Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help The following transactions relate to the city of Monticello for the fiscal year ended June 30, 2021. 1. The city established a Central Supplies

help

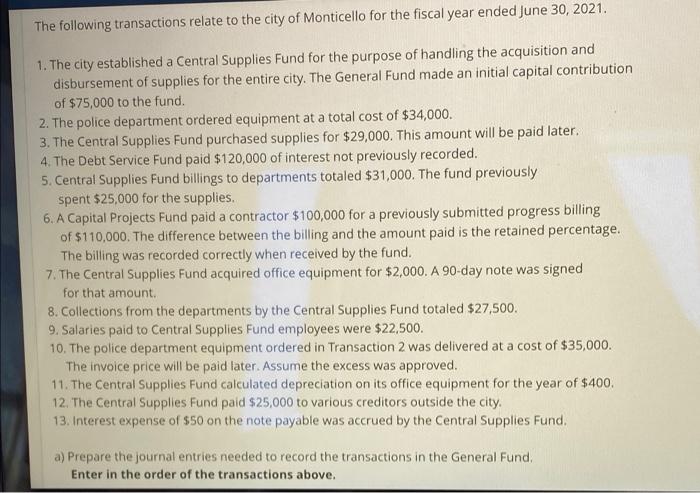

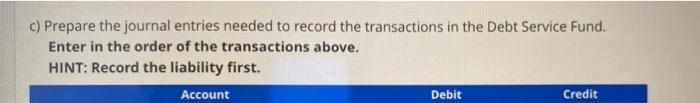

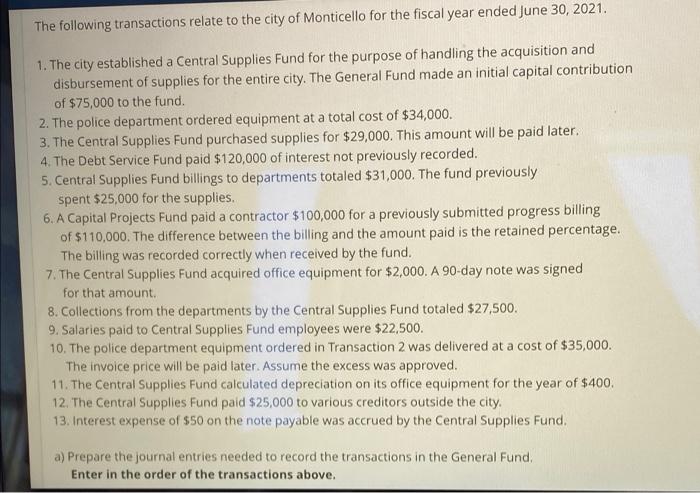

The following transactions relate to the city of Monticello for the fiscal year ended June 30, 2021. 1. The city established a Central Supplies Fund for the purpose of handling the acquisition and disbursement of supplies for the entire city. The General Fund made an initial capital contribution of $75,000 to the fund. 2. The police department ordered equipment at a total cost of $34,000. 3. The Central Supplies Fund purchased supplies for $29,000. This amount will be paid later. 4. The Debt Service Fund paid $120,000 of interest not previously recorded. 5. Central Supplies Fund billings to departments totaled $31,000. The fund previously spent $25,000 for the supplies. 6. A Capital Projects Fund paid a contractor $100,000 for a previously submitted progress billing of $110,000. The difference between the billing and the amount paid is the retained percentage. The billing was recorded correctly when received by the fund. 7. The Central Supplies Fund acquired office equipment for $2,000. A 90-day note was signed for that amount 8. Collections from the departments by the Central Supplies Fund totaled $27,500. 9. Salaries paid to Central Supplies Fund employees were $22,500. 10. The police department equipment ordered in Transaction 2 was delivered at a cost of $35,000. The invoice price will be paid later. Assume the excess was approved. 11. The Central Supplies Fund calculated depreciation on its office equipment for the year of $400. 12. The Central Supplies Fund paid $25,000 to various creditors outside the city. 13. Interest expense of $50 on the note payable was accrued by the Central Supplies Fund. a) Prepare the journal entries needed to record the transactions in the General Fund, Enter in the order of the transactions above. b) Prepare the journal entries needed to record the transactions in the Central Supplies Fund. Enter in the order of the transactions above. c) Prepare the journal entries needed to record the transactions in the Debt Service Fund. Enter in the order of the transactions above. HINT: Record the liability first. Account Debit Credit d) Prepare the journal entry needed to record the transactions in the Capital Projects Fund. Enter in the order of the transactions above. e) Prepare the statement of revenues, expenses, and changes in fund net position for the Central Supplies Fund for the year ended June 30, 2021. Enter operating expenses in order of magnitude (largest to smallest amounts). City of Monticello Central Supplies Internal Service Fund Statement of Revenues, Expenses, and Changes in Fund Net Position For the Year Ended June 30, 2021 f) Prepare the statement of net position for the Central Supplies Fund at June 30,2021. Enter all amounts as positive numbers. City of Monticello Central Supplies Internal Service Fund Statement of Net Position June 30, 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started