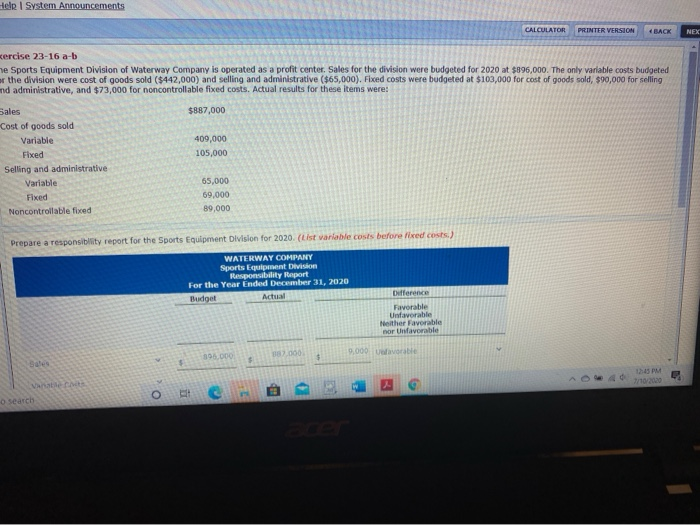

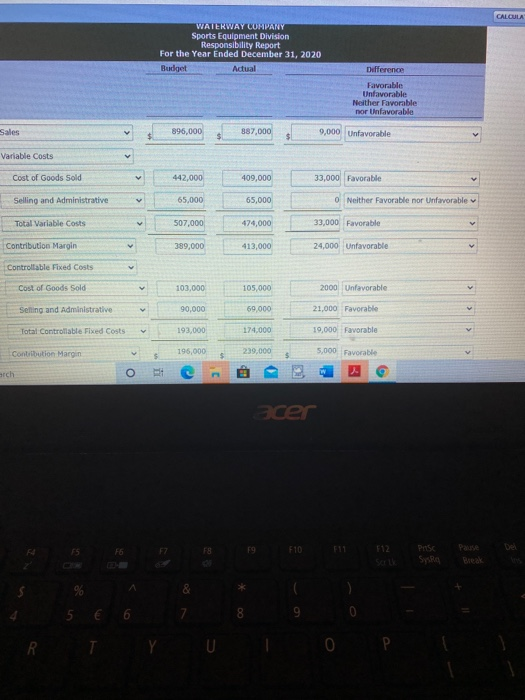

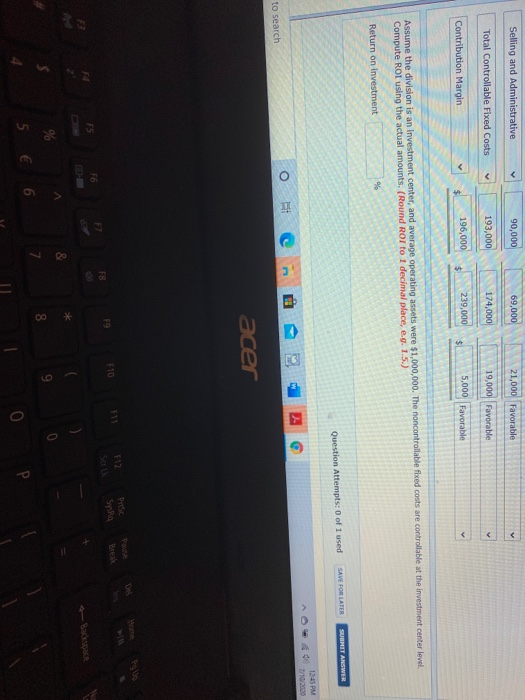

Help System Announcements CALCULATOR PRINTER VERSION 4 ACR NEX kercise 23-16 a-b ne Sports Equipment Division of Waterway Company is operated as a profit center. Sales for the division were budgeted for 2020 at $896,000. The only variable costs budgeted the division were cost of goods sold ($442,000) and selling and administrative ($65,000). Fixed costs were budgeted at $103,000 for cost of goods sold, $90,000 for selling md administrative, and $73,000 for noncontrollable fixed costs. Actual results for these items were: $887,000 409,000 105,000 Sales Cost of goods sold Variable Fixed Selling and administrative Variable Fixed Noncontrollable fixed 65,000 69.000 89,000 Prepare a responsibility report for the Sports Equipment Division for 2020. (List variable costs before fixed costs.) WATERWAY COMPANY Sports Equipment Division Responsibility Report For the Year Ended December 31, 2020 Budget Actual Difference Favorable Unfavorable Neither Favorable nor Unfavorable 395.000 000 9,000 lavorable $ $ Sales d a O search CALCULA WATERWAY COMPANY Sports Equipment Division Responsibility Report For the Year Ended December 31, 2020 Budget Actual Difference Favorable Unfavorable Neither Favorable nor Unfavorable Sales 895,000 887,000 9,000 Unfavorable Variable costs Cost of Goods Sold 442,000 409,000 33,000 Favorable Selling and Administrative 65,000 65,000 0 Neither Favorable nor Unfavorable Total Variable costs v 507,000 474,000 33,000 Favorable Contribution Margin 389,000 413,000 24,000 Unfavorable Controllable Fixed Costs Cost of Goods Sold 103,000 105,000 2000 Unfavorable Selting and Administrative 90,000 69,000 21,000 Favorable > > > > Total Controllable Fixed Costs y 193,000 174,000 19,000 Favorable 195,000 Contribution Margin 239,000 $ 5.000 Favorable o acer 54 ES F6 78 F9 F10 512 Del Piase Break 5 6 9 R. 0 Selling and Administrative 90,000 69,000 21,000 Favorable Total Controllable Fixed Costs 193,000 174,000 19,000 Favorable 239,000 Contribution Margin 196,000 $ 5,000 Favorable Assume the division is an Investment center, and average operating assets were $1,000,000. The noncontrollable fixed costs are controllable at the investment center level. Compute ROI using the actual amounts. (Round ROI to I decimal place, e.g. 1.5.) Return on investment SAVE FOR LATER SUBMIT ANSWER Question Attempts: 0 of 1 used 7/10/2020 O DE C to search acer F10 Systra FB FS F6 A % 5 E 6