Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Help understanding what the question is asking and how to caluclate the answer. Assume that UHS will issue a 5-year bond with an annual coupon

Help understanding what the question is asking and how to caluclate the answer.

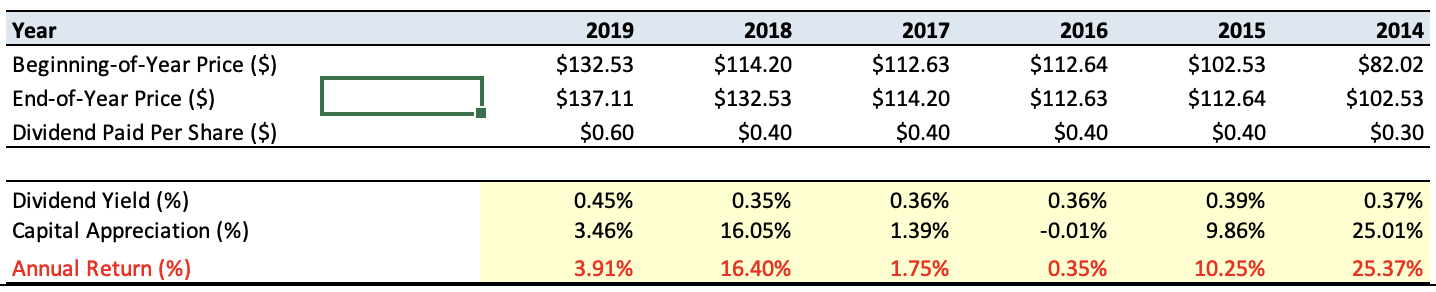

Assume that UHS will issue a 5-year bond with an annual coupon rate of 7.625%. You are considering making an $100,000 investment in UHS either through buying bonds or stocks. Comparing the bond's yield with the annual return on stock investments calculated above, you have to make a decision. Which investment option would you prefer? Explain briefly.

\begin{tabular}{lrrrrrr} \hline Year & 2019 & 2018 & 2017 & 2016 & 2015 & 2014 \\ \hline Beginning-of-Year Price (\$) & $132.53 & $114.20 & $112.63 & $112.64 & $102.53 & $82.02 \\ End-of-Year Price (\$) & $137.11 & $132.53 & $114.20 & $112.63 & $112.64 & $102.53 \\ Dividend Paid Per Share (\$) & $0.60 & $0.40 & $0.40 & $0.40 & $0.40 & $0.30 \\ \hline & & & & & & \\ \hline Dividend Yield (\%) & & & & & & \\ Capital Appreciation (\%) & 3.45% & 0.35% & 0.36% & 0.36% & 0.39% & 0.37% \\ Annual Return (\%) & 3.91% & 16.05% & 1.39% & 0.01% & 9.86% & 25.01% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started