Answered step by step

Verified Expert Solution

Question

1 Approved Answer

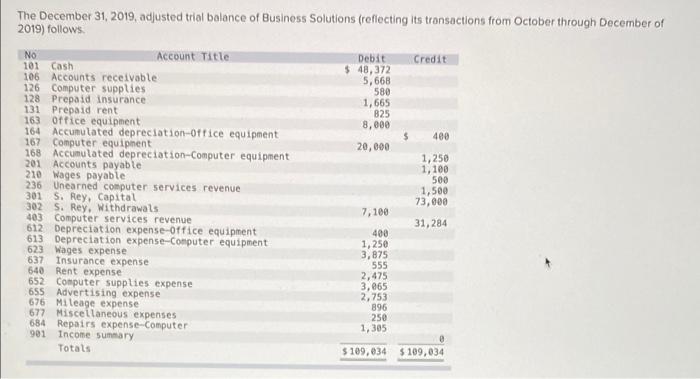

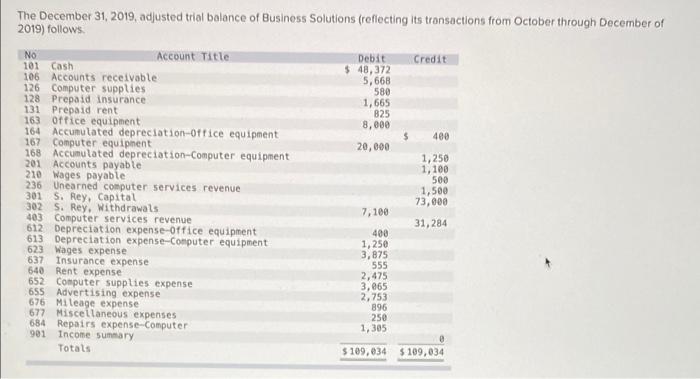

help The December 31, 2019, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2019) follows. No Account Title Debit

help

The December 31, 2019, adjusted trial balance of Business Solutions (reflecting its transactions from October through December of 2019) follows. No Account Title Debit Credit 101 Cash 106 Accounts receivable 126 Computer supplies 128 Prepaid insurance. 131 Prepaid rent 163 Office equipment. 400 164 Accumulated depreciation-Office equipment Computer equipment 167 168 Accumulated depreciation-Computer equipment 201 1,250 Accounts payable 1,100 210 Wages payable 500 236 Unearned computer services revenue 301 S. Rey, Capital 1,500 73,000 302 S. Rey, Withdrawals 403 Computer services revenue 31,284 612 Depreciation expense-Office equipment 613 Depreciation expense-Computer equipment 623 Wages expense 637 Insurance expense 640 Rent expense 652 Computer supplies expense 655 Advertising expense 676 Mileage expense 677 Miscellaneous expenses 684 Repairs expense-Computer 901 Income summary Totals $ 48,372 5,668 580 1,665 825 8,000 20,000 7,100 400 1,250 3,875 555 2,475 3,065 2,753 896 250 1,305 $109,034 $109,034 Totals Required: 1. Record the closing entries as of December 31, 2019. 2. Prepare a post-closing trial balance as of December 31, 2019. $ 109,0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started