help solving what is wrong

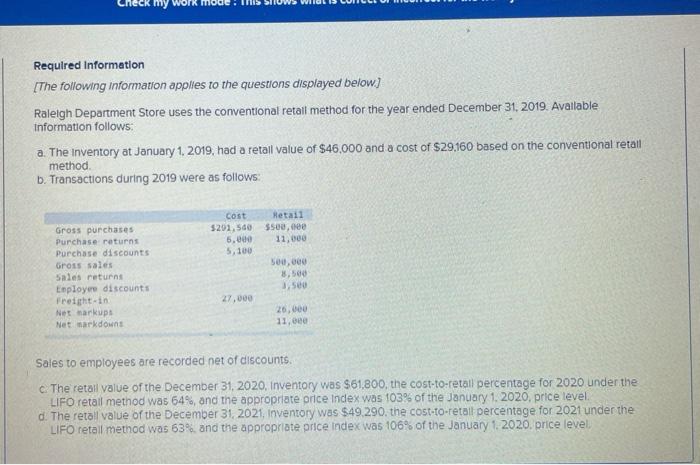

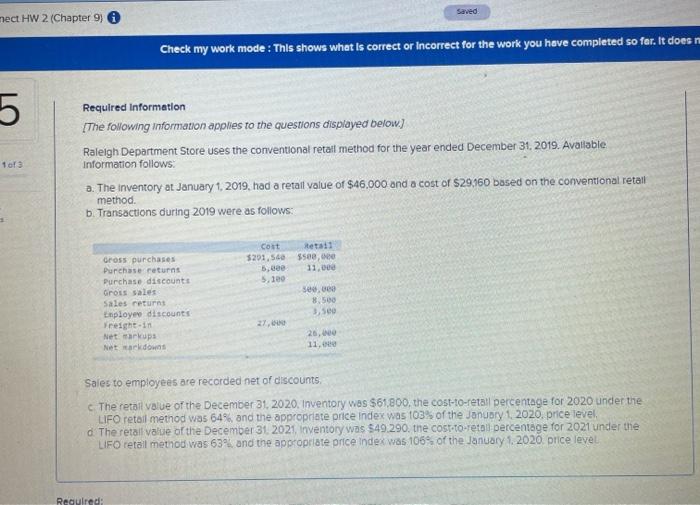

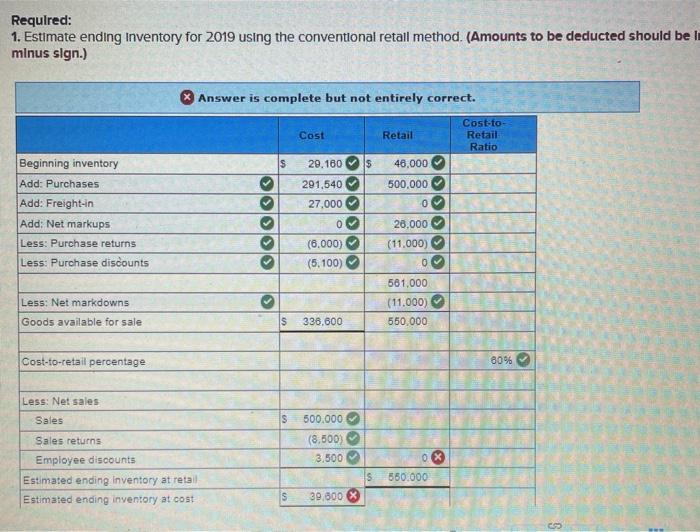

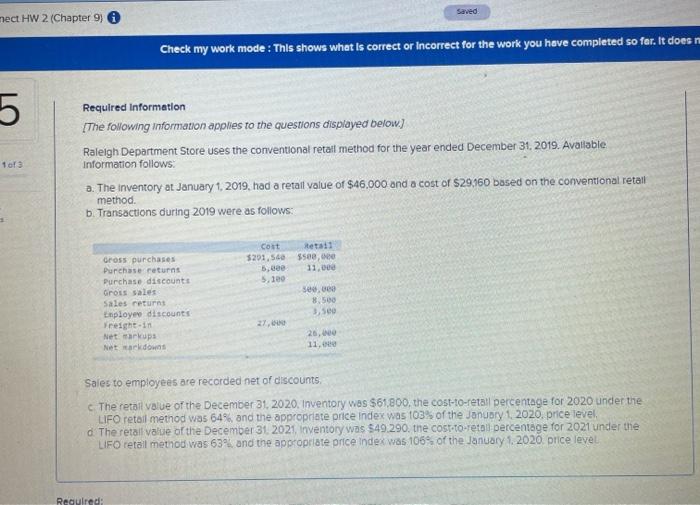

Required: 1. Estimate ending Inventory for 2019 using the conventional retail method. (Amounts to be deducted should be li minus slgn.) Answer is complete but not entirely correct. Cost Retail Cost-to- Retail Ratio IS 20.160 $ Beginning inventory Add: Purchases Add: Freight-in Add: Net markups Less: Purchase returns Less: Purchase discounts OO 291.540 27,000 0 (6.000) (5,100) 46,000 500,000 0 20.000 (11.000) 0 OOO OOOOO > Less: Net markdowns Goods available for sale 561,000 (11.000) 550.000 S 338.600 > Cost-to-retail percentage 80% Less: Net sales S 500.000 (8,500) >$ Sales Sales returns Employee discounts Estimated ending Inventory at retail Estimated ending inventory at cost 3.500 0 % $ 550.000 s 39.800 saved nect HW 2 (Chapter 9) Check my work mode: This shows what is correct or Incorrect for the work you have completed so far. It does 5 tor Required Information The following information applies to the questions displayed below) Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available Information follows a. The inventory at January 1, 2019, had a retall value of $46,000 and a cost of $29,160 based on the conventional retail method b. Transactions during 2019 were as follows: Cost $201.540 etsii $500,00 11.00 5. Bee 5.10 Gross purchases Purchase returns Purchase discounts Gros Sales Sales returns Employee discounts Freight-in Net markups Netsarkdowns S. 8.500 3.500 27,00 26.00 11. Sales to employees are recorded niet of discounts c The retall value of the December 31, 2020. Inventory was $61,800, the cost-10-retall percentage for 2020 under the LIFO retail method was 64% and the appropriate price index was 103% of the Janubry 1 2020, price level, . The retail value of the December 31 2021. Inventory was $49.290, the cost to-retall percentage for 2021 under the LIFO retail method was 63% and the appropriate price index was 106% of the January 1, 2020 price level Required: my WW Required Information [The following information applies to the questions displayed below) Raleigh Department Store uses the conventional retail method for the year ended December 31, 2019. Available Information follows: a The Inventory at January 1, 2019, had a retail value of $46,000 and a cost of $29,160 based on the conventional retail method. b. Transactions during 2019 were as follows: cost 5201,500 5.000 5.100 Retail $500, 11,000 Gross purchases Purchase returns Purchase discounts Gris Sales Sales returns Employee discounts Freight in Net narkups Netmarkdown 500,000 8.500 3.500 27,000 20,000 11,000 Sales to employees are recorded net of discounts. c The retail value of the December 31, 2020, Inventory was $61,800, the cost-to-retall percentage for 2020 under the LIFO retail method was 64%, and the appropriate orice Index was 103% of the January 1, 2020, price level. d. The retall value of the December 31, 2021, Inventory was $49.290, the cost-to-retail percentage for 2021 under the LIFO retall method was 63%, and the appropriate price index was 106% of the January 1, 2020. price level

help solving what is wrong

help solving what is wrong