERP project begin when the system is put into operation. After the initial investment, the following benets are expected annually over a 5 year period: reduced inventory costs of $215,000, and reduced administrative costs of $105,000. Software and hardware are depreciated straight line over 3 and 5 years, respectively, with no salvage values. Recurring expenses include the software maintenance and implementation team costs, the latter of which reduce to $45,000 annually after year 0 for Vendor 2 and reect ongoing team oversight of the ERP. The company's cost of capital is 10%. The company's required rate of return is 12%. The tax rate is 35%. Note: Assume current capital and operating lease rules apply. ASSIGNMENT: You are working on the cost justification: a. Perform a capital budgeting analysis using 3 methods of measuring return on the project. One method must employ net present value analysis. The other two methods should include methods that consider the time value of money. Upon completing the analysis, your report should include a short explanation of each analysis, comments as to whether the methods support each other, a description of some of the intangibles benets, not captured in the calculations, and your conclusion regarding the capital budgeting decision for each vendor