help

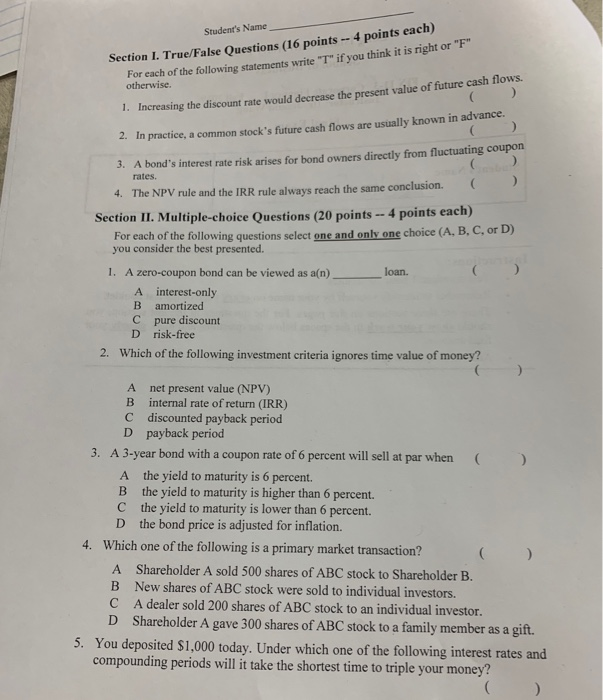

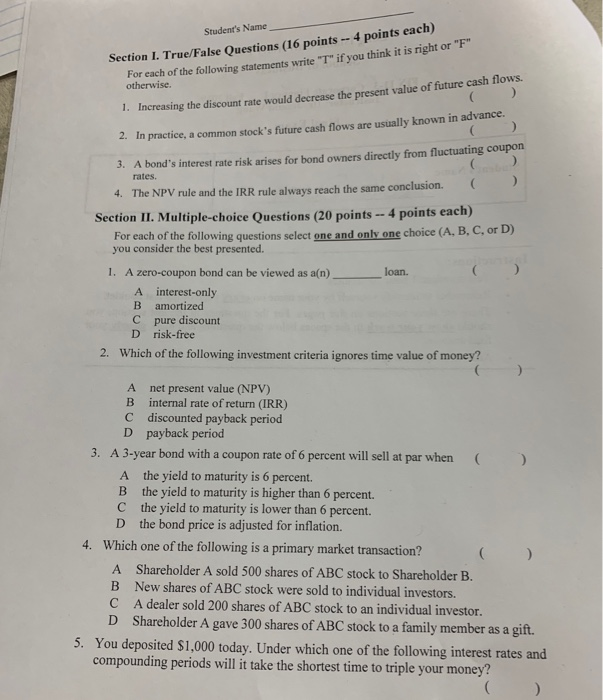

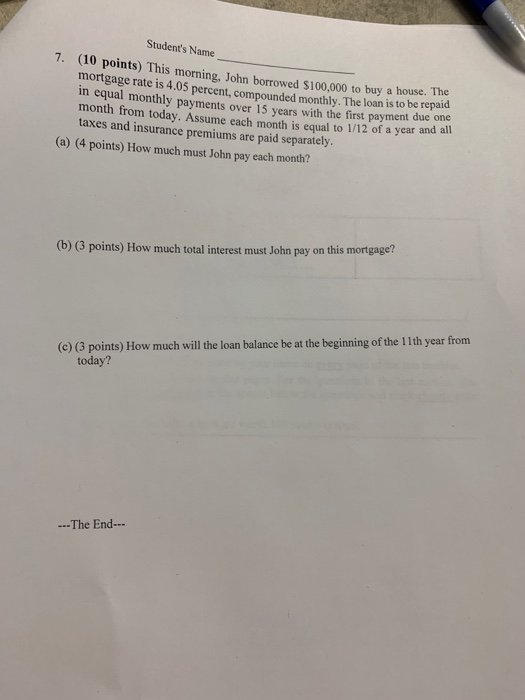

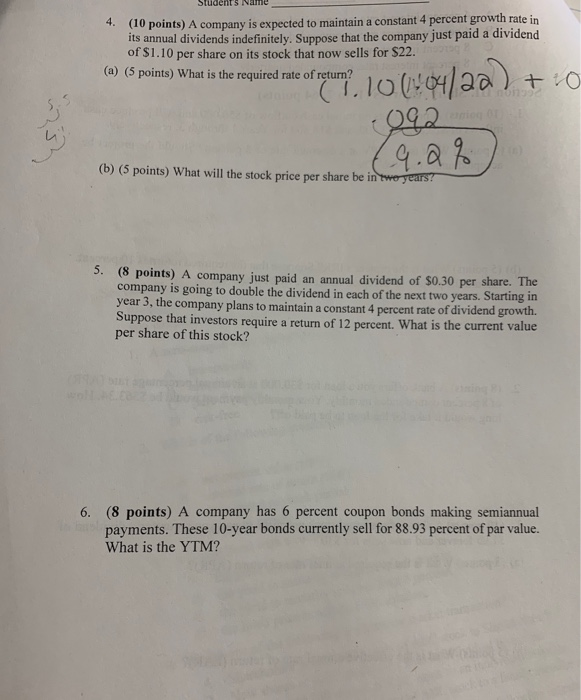

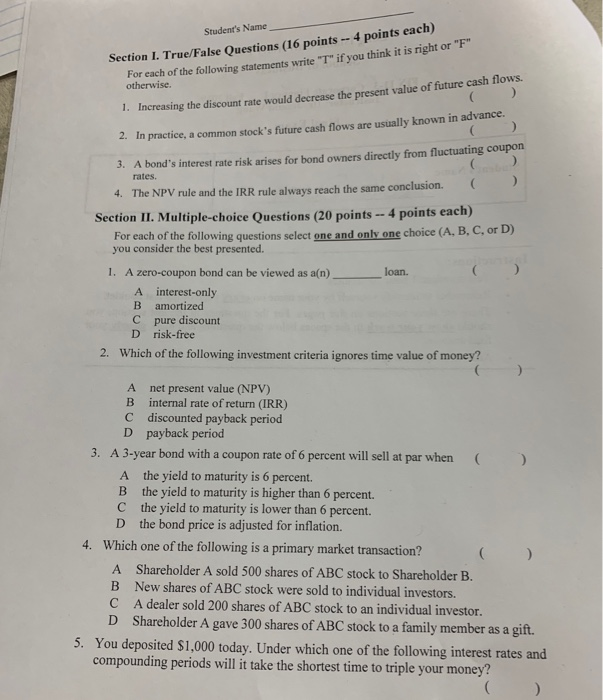

Student's Name Section I. True/False Questions (16 points -- 4 points each) For each of the following statements write "T" if you think it is right or "F otherwise. 1. Increasing the discount rate would decrease the present value of future cash flows. 2. In practice, a common stock's future cash flows are usually known in advance. 3. A bond's interest rate risk arises for bond owners directly from fluctuating coupon rates. 4. The NPV rule and the IRR rule always reach the same conclusion. C ) Section II. Multiple-choice Questions (20 points -- 4 points each) For each of the following questions select one and only one choice (A, B, C, or D) you consider the best presented. 1. A zero-coupon bond can be viewed as a(n) loan. A interest-only B amortized C pure discount D risk-free 2. Which of the following investment criteria ignores time value of money? A net present value (NPV) B internal rate of return (IRR) C discounted payback period D payback period 3. A 3-year bond with a coupon rate of 6 percent will sell at par when C ). A the yield to maturity is 6 percent. B the yield to maturity is higher than 6 percent. C the yield to maturity is lower than 6 percent. D the bond price is adjusted for inflation. 4. Which one of the following is a primary market transaction? A Shareholder A sold 500 shares of ABC stock to Shareholder B. B New shares of ABC stock were sold to individual investors. C A dealer sold 200 shares of ABC stock to an individual investor. D Shareholder A gave 300 shares of ABC stock to a family member as a gift. 5. You deposited $1,000 today. Under which one of the following interest rates and compounding periods will it take the shortest time to triple your money? Student's Name 7. (10 points) This morning, John borrowed $100,000 to buy a house. The mortgage rate is 4.05 percent, compounded monthly. The loan is to be repaid hly payments over 15 years with the first payment due one month from today. Assume each month is equal to 1/12 of a year and all taxes and insurance premiums are paid separately. (a) (4 points) How much must John pay each month? in equal monthly na percent, compounded 100,000 to buy a house. The (b) (3 points) How much total interest must John pay on this mortgage? (C) (3 points) How much will the loan balance be at the beginning of the 11th year from today? ---The End- Students Name 4. (10 points) A company is expected to maintain a constant 4 percent growth rate in its annual dividends indefinitely. Suppose that the company just paid a dividend of $1.10 per share on its stock that now sells for $22. (a) (5 points) What is the required rate of return? (7.10(1404/2a) + 092 (9.2%) (b) (5 points) What will the stock price per share be in two years? 5. (8 points) A company just paid an annual dividend of $0.30 per share. The company is going to double the dividend in each of the next two years. Starting in year 3, the company plans to maintain a constant 4 percent rate of dividend growth. Suppose that investors require a return of 12 percent. What is the current value per share of this stock? 6. (8 points) A company has 6 percent coupon bonds making semiannual payments. These 10-year bonds currently sell for 88.93 percent of par value. What is the YTM