help to solve this question with explanation

help to solve this question with explanation

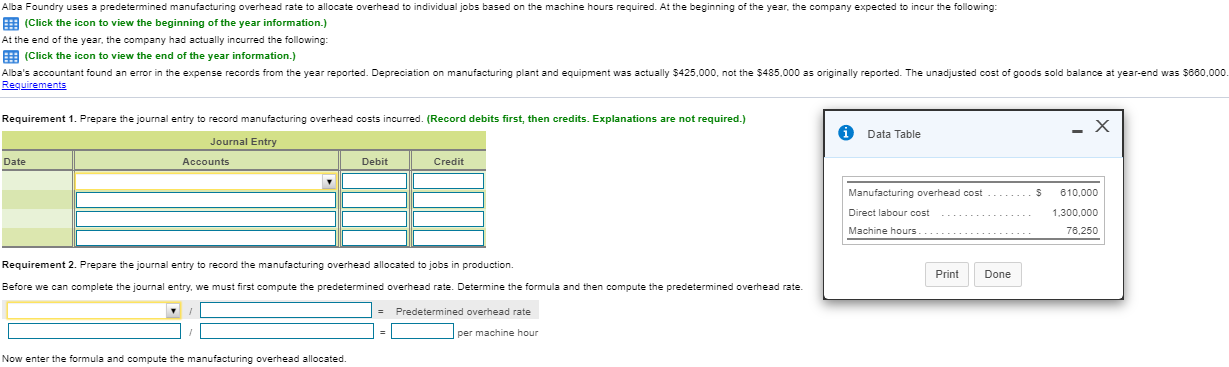

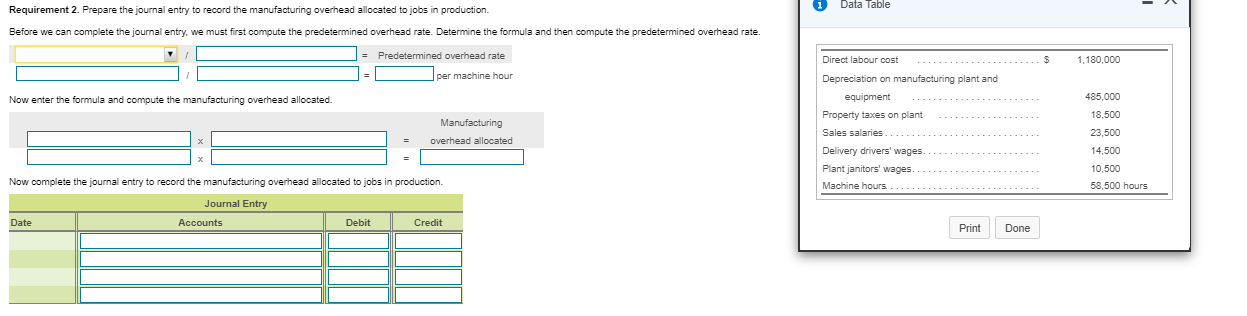

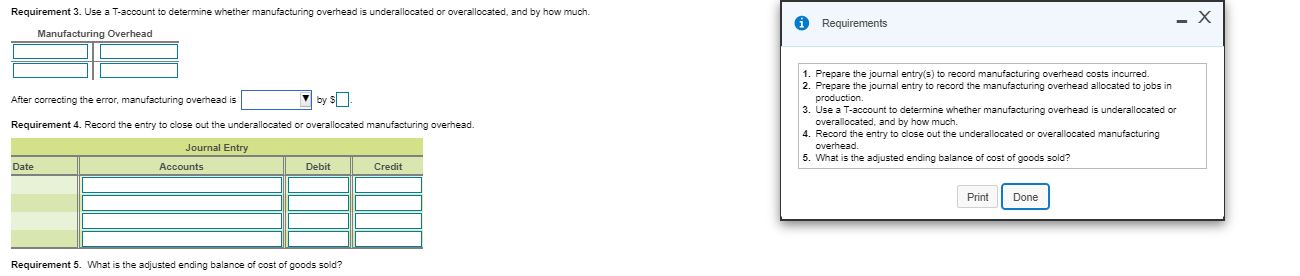

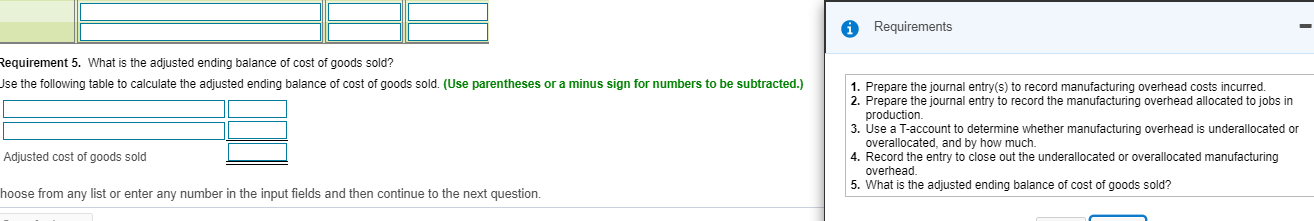

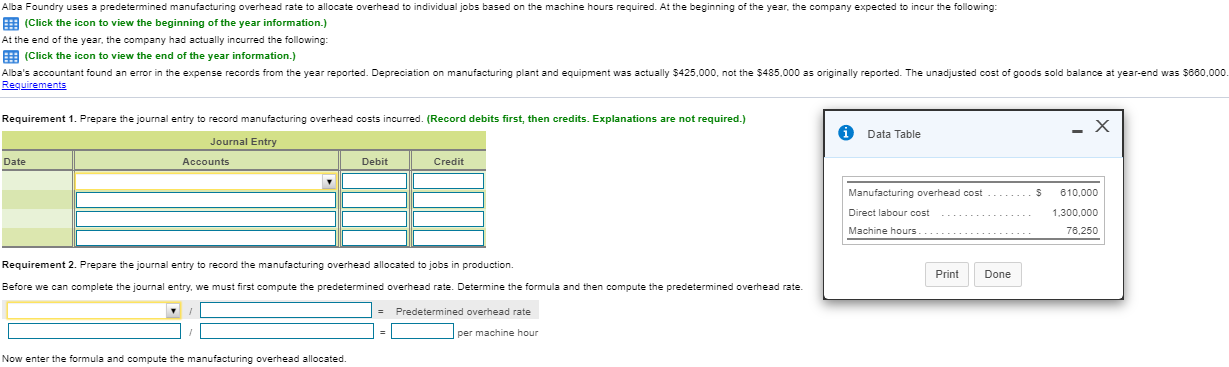

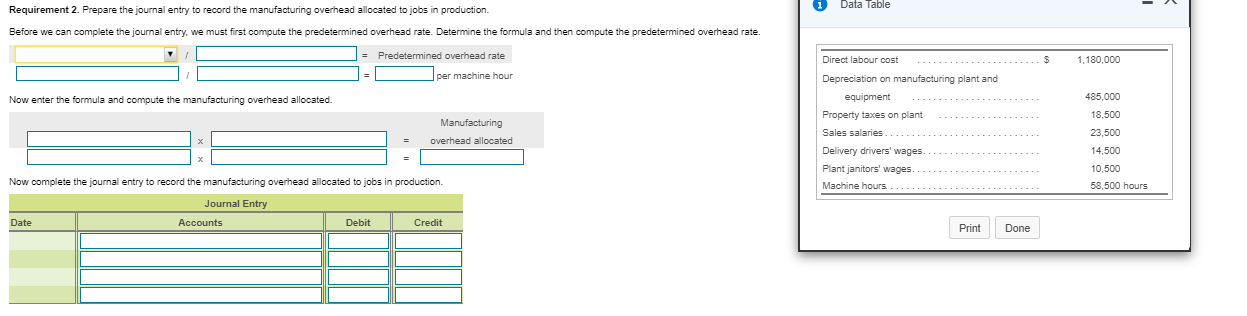

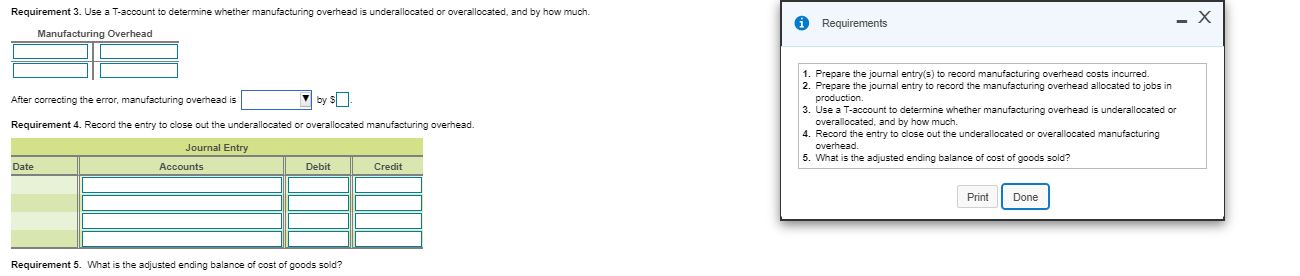

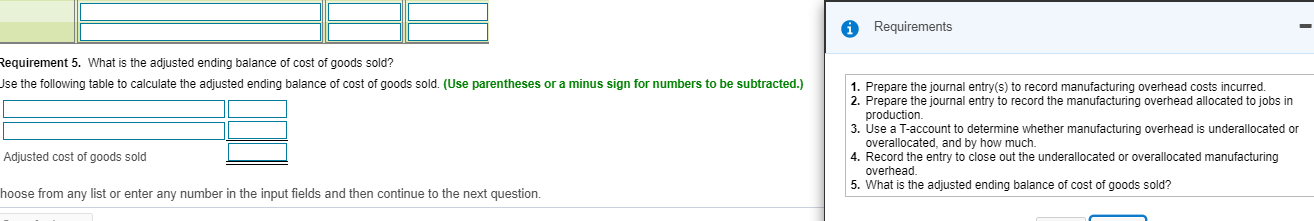

Alba Foundry uses a predetermined manufacturing overhead rate to allocate overhead to individual jobs based on the machine hours required. At the beginning of the year, the company expected to incur the following: (Click the icon to view the beginning of the year information.) At the end of the year, the company had actually incurred the following: B (Click the icon to view the end of the year information.) Alba's accountant found an error in the expense records from the year reported. Depreciation on manufacturing plant and equipment was actually $425,000, not the $485,000 as originally reported. The unadjusted cost of goods sold balance at year-end was $600,000 Requirements Requirement 1. Prepare the journal entry to record manufacturing overhead costs incurred. (Record debits first, then credits. Explanations are not required.) Data Table Journal Entry Accounts Date Debit Credit $ Manufacturing overhead cost Direct labour cost 610,000 1,300,000 78,250 Machine hours Requirement 2. Prepare the journal entry to record the manufacturing overhead allocated to jobs in production. Before we can complete the journal entry, we must first compute the predetermined overhead rate. Determine the formula and then compute the predetermined overhead rate. Print Done = Predetermined overhead rate per machine hour Now enter the formula and compute the manufacturing overhead allocated. Data Table Requirement 2. Prepare the journal entry to record the manufacturing overhead allocated to jobs in production. Before we can complete the journal entry, we must first compute the predetermined overhead rate. Determine the formula and then compute the predetermined overhead rate. = Predetermined overhead rate per machine hour 1,180,000 Now enter the formula and compute the manufacturing overhead allocated. 485.000 18,500 Manufacturing overhead allocated Direct labour cost Depreciation on manufacturing plant and equipment Property taxes on plant Sales salaries.... Delivery drivers' wages. Plant janitors' wages. Machine hours 23,500 14,500 10.500 58.500 hours Now complete the journal entry to record the manufacturing overhead allocated to jobs in production. Journal Entry Date Accounts Debit Credit Print Done Requirement 3. Use a T-account to determine whether manufacturing overhead is underallocated or overallocated, and by how much Manufacturing Overhead * Requirements After correcting the error, manufacturing overhead is by s 1. Prepare the journal entry(s) to record manufacturing overhead costs incurred. 2. Prepare the journal entry to record the manufacturing overhead allocated to jobs in production 3. Use a T-account to determine whether manufacturing overhead is underallocated or overallocated, and by how much Record the entry to close out the underallocated or overallocated manufacturing overhead. 5. What is the adjusted ending balance of cost of goods sold? Requirement 4. Record the entry to close out the underallocated or overallocated manufacturing overhead. Journal Entry Accounts Date Debit Credit Print Done Requirement 5. What is the adjusted ending balance of cost of goods sold? Requirements Requirement 5. What is the adjusted ending balance of cost of goods sold? Use the following table to calculate the adjusted ending balance of cost of goods sold. (Use parentheses or a minus sign for numbers to be subtracted.) 1. Prepare the journal entry(s) to record manufacturing overhead costs incurred. 2. Prepare the journal entry to record the manufacturing overhead allocated to jobs in production 3. Use a T-account to determine whether manufacturing overhead is underallocated or overallocated, and by how much. 4. Record the entry to close out the underallocated or overallocated manufacturing overhead 5. What is the adjusted ending balance of cost of goods sold? Adjusted cost of goods sold hoose from any list or enter any number in the input fields and then continue to the next

help to solve this question with explanation

help to solve this question with explanation