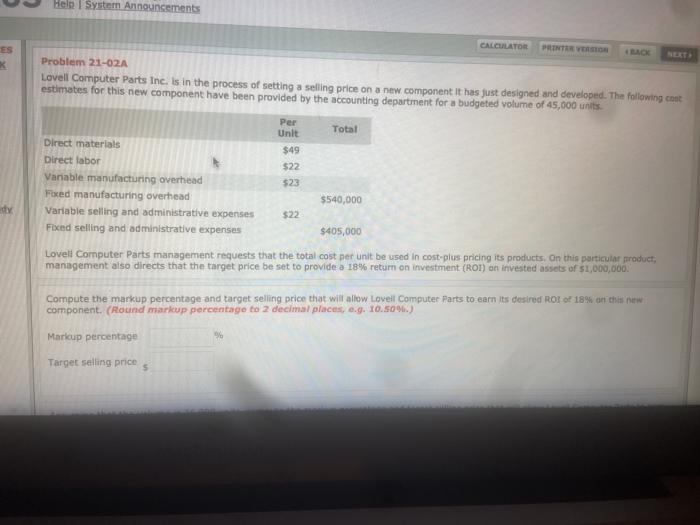

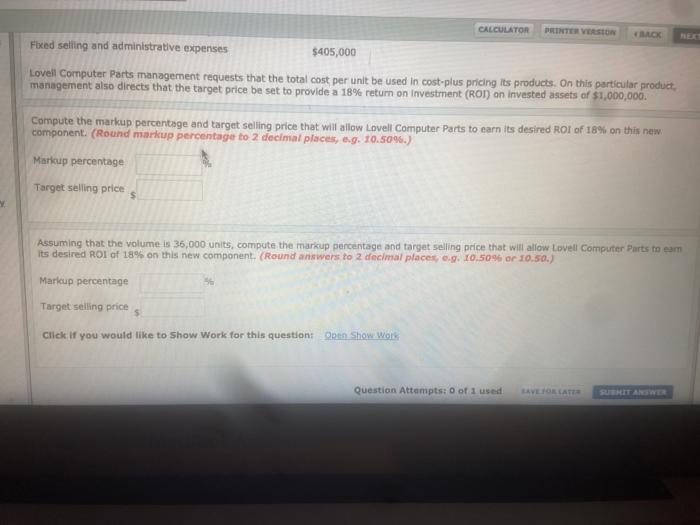

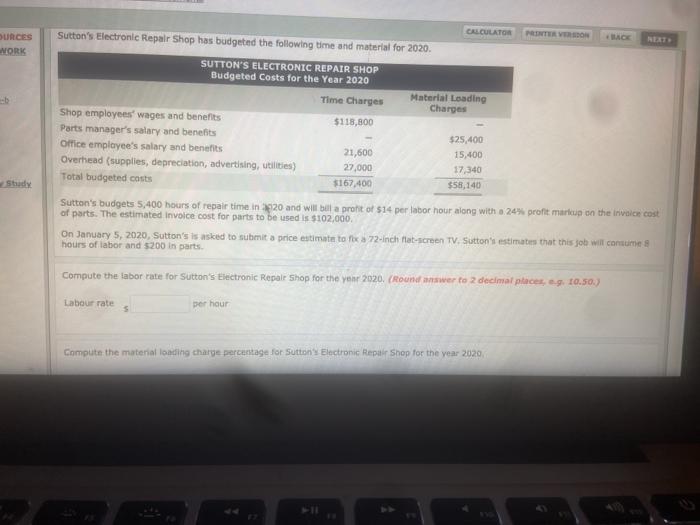

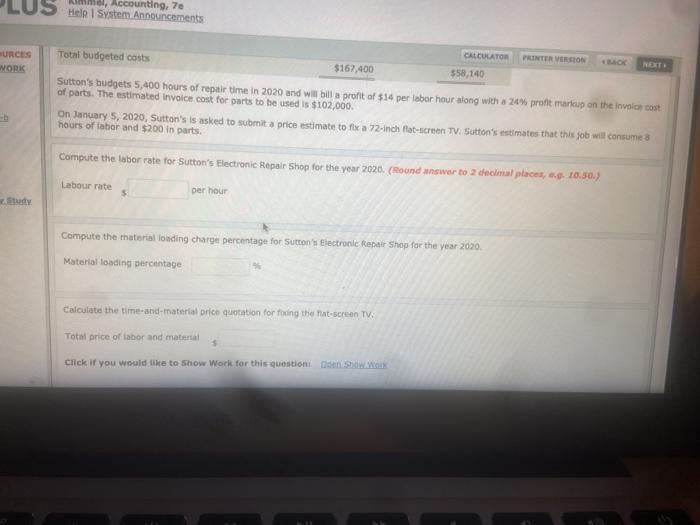

Help System Announcements ES CALCULATOR PRINTER VOOR Problem 21-02A Lovell Computer Parts Inc. is in the process of setting a selling price on a new component It has just designed and developed. The following cont estimates for this new component have been provided by the accounting department for a budgeted volume of 45,000 units. Per Unit Total Direct materials $49 Direct labor $22 Variable manufacturing overhead $23 Fixed manufacturing overhead $540,000 Variable selling and administrative expenses $22 Fixed selling and administrative expenses $405,000 Lovell Computer Parts management requests that the total cost per unit be used in cost-plus pricing its products. On this particular product, management also directs that the target price be set to provide a 18% return on investment (ROI) on invested assets of $1,000,000 Compute the markup percentage and target selling price that will allow Lovel Computer Parts to earn its desired ROI of 18 an this new component. (Round markup percentage to 2 decimal places, e.g. 10.50%) Markup percentage Target selling price S CALCULATOR PRINTER VEST Fixed selling and administrative expenses $405,000 Lovell Computer Parts management requests that the total cost per unit be used in cost-plus pricing its products. On this particular product management also directs that the target price be set to provide a 18% return on investment (ROI) an invested assets of $1,000,000. Compute the markup percentage and target selling price that will allow Lovell Computer Parts to earn its desired ROI of 18% on this new component. (Round markup percentage to 2 decimal places, e.g. 10.509.) Maricup percentage Target selling price $ Assuming that the volume is 36,000 units, compute the markup percentage and target selling price that will allow Lovell Computer Parts to sam its desired ROI of 18% on this new component. (Round answers to 2 decimal places. c.9. 10.50% or 10.50.) Markup percentage Target selling price S Click If you would like to show Work for this question Open Show Work Question Attempts: 0 of 1 used CALCULATOR Sutton's Electronic Repair Shop has budgeted the following time and material for 2020. PINTU VERON OURCES NORK CRACK Material Loading Charges SUTTON'S ELECTRONIC REPAIR SHOP Budgeted Costs for the Year 2020 Time Charges Shop employees' wages and benefits $118,800 Parts manager's salary and benefits Office employee's salary and benefits 21,600 Overhead (supplies, depreciation, advertising, utilities) 27,000 Total budgeted costs $167.400 $25,400 15,400 17,340 $58,140 Study Sutton's budgets 5,400 hours of repair time in 1920 and will bell a profit of 514 per labor hour along with a 24% profit mark on the invoice cost of parts. The estimated Invoice cost for parts to be used is $102,000. On January 5, 2020, Sutton's is asked to submit a price estimate to foc a 72-inch flat-screen TV. Sutton's estimates that this job will costumes hours of labor and $200 in parts Compute the labor rate for Sutton's Electronic Repair Shop for the year 2020. Round answer to 2 decimal places, s. 10.50.) Labour rate per hour Compute the material loading charge percentage for Sutton Electronic Repair Shop for the year 2020 Accounting, 70 Help System Announcements URCES WORK Total budgeted costs PRINTER VERSION $167,400 CALCULATOR 558,140 Sutton's budgets 5,400 hours of repair time in 2020 and will bill a profit of $14 per labor hour along with a 24% profit markup on the invoice cost of parts. The estimated Invoice cost for parts to be used is $102,000 On January 5, 2020, Sutton's is asked to submit a price estimate to fix a 72-Inch flat-screen TV. Sutton's estimates that this job will consume & hours of labor and $200 in parts Compute the labor rate for Sutton's Electronic Repair Shop for the year 2020. (Round answer to 2 decimal places, s. 10.30.) Labour rate per hour Study Compute the material loading charge percentage for Sutton's Electronic Repair Shop for the year 2020 Material loading percentage Calculate the time and material price quotation for fosing the flat-screen TV Total price of labor and material Click if you would like to show Work for this questions On Way