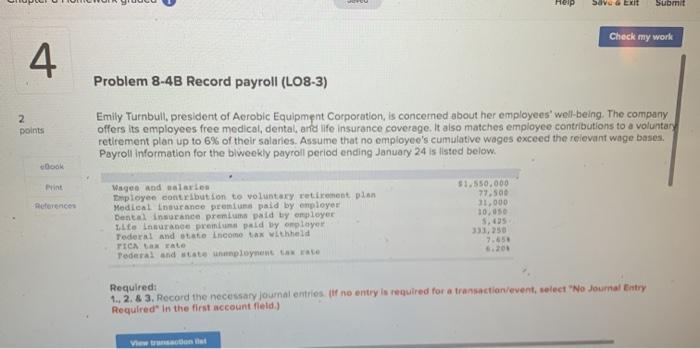

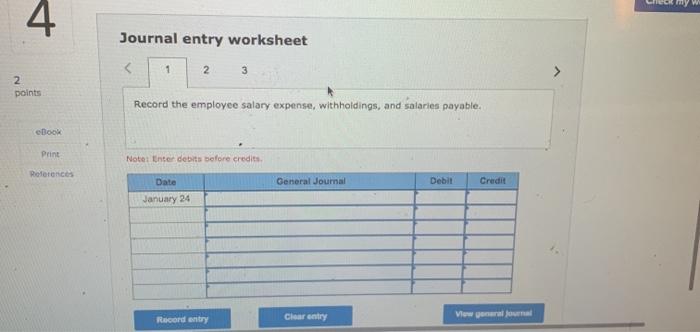

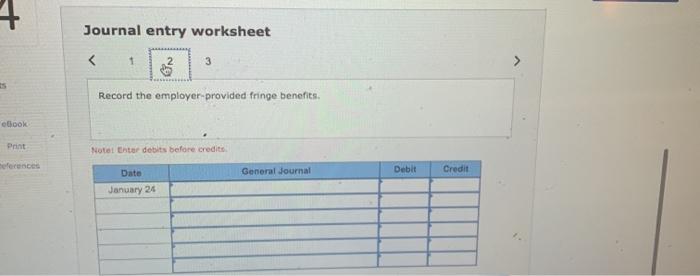

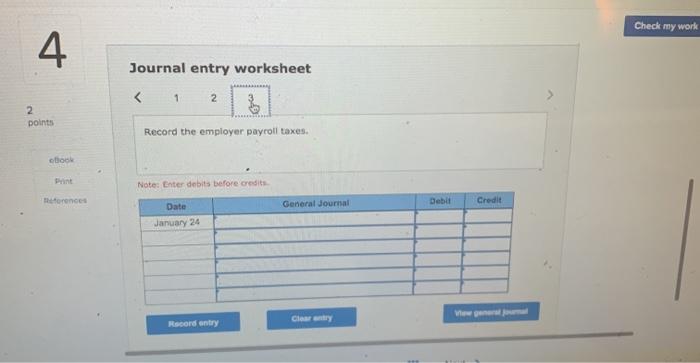

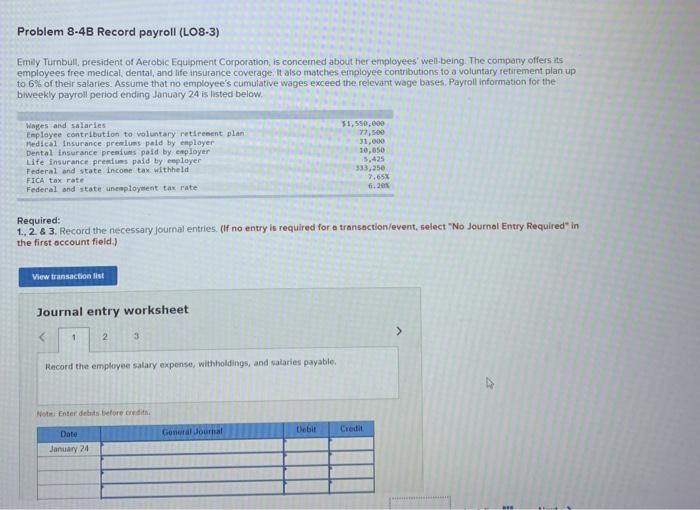

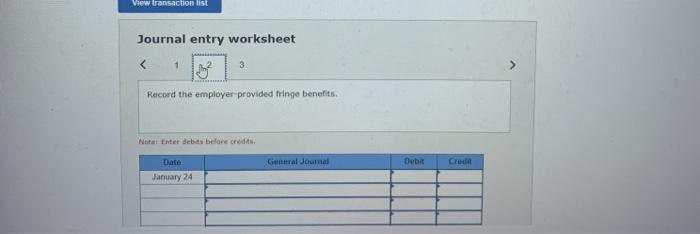

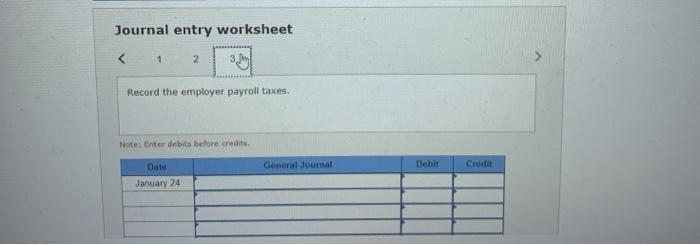

Help Sove EXIT Submit Check my work 4. Problem 8-4B Record payroll (LO8-3) 2 points Emily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees' well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a voluntary retirement plan up to 6% of their salaries. Assume that no employee's cumulative wages exceed the relevant wage bases, Payroll Information for the biweekly payroll period ending January 24 is listed below. ook Print $1.550.000 77.500 31,000 References Wages and salaries imployee contribution to voluntary retirement plan Medical insurance promuns paid by employer Dental Insurance premium paid by employee Lito Insurance premium paid by employer Tederal and state income tax withheld TICA Lax rate Tederal and state planetarate 5.45 333,250 Required: 1., 2. & 3. Record the necessary journal entries. If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) 4 Journal entry worksheet 1 2 3 2 points Record the employee salary expense, withholdings, and salaries payable. ebook Print Note: Enter debits before credits References Date General Journal Debit Credit January 24 Record entry Clear entry View all Journal entry worksheet 3 Record the employer-provided fringe benefits. book Print Note Entor debts before credite eferences Date General Journal Debit Credit January 24 Problem 8-4B Record payroll (LO8-3) Emily Turnbull, president of Aerobic Equipment Corporation, is concerned about her employees' well-being. The company offers its employees free medical, dental, and life insurance coverage. It also matches employee contributions to a voluntary retirement plan up to 6% of their salaries. Assume that no employee's cumulative wages exceed the relevant wage bases, Payroll information for the biweekly payroll period ending January 24 is listed below. Wages and salaries Employee contribution to voluntary retirement plan Medical Insurance preluns paid by employer Dental insurance presius paid by employer Life insurance premium paid by employer Federal and state income tax withheld FICA tax rate Federal and state unemployment tax rate 31,550.000 77,500 31,000 10,050 5.425 333,250 7.65% fi. 201 Required: 1., 2. & 3. Record the necessary Journal entries. (If no entry is required for a transaction/event, select "No Journal Entry Required in the first account field.) View transaction list Journal entry worksheet > 1 2 3 Record the employee salary expense, withholdings, and salaries payable Not Enter debts before credit General Journal Debit Credit Date January 24 BE View transaction list Journal entry worksheet