Answered step by step

Verified Expert Solution

Question

1 Approved Answer

help urgent! for 23-6 23-6 23-6 FCFE Hiland Airways is planning to acquire Interstate Carriers. Interstate's cost of equity is 10%; it is financed 75%

help urgent!

for 23-6

23-6

23-6

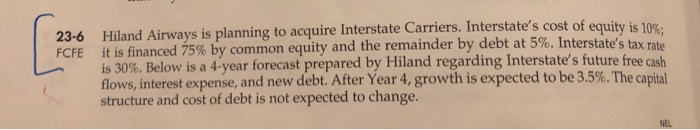

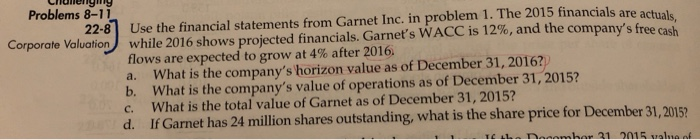

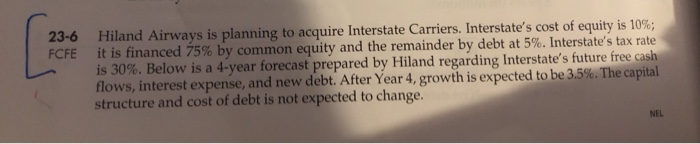

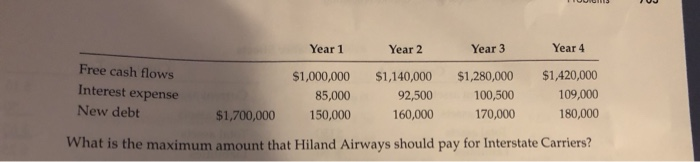

23-6 FCFE Hiland Airways is planning to acquire Interstate Carriers. Interstate's cost of equity is 10%; it is financed 75% by common equity and the remainder by debt at 5%. Interstate's tax rate is 30%. Below is a 4-year forecast prepared by Hiland regarding Interstate's future free cash flows, interest expense, and new debt. After Year 4, growth is expected to be 3.5%. The capital structure and cost of debt is not expected to change. Problems 8-11 22-8 Corporate Valuation Use the financial statements from Garnet Inc. in problem 1. The 2015 financials are actuals, while 2016 shows projected financials. Garnet's WACC is 12%, and the company's free cash flows are expected to grow at 4% after 2016, What is the company's horizon value as of December 31, 2016? b. What is the company's value of operations as of December 31, 2015? What is the total value of Garnet as of December 31, 2015? d. If Garnet has 24 million shares outstanding, what is the share price for December 31, 2015? a. c. TELL nanamkan 21 0015 wale af [ 23-6 FCFE Hiland Airways is planning to acquire Interstate Carriers. Interstate's cost of equity is 10%; it is financed 75% by common equity and the remainder by debt at 5%. Interstate's tax rate is 30%. Below is a 4-year forecast prepared by Hiland regarding Interstate's future free cash flows, interest expense, and new debt. After Year 4, growth is expected to be 3.5%. The capital structure and cost of debt is not expected to change. NEL Year 1 Year 2 Year 3 Year 4 $1,000,000 $1,140,000 $1,280,000 $1,420,000 85,000 92,500 100,500 109,000 $1,700,000 150,000 160,000 170,000 180,000 What is the maximum amount that Hiland Airways should pay for Interstate Carriers? Free cash flows Interest expense New debt

23-6

23-6 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started