Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help to solve this question fast!!! RVX engages in the manufacturing, distribution and sales of automobiles. Using the income statement for RVX analyze their gross,

Help to solve this question fast!!!

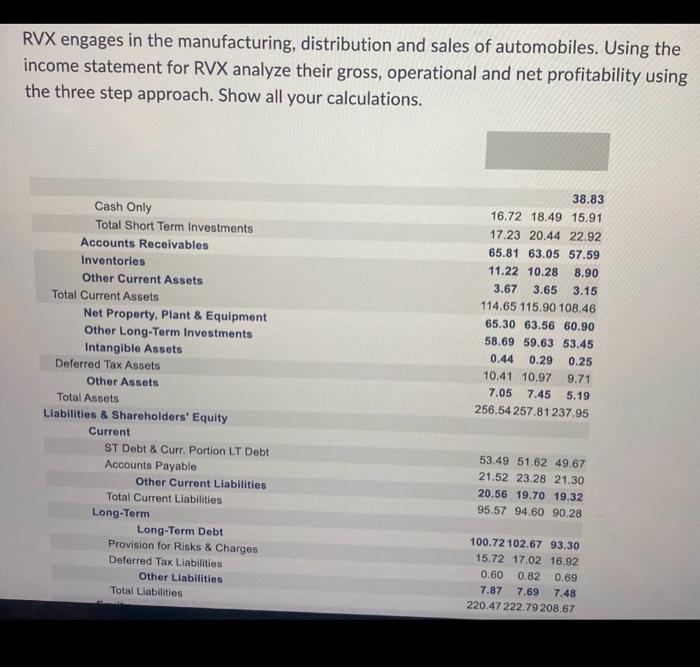

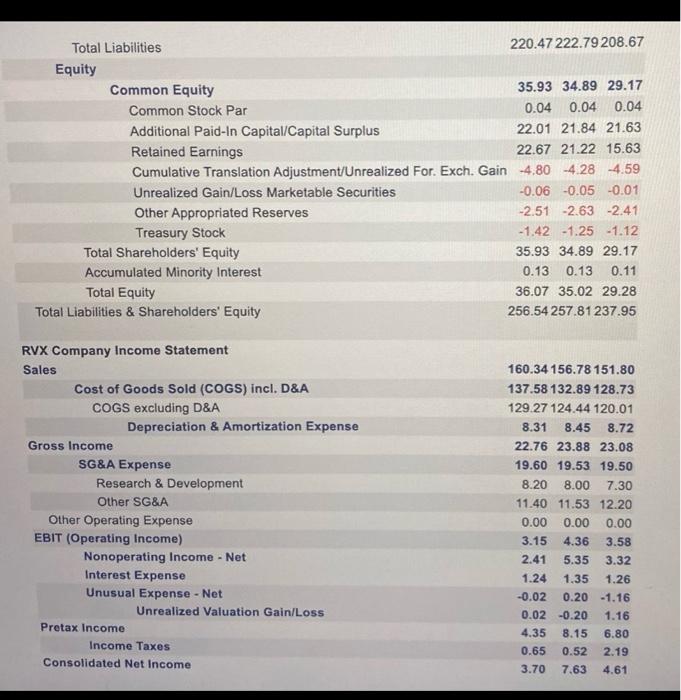

RVX engages in the manufacturing, distribution and sales of automobiles. Using the income statement for RVX analyze their gross, operational and net profitability using the three step approach. Show all your calculations. Total Liabilities 220.47222 .79208 .67 Equity \begin{tabular}{lrrr} Common Equity & 35.93 & 34.89 & 29.17 \\ Common Stock Par & 0.04 & 0.04 & 0.04 \\ Additional Paid-In Capital/Capital Surplus & 22.01 & 21.84 & 21.63 \\ Retained Earnings & 22.67 & 21.22 & 15.63 \\ Cumulative Translation Adjustment/Unrealized For. Exch. Gain & -4.80 & -4.28 & -4.59 \\ Unrealized Gain/Loss Marketable Securities & -0.06 & -0.05 & -0.01 \\ Other Appropriated Reserves & -2.51 & -2.63 & -2.41 \\ Treasury Stock & -1.42 & -1.25 & -1.12 \\ Total Shareholders' Equity & 35.93 & 34.89 & 29.17 \\ Accumulated Minority Interest & 0.13 & 0.13 & 0.11 \\ Total Equity & 36.07 & 35.02 & 29.28 \\ abilities \& Shareholders' Equity & 256.54257 .81237 .95 \end{tabular} RVX Company Income Statement \begin{tabular}{crrr} Sales & & 160.34 & 156.78151 .80 \\ Cost of Goods Sold (COGS) incl. D\&A & 137.58 & 132.89 & 128.73 \\ COGS excluding D\&A & 129.27 & 124.44 & 120.01 \\ Depreciation \& Amortization Expense & 8.31 & 8.45 & 8.72 \\ Gross Income & 22.76 & 23.88 & 23.08 \\ SG\&A Expense & 19.60 & 19.53 & 19.50 \\ Research \& Development & 8.20 & 8.00 & 7.30 \\ Other SG\&A & 11.40 & 11.53 & 12.20 \\ Other Operating Expense & 0.00 & 0.00 & 0.00 \\ EBIT (Operating Income) & 3.15 & 4.36 & 3.58 \\ Nonoperating Income - Net & 2.41 & 5.35 & 3.32 \\ Interest Expense & 1.24 & 1.35 & 1.26 \\ Unusual Expense - Net & -0.02 & 0.20 & -1.16 \\ Unrealized Valuation Gain/Loss & 0.02 & -0.20 & 1.16 \\ Pretax Income & 4.35 & 8.15 & 6.80 \\ Income Taxes & 0.65 & 0.52 & 2.19 \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started