Answered step by step

Verified Expert Solution

Question

1 Approved Answer

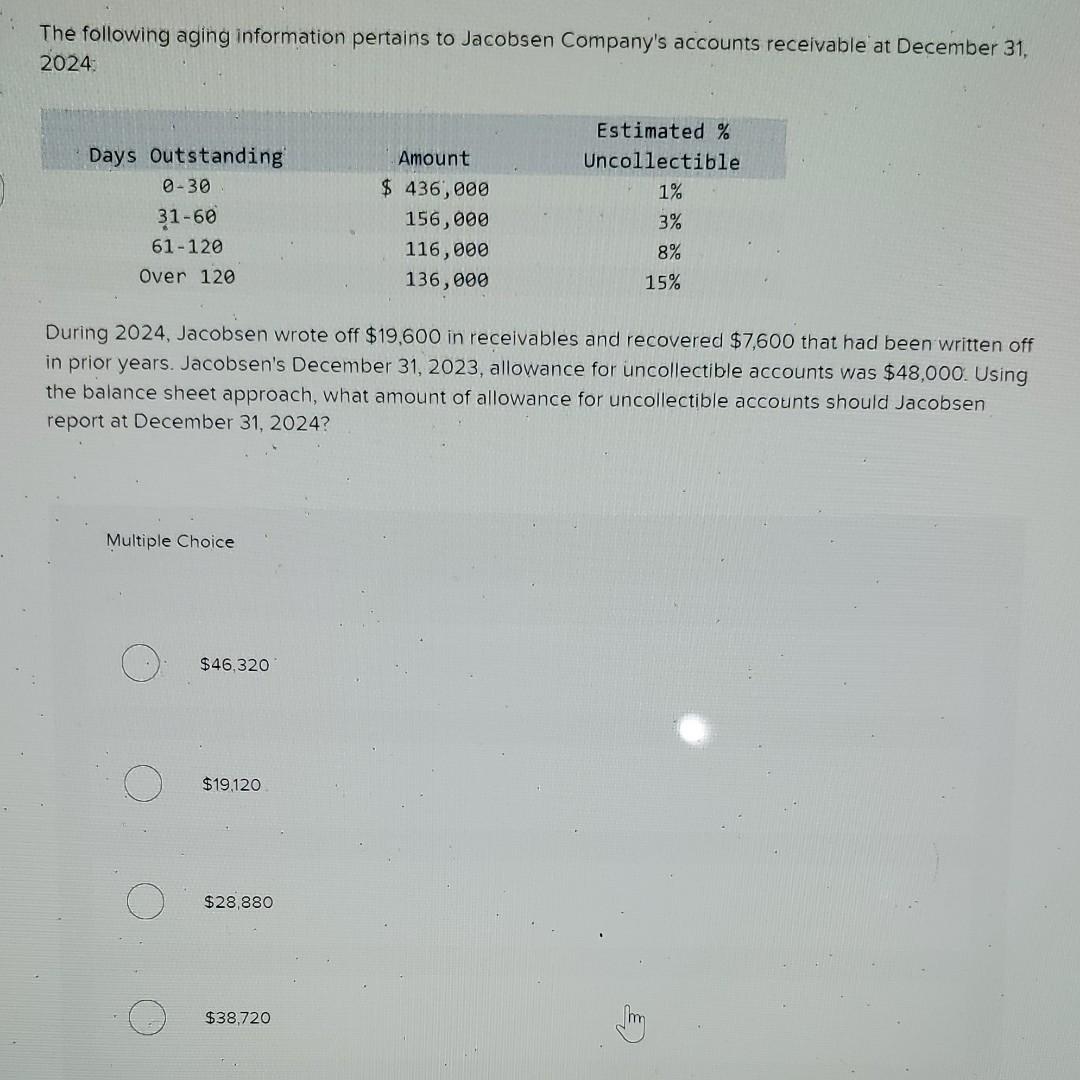

help The following aging information pertains to Jacobsen Company's accounts receivable at December 31 , 2024 During 2024 , Jacobsen wrote off $19,600 in receivables

help

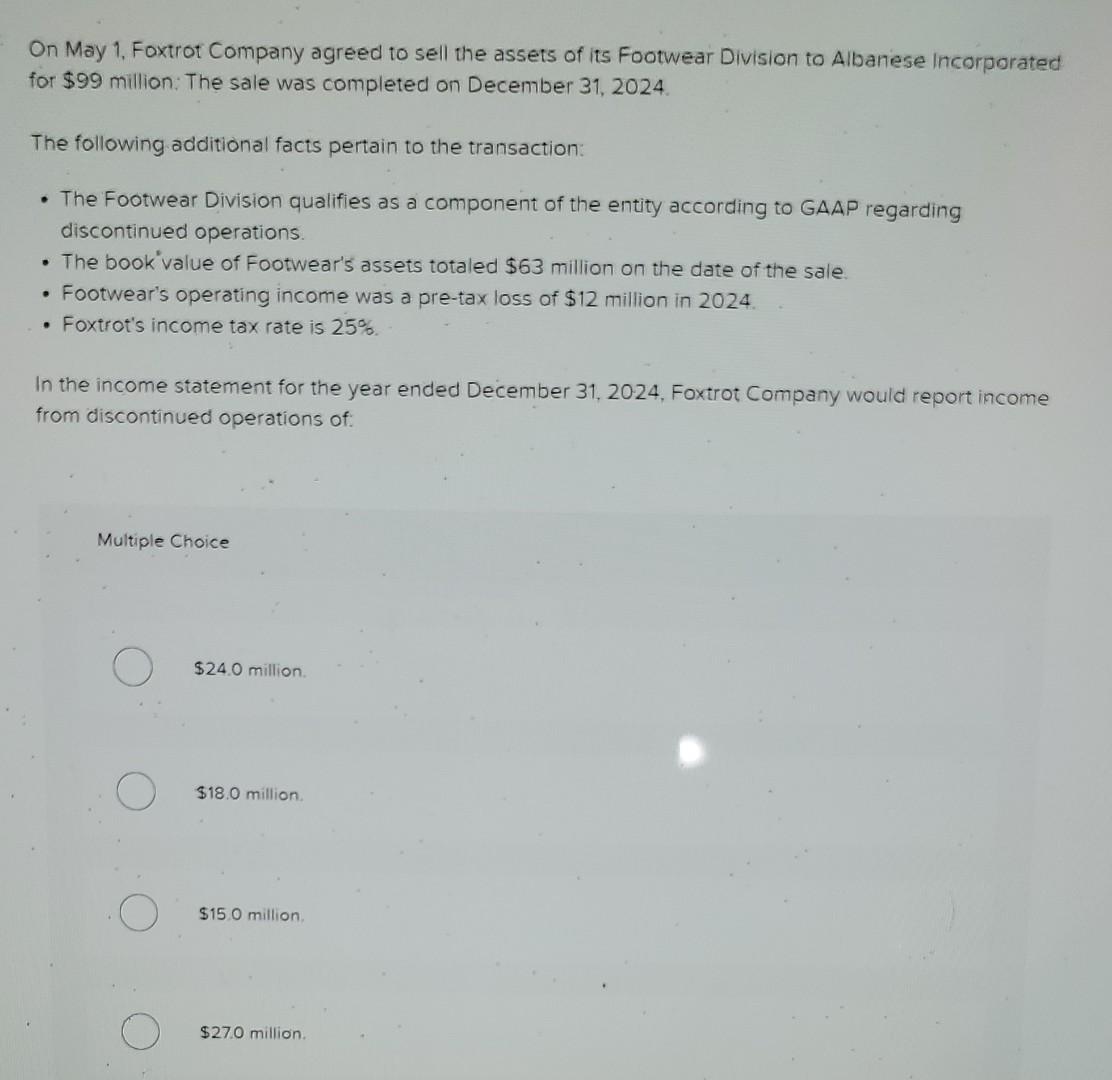

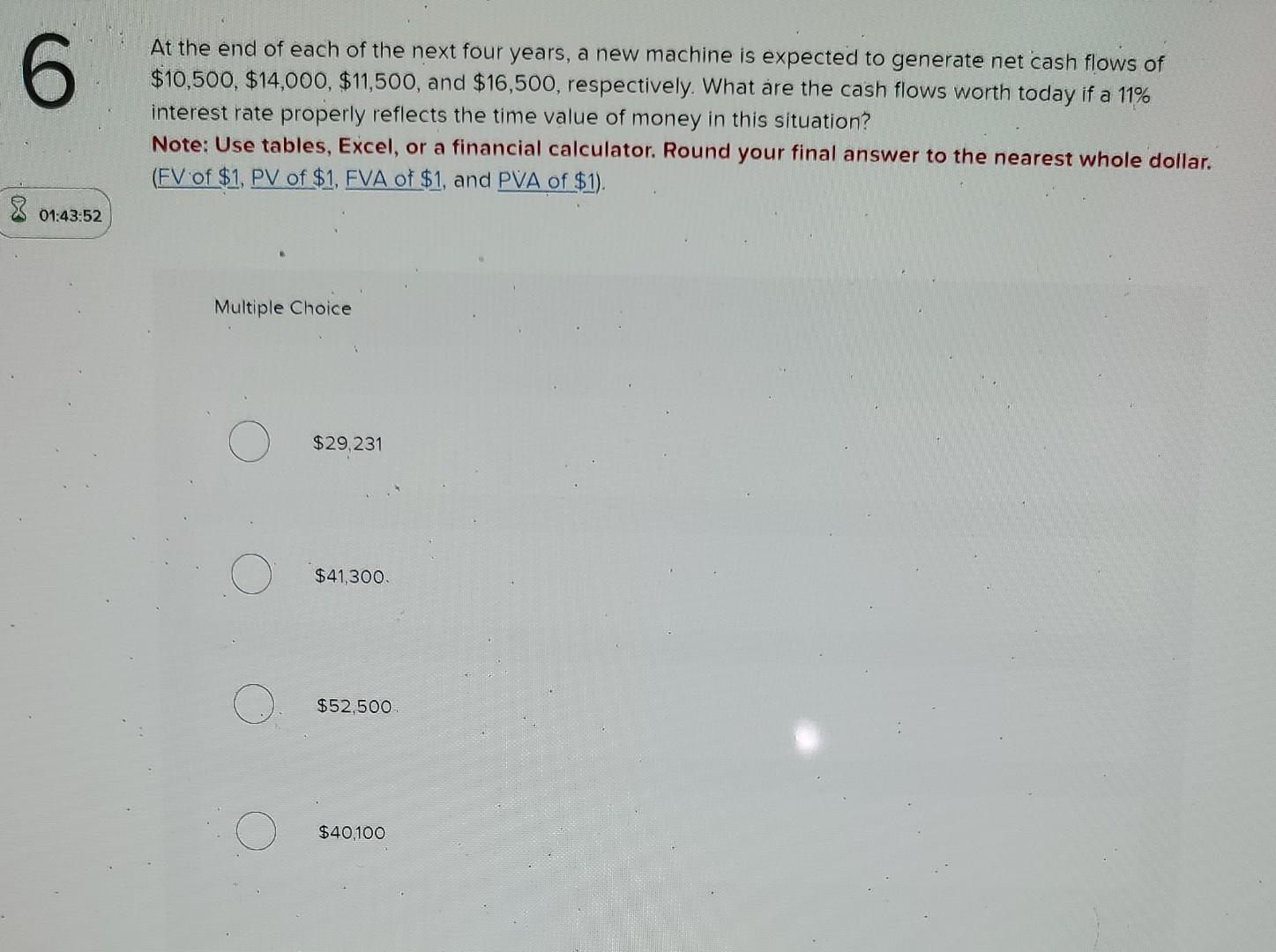

The following aging information pertains to Jacobsen Company's accounts receivable at December 31 , 2024 During 2024 , Jacobsen wrote off $19,600 in receivables and recovered $7,600 that had been written off in prior years. Jacobsen's December 31,2023 , allowance for uncollectible accounts was $48,000. Using the balance sheet approach, what amount of allowance for uncollectible accounts should Jacobsen report at December 31,2024 ? Multiple Choice $46,320 $19.120 $28,880 $38,720 On May 1. Foxtrot Company agreed to sell the assets of its Footwear Division to Albanese Incorporated for $99 million: The sale was completed on December 31, 2024 . The following additional facts pertain to the transaction: - The Footwear Division qualifies as a component of the entity according to GAAP regarding discontinued operations. - The book'value of Footwear's assets totaled $63 million on the date of the sale. - Footwear's operating income was a pre-tax loss of $12 million in 2024. - Foxtrot's income tax rate is 25%. In the income statement for the year ended December 31, 2024, Foxtrot Company would report income from discontinued operations of: Multiple Choice $24.0 million. \$18.0 million. \$15.0 million. $27.0 million. At the end of each of the next four years, a new machine is expected to generate net cash flows of $10,500,$14,000,$11,500, and $16,500, respectively. What are the cash flows worth today if a 11% interest rate properly reflects the time value of money in this situation? Note: Use tables, Excel, or a financial calculator. Round your final answer to the nearest whole dollar. (FV of $1,PV of $1, FVA of $1, and PVA of $1 ). Multiple Choice $29,231 $41,300. $52,500 $40,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started